Elon Musk has announced that his artificial intelligence (AI) startup company xAI has merged with X, his social media company, in an all-stock deal.

According to Musk, the transaction values xAI at $80 billion and X, formerly known as Twitter, at $33 billion. “xAI and X’s futures are intertwined,” wrote Musk in a social media post. “Today, we officially take the step to combine the data, models, compute, distribution and talent.” X and xAI are each privately held companies and their stock does not trade on a public exchange.

Musk added that the merger should “unlock immense potential by blending xAI’s advanced AI capability and expertise with X’s massive reach.” Musk, who also runs electric vehicle maker Tesla (TSLA) and commercial space company SpaceX, bought Twitter in late 2022 for $44 billion.

A Difficult Time

After acquiring Twitter, Musk took the social media company private, rebranded it as X, and enacted massive cost cuts. xAI is involved in the development of generative AI and is seen as a competitor of other AI startups such as OpenAI and Anthropic. xAI was valued at $50 billion last fall in a funding round that raised $5 billion for the company.

The merger of xAI with social media platform X comes at a difficult time for Musk and his businesses. The involvement Musk has with the administration of U.S. President Donald Trump has led to a backlash against him and the companies he runs. The backlash is most evident with publicly traded Tesla, whose sales have dropped off sharply, and whose vehicles and showrooms have been vandalized.

Is TSLA Stock a Buy?

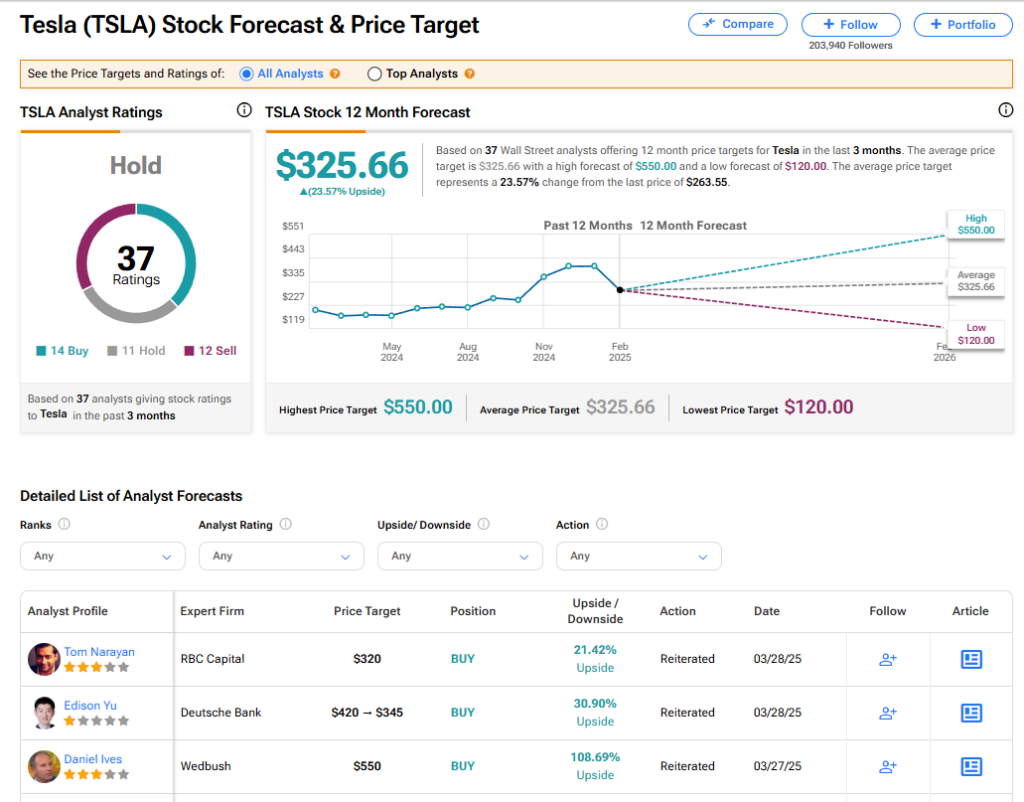

Let’s look at Elon Musk’s only publicly traded company, Tesla. The stock of Tesla currently has a consensus Hold rating among 37 Wall Street analysts. That rating is based on 14 Buy, 11 Hold, and 12 Sell recommendations issued in the last three months. The average TSLA price target of $325.66 implies 23.57% upside from current levels.