Are you looking to invest in the solar market? That’s fine, but you might get burned if you pour your capital into Enphase Energy (NASDAQ:ENPH) stock now. In a challenging solar-equipment landscape, Enphase Energy appears to be struggling, and until the circumstances change dramatically, I am staying neutral on ENPH stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Enphase Energy is a California-headquartered supplier of microinverter-based solar and battery systems. The company has been quite active lately. For example, Enphase Energy recently launched its IQ Combiner Lite solar energy systems in the Netherlands for low-income housing. Furthermore, the company announced a team-up with Octopus Energy Group in the United Kingdom (UK) to deploy Enphase IQ8 Microinverter and IQ Battery 5P products.

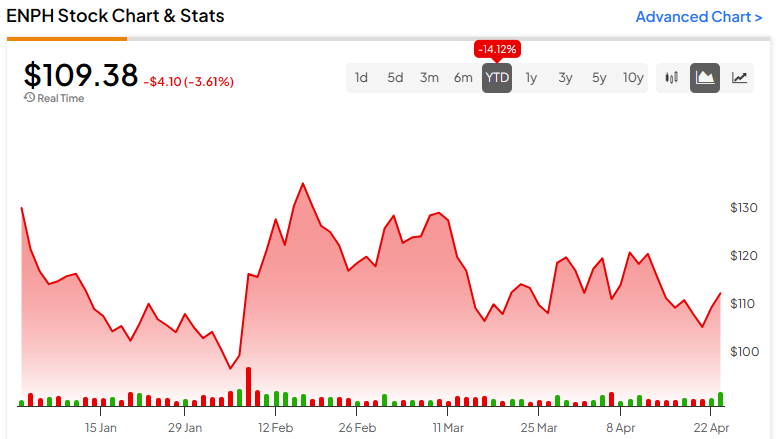

All of this activity might sound exciting, but be sure to get the full story on Enphase Energy. ENPH stock just can’t seem to get going this year. There might be a good reason why investors aren’t particularly enthused about Enphase Energy, so let the data be your guide, and always choose caution over haste.

ENPH Stock Sinks and Recovers – But Why?

In the after-market hours of Tuesday, April 23, ENPH stock quickly sank into the red on heavy trading volume. It’s not difficult to identify the negative catalyst, as Enphase Energy had just published its financial results for the first quarter of 2024.

Fast-forward to the next morning, and on April 24, Enphase Energy stock surprisingly rallied into the green for a little while. From this, it may be tempting to assume that Enphase Energy must have posted excellent quarterly results.

Don’t jump to any conclusions, though. As we’ll discover, Enphase Energy’s results aren’t ideal, and there’s another possible explanation for the turnaround in ENPH stock.

Bear in mind that the market was generally in a good mood about clean-energy investments today. For instance, Tesla (NASDAQ:TSLA) stock is up 11%. Furthermore, both Tesla stock and Enphase Energy stock are part of the Nasdaq 100 (NDX), and the Nasdaq is up today.

As the old saying goes, a rising tide lifts all boats. In any case, I don’t want you to potentially get faked out by a short-term rally in ENPH stock. Serious, long-term investors need to conduct their due diligence on Enphase Energy and really look under the hood. So, let’s do that right now, and don’t be too shocked if the results aren’t bright and sunny.

Challenging Conditions Create Problems for Enphase Energy

It’s definitely not an easy time to operate a solar-equipment business. Inventory levels are elevated in Europe, which is a crucial market for solar infrastructure. Moreover, metering reform in California has been problematic for solar businesses in general. On top of all that, Enphase Energy has had to deal with persistently elevated interest rates, which make it more difficult for solar equipment customers to repay their loans.

These factors all weighed heavily on Enphase Energy during this year’s first quarter. The market might be able to “shake it off” and push ENPH stock up in the short term, but the data tells a not-so-sunny story.

Enphase Energy shipped 1,382,195 microinverters in Q1 of 2024, which might sound like a lot. However, the company shipped 1,595,677 microinverters in Q4 of 2023 and 3,905,239 microinverters in Q3 of 2023. This rapid downtrend is evidence that challenging market conditions are taking a toll on Enphase Energy’s sales figures.

Speaking of sales figures, Enphase Energy reported first-quarter 2024 revenue of $263.339 million, down by a whopping 63.7% year-over-year. Also, this result fell short of the consensus estimate of $279.8 million in quarterly revenue. For the current quarter, the company expects to generate $290 million to $330 million in revenue, but the consensus estimate was $348.6 million.

Now, we have to address Enphase Energy’s bottom-line figures. If we’re using GAAP-measured results, then it’s bad news because Enphase Energy flipped from an income of $0.15 per share in Q4 2023 to a loss of $0.12 per share in Q1 2024. Meanwhile, if we’re using a non-GAAP (adjusted) measurement, then the company reported earnings of $0.35 per share; however, Wall Street had expected Enphase Energy to earn $0.41 per share.

Is ENPH Stock a Buy, According to Analysts?

On TipRanks, ENPH comes in as a Moderate Buy based on 16 Buys, 10 Holds, and one Sell rating assigned by analysts in the past three months. The average Enphase Energy stock price target is $126.96, implying 16.6% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell ENPH stock, the most accurate analyst covering the stock (on a one-year timeframe) is Colin Rusch of Oppenheimer, with an average return of 168.89% per rating and a 78% success rate. Click on the image below to learn more.

Conclusion: Should You Consider ENPH Stock?

Enphase Energy is dealing with issues that are causing problems for the solar-equipment market generally. Maybe these problems aren’t Enphase Energy’s fault, but it looks like they’re still weighing on the company’s top- and bottom-line results.

It could take a long time for these issues to resolve and for Enphase Energy’s financial results to improve. Therefore, I’m choosing to monitor Enphase Energy from the sidelines and am not currently considering ENPH stock.