Elon Musk’s Starlink is hitting the heights in the U.K. with profits doubling in 2024.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Gateway Services

According to new financial accounts for the satellite internet business, its turnover rose from £2.5 million in 2023 to £4.2 million in its latest financial year. Its pre-tax profit rose from £121,166 to £203,456.

In the report, the company said that its strategic focus was on “expanding its role as a gateway services provider.”

It said: “We will continue to pursue opportunities to innovate, improve operational efficiencies, and enhance our technologies to better support and grow our customer base in the U.K.”

Those hopes were further lifted last month when it emerged that Starlink is on track to play a larger role in the UK’s broadband infrastructure.

Last month, telecoms regulator Ofcom proposed new temporary spectrum licenses which would expand Starlink’s capacity across the U.K.

Under the plans, which are out to consultation until June 27, Starlink would gain access to additional E band frequencies at three of its current ground stations in Hampshire, Suffolk, and Cambridgeshire.

International Expansion

English and Welsh train operators are also reportedly looking at Starlink satellites to improve patchy Wi-Fi connections on their trains.

They are reportedly currently examining whether Starlink could be used to boost connectivity after a six-month trial of the technology began in Scotland last month.

Starlink is continuing its international expansion.

It recently received a key license from India’s telecoms ministry. This cleared a major hurdle for the satellite provider and brought it closer to launching commercial operations.

Last month, the Democratic Republic of Congo (DRC) granted the company a license to operate.

Is TSLA a Good Stock to Buy Now?

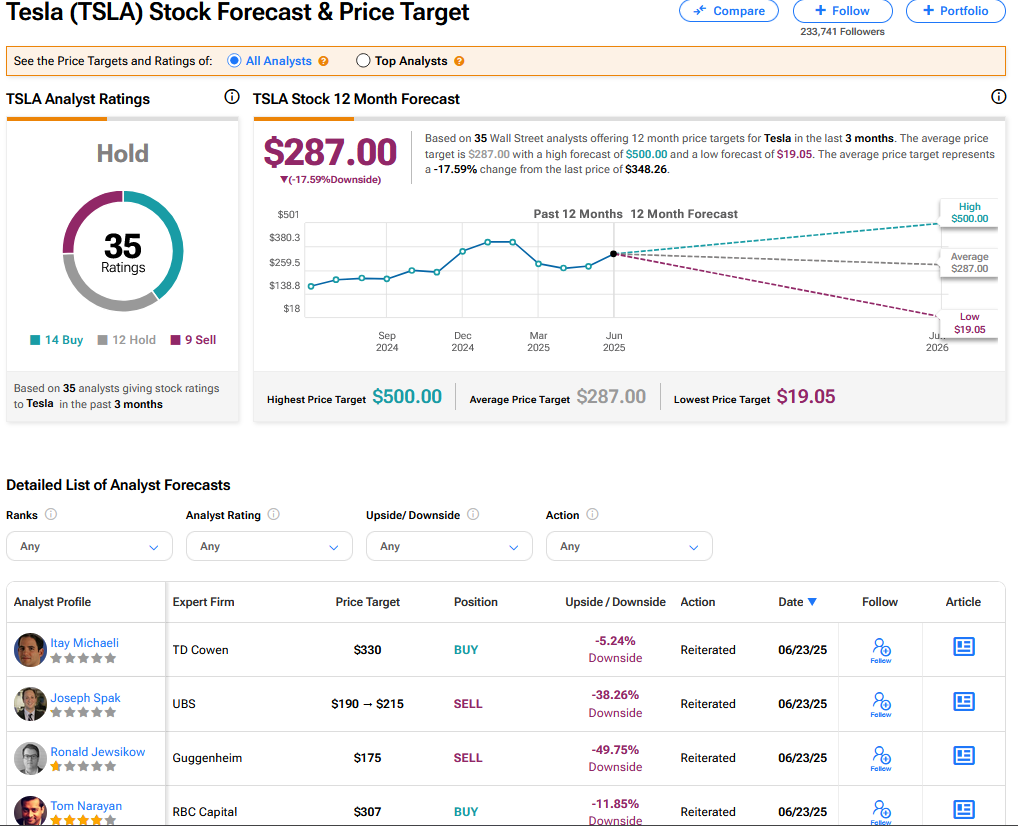

Of course, Starlink is still a privately held company, so let’s see how Musk’s publicly traded company, Tesla, fares with Wall Street analysts these days. Tesla sports a Hold consensus based on 14 Buy, 12 Hold and 9 Sell ratings. TSLA stock’s consensus price target is $287 implying an 17.59% downside.