The Department of Government Efficiency (DOGE), led by Tesla (TSLA) CEO Elon Musk, has been using AI software to analyze sensitive data from the U.S. Education Department. The data includes personally identifiable information and internal financial details, which are being used to investigate the department’s programs and spending. The AI investigation is focused on examining funds disbursed by the department and includes contracts, grants, and expenses.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The DOGE team has been accessing the Education Department’s financial data through Microsoft’s (MSFT) Azure cloud service. It is worth noting that it was Agency leadership that directed lower-level employees to grant Musk’s team access to the data. In fact, a spokesperson for the Education Department defended the actions by stating that the DOGE employees are working to make the department more cost-efficient and accountable.

The DOGE team’s ultimate goal is to reduce spending and shrink the Education Department. The team also plans to replicate this process of using AI to analyze spending on employees and programs across other government departments and agencies. This effort is part of a broader push to identify areas of potential fraud or waste in government spending.

What Is the Prediction for Tesla Stock?

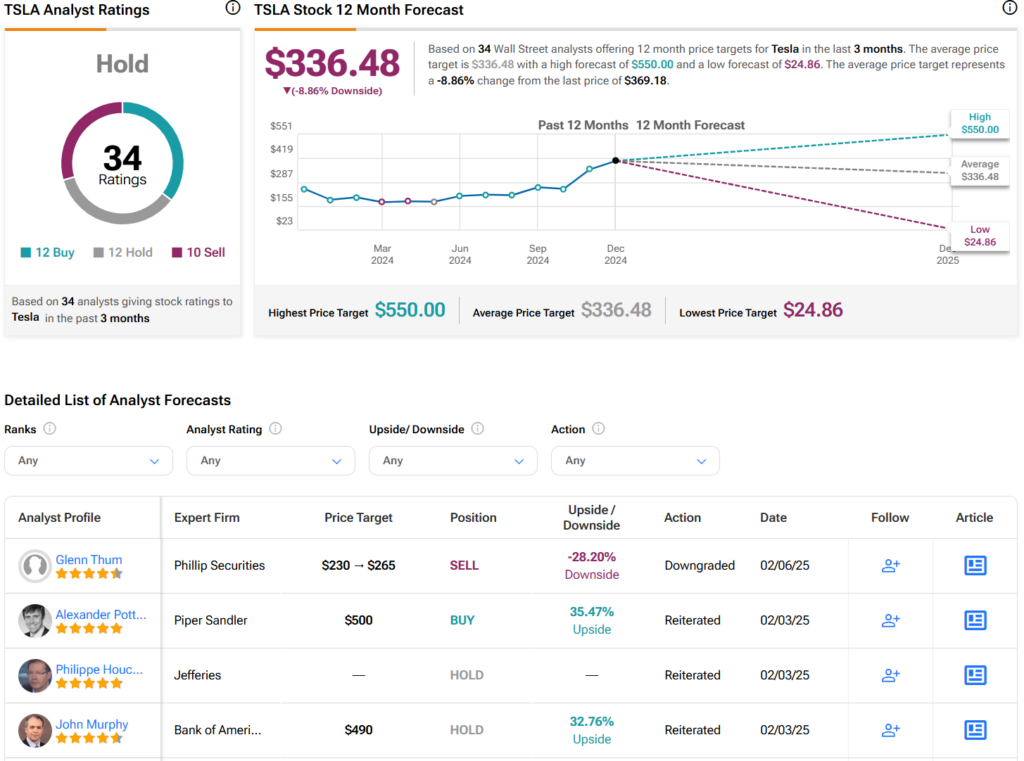

When it comes to Elon Musk’s companies, most of them are privately held. However, retail investors can invest in his most popular company – Tesla. Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 12 Buys, 12 Holds, and 10 Sells assigned in the past three months, as indicated by the graphic below. After a 96% rally in its share price over the past year, the average TSLA price target of $336.48 per share implies 8.9% downside risk.