xAI, the artificial intelligence (AI) start-up company led by Elon Musk, has been valued at $50 billion in a new funding round.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company, which is involved in developing generative AI, raised a total of $5 billion in its latest funding round based on a valuation of $50 billion. The new valuation is more than twice what xAI was valued at a few months ago. In all, xAI has raised $11 billion this year.

Qatar’s sovereign-wealth fund, Qatar Investment Authority, and investment firms Valor Equity Partners, Sequoia Capital, and Andreessen Horowitz are reported to have participated in the new funding round. xAI was valued at $24 billion when it last raised capital this spring, attracting $6 billion in funding.

The Trump Effect

Interest in the companies run by Elon Musk, which also include SpaceX and electric vehicle maker Tesla (TSLA), has increased sharply since Donald Trump won the U.S. presidential election. Musk was one of Trump’s biggest donors and supporters and is now involved with Trump’s transition team.

xAI, which was launched in July 2023, said it plans to use the new $5 billion that it has raised to finance the purchase of 100,000 Nvidia (NVDA) microchips that are used to train its AI models. The privately held start-up company has said that its revenue has reached $100 million on an annual basis.

xAI’s main product is its “Grok” chatbot, which is available to premium subscribers of Musk’s social media platform X, formerly Twitter. xAI is expected to debut the third version of its Grok chatbot in December of this year.

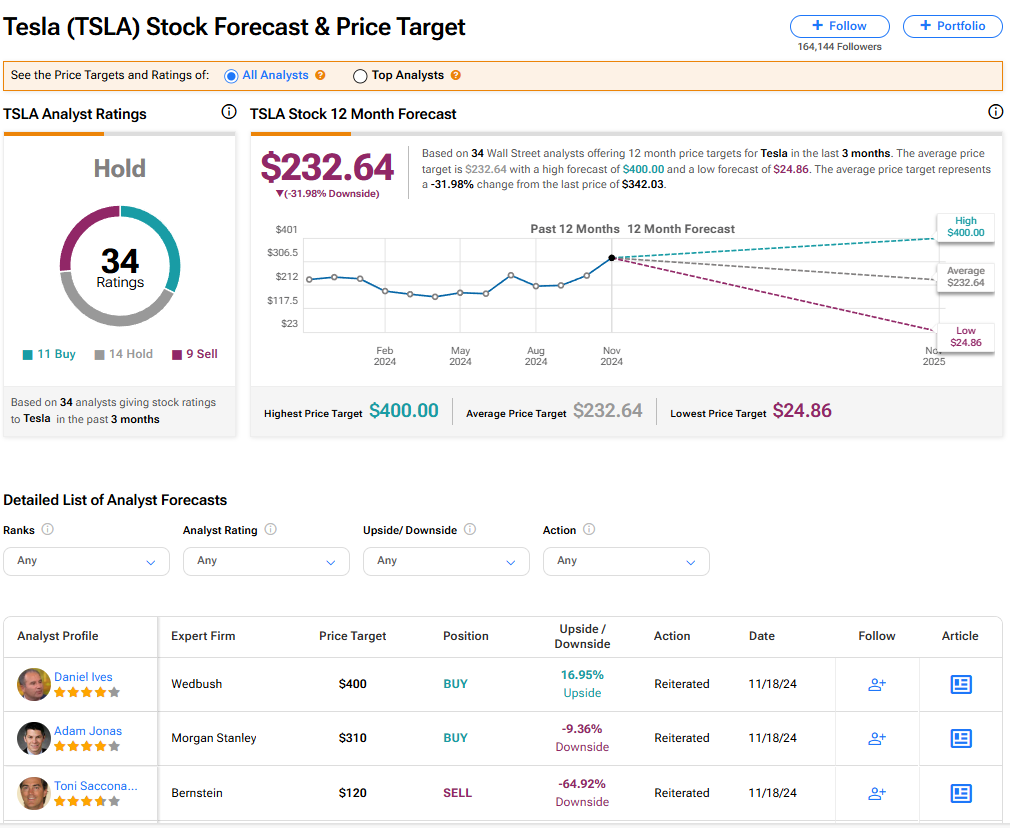

Is TSLA Stock a Buy?

With no xAI stock, we look at Elon Musk’s other company, Tesla. Its stock currently has a consensus Hold rating among 34 Wall Street analysts. That rating is based on 11 Buy, 14 Hold, and nine Sell recommendations made in the last three months. The average TSLA price target of $232.64 implies 31.98% downside risk from current levels.