Elon Musk’s AI company xAI has introduced Grok 4 Fast, which is a new reasoning model that is designed to be both powerful and affordable. Indeed, it is built on the earlier Grok 4 system but uses large-scale reinforcement learning to boost what the company calls “intelligence density.” In practice, this means that Grok 4 Fast can perform just as well as Grok 4 on benchmarks while using about 40% fewer thinking tokens.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The model also combines quick-response and deep-reasoning modes into a single system, so it can instantly handle simple queries or dive into more complex reasoning without switching models. Interestingly, xAI says that independent testing shows that the model beats rivals such as OpenAI’s o3-search and Google’s Gemini 2.5 Pro. In fact, benchmark results highlighted its ability to match or outperform GPT-5 on several reasoning tests while cutting costs by as much as 98% compared to Grok 4.

It is also worth noting that the model is already available through grok.com, mobile apps, developer platforms, and the xAI API. In addition, for the first time, even free users have access to xAI’s newest model as the company looks to make advanced AI widely available. Separately, previous reports suggested that xAI was raising $10 billion at a $200 billion valuation. However, Musk denied that, although he has said that Tesla (TSLA) could invest in xAI in the future.

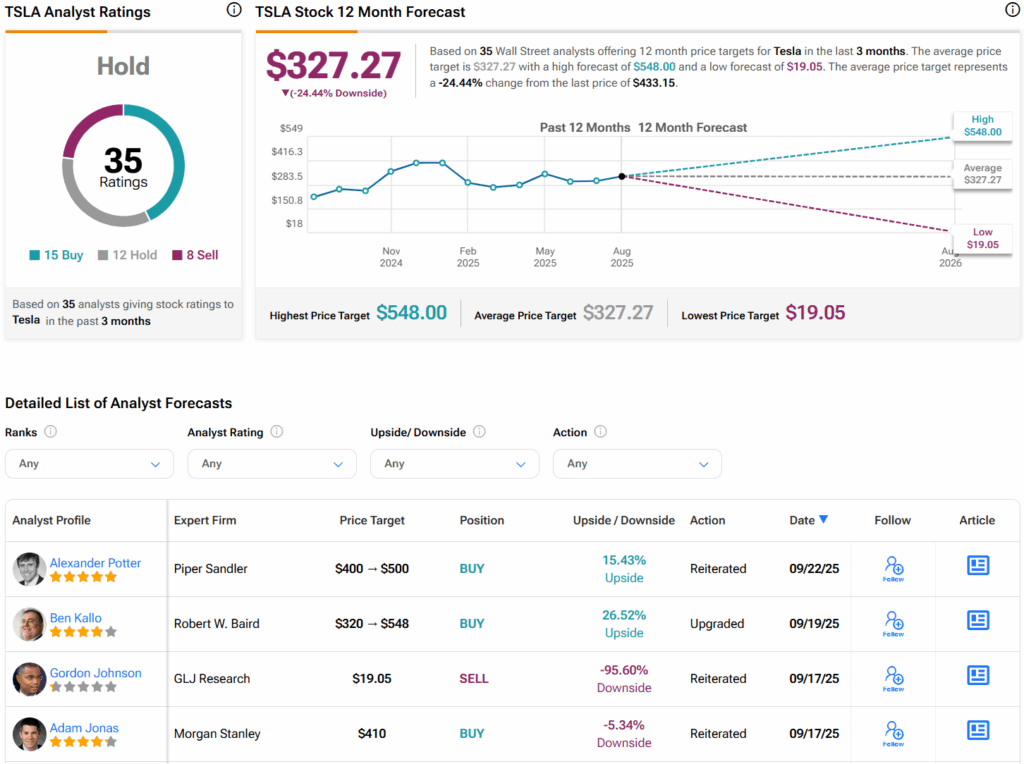

What Is the Prediction for Tesla Stock?

When it comes to Elon Musk’s companies, most of them are privately held. However, retail investors can invest in his most popular company, Tesla (TSLA). Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 15 Buys, 12 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $327.27 per share implies 24.4% downside risk.