Elevance Health (NYSE:ELV) reported better-than-expected results in the second quarter with adjusted diluted earnings of $10.12 per share, up by 12% year-over-year, which exceeded analysts’ consensus estimate of $10 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ELV’s Revenue Breakdown

Unfortunately, the health insurance provider’s operating revenues in the second quarter declined by $0.2 billion year-over-year to $43.2 billion. This exceeded analysts’ expectations of $42.99 billion.

The company’s two business segments include Health Benefits and Carelon. Elevance’s health benefits business includes individual, employer group risk-based and fee-based, BlueCard, Medicare, Medicaid, and Federal Health Products & Services businesses.

The health benefits business generated Q2 operating revenue of $37.2 billion, a decline of 2% year-over-year due to Medicaid membership attrition. Medicaid is a free or low-cost public health insurance program in the U.S. for eligible low-income adults and children.

Carelon offers a broad portfolio of healthcare services that generated operating revenues of $13.3 billion in the second quarter, up by 10% year-over-year.

ELV’s Dividend and FY24 Outlook

Looking forward, management reiterated its FY24 outlook and expects adjusted earnings to be at least $37.20 per share, slightly below consensus estimates of $37.28 per share.

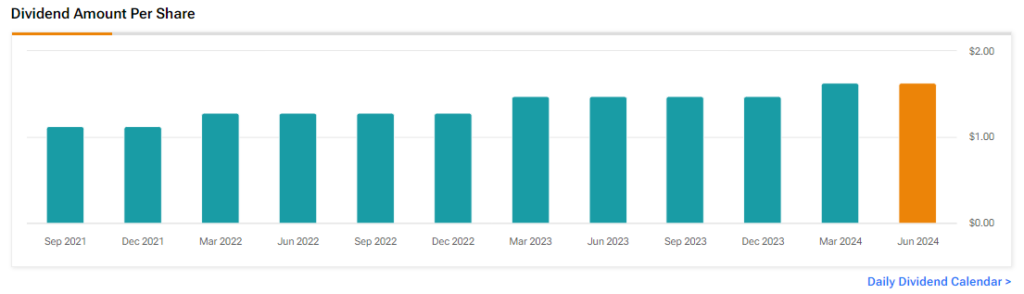

In addition, the company declared a third-quarter dividend of $1.63 per share payable on September 25, 2024, to shareholders of record at the close of business on September 10.

Is ELV Stock a Buy?

Analysts remain bullish about ELV stock, with a Strong Buy consensus rating based on a unanimous 16 Buys. Over the past year, ELV has increased by more than 25%, and the average ELV price target of $615.50 implies an upside potential of 11.3% from current levels. However, these analyst ratings are likely to change following Elevance’s Q2 results today.