Having kid-friendly, or at least family-friendly, content on your streaming platform does tend to be helpful. There are plenty of families out there looking for entertainment that will not bore or traumatize the little ones, and that is where entertainment giant Warner Bros. Discovery (WBD) came in. It launched a new “kids pop-up channel” in the Middle East, hoping to make a connection with the young folks in the region. But investors did not feel the love, and sent shares down slightly in the closing minutes of Monday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The channel will not run for very long, reports note, only starting today and ending August 24. It will run in collaboration with OSN, reports note, and can be found on channel seven on OSN legacy boxes. For those with OSN Android boxes, meanwhile, the pop-up channel can be found on channel 10.

The channel was launched as part of the 85th anniversary celebration of Tom & Jerry, the cartoon cat and mouse duo that have been antagonists almost as much as they have been friends. It will also serve as a means for Cartoon Network—a Warner property—to cross-promote its own shows on the platform. Further, as noted by vice-president of pay TV networks Sean Gorman, it also serves as a means to “…empower local creators, providing them with the tools and platform to produce high-quality, locally relevant content.” Though how that will happen in the week the channel exists is somewhat unclear.

The Analysts Question

A new report recently emerged in the wake of Warner’s second quarter earnings call a while back. Apparently, analysts on the call asked some very interesting questions of Warner, and the responses were particularly telling.

For instance, one point that got an answer came from Goldman Sachs analyst Michael Ng, who asked about Warner’s plans to use DC and other franchise properties in theme parks and live events. Warner noted here that it would be focusing on licensing and partnerships rather than outright building theme parks. Meanwhile, MoffettNathanson analyst Robert Fishman asked about licensing content to third-party streamers. Warner noted it would focus on HBO Max, but would “…assess licensing opportunities case by case.”

Is WBD Stock a Good Buy?

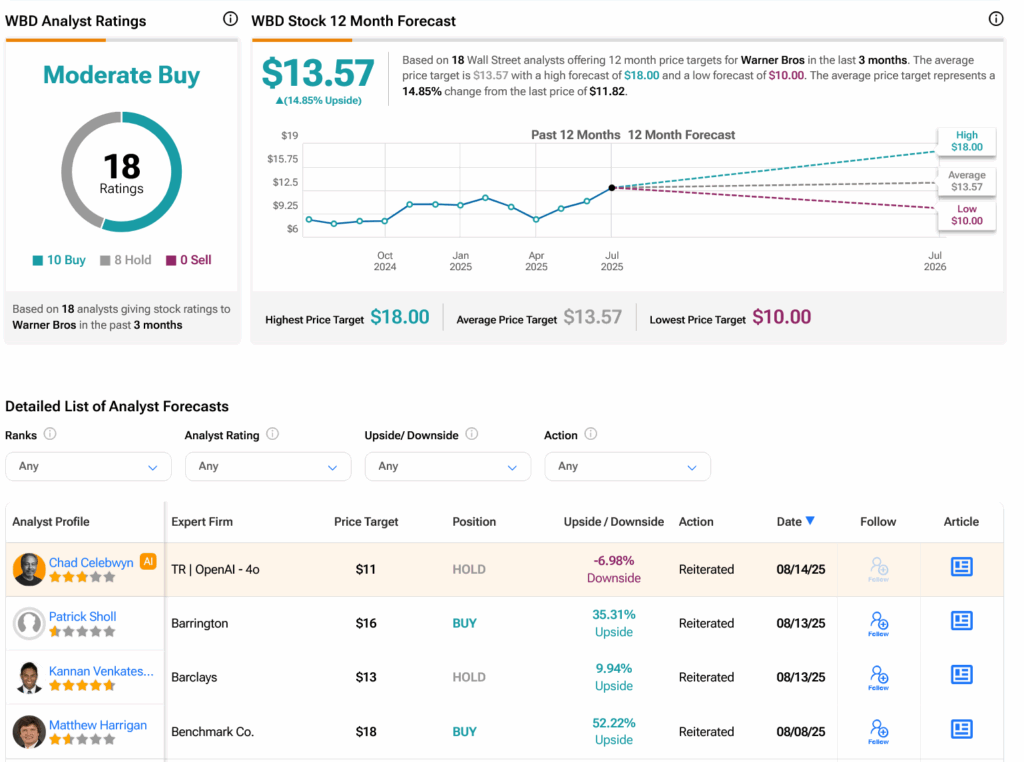

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on 10 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 55.31% rally in its share price over the past year, the average WBD price target of $13.57 per share implies 14.85% upside potential.