While a lot of attention has been squarely on the banking sector as of late, there’s another sector that’s been suffering just as hard, and essentially because the banking sector is faltering. It’s the energy sector, and energy stocks are taking a beating just as much as bank stocks in Wednesday afternoon’s trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

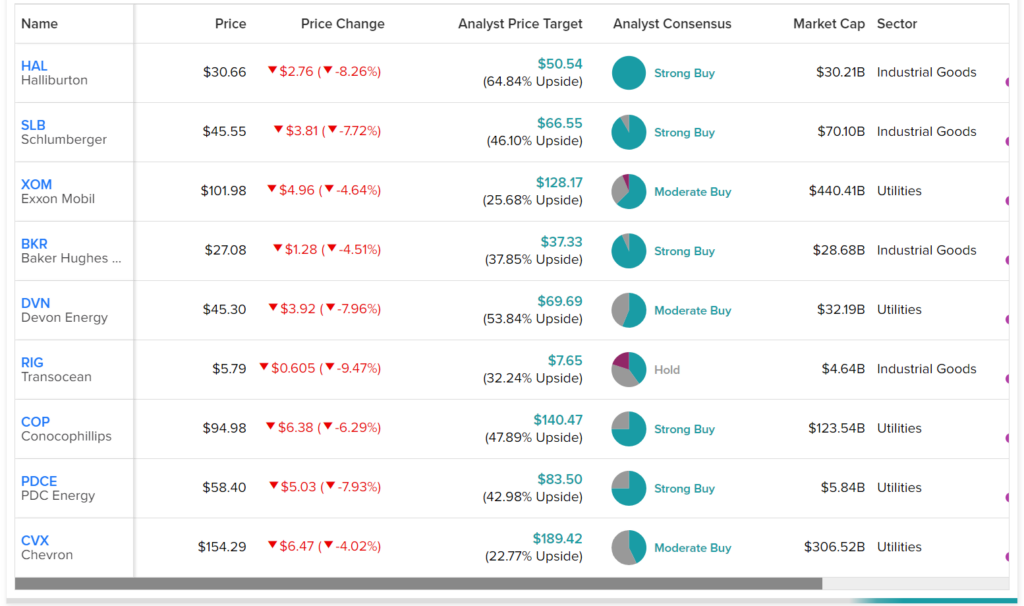

Large portions of the energy market are down in a big way. Currently leading the drop is Transocean (NYSE:RIG), while other stocks like Halliburton (NYSE:HAL), PDC Energy (NASDAQ:PDCE), Devon Energy (NYSE:DVN), and Schlumberger (NYSE:SLB) are not far behind.

So what brought about this sudden death spiral in energy, especially while prices at the pump are still best described as “a step or two below nightmarish?” Oddly enough, it’s actually a kind of contagion from the banking sector’s losses. Investors are concerned that the fallout from the bank losses might be a drag on overall wealth effects, which would encourage people to stay closer to home and spend less.

As a result, stock price losses are proving a disaster for investors, but the conditions are hardly the same. For instance, the smallest loser today is Chevron (NYSE:CVX), which is down 4.02%. It’s considered a Moderate Buy with 22.77% upside potential thanks to its average price target of $189.42. However, Transocean, which was hit the hardest, is called a Hold. Its $7.65 average price target gives it 32.24% upside potential.