Elon Musk says he’s back in the trenches — working 24/7, sleeping in server rooms, and laser-focused on fixing X, scaling Tesla, and launching Starship.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

After a weekend outage on X (formerly Twitter) that triggered global user complaints, Musk admitted the platform needs “major” operational improvements. In response, he pledged to return to his round-the-clock grind. “I must be super focused on X/xAI and Tesla (TSLA) (plus Starship launch next week),” he posted on X Saturday.

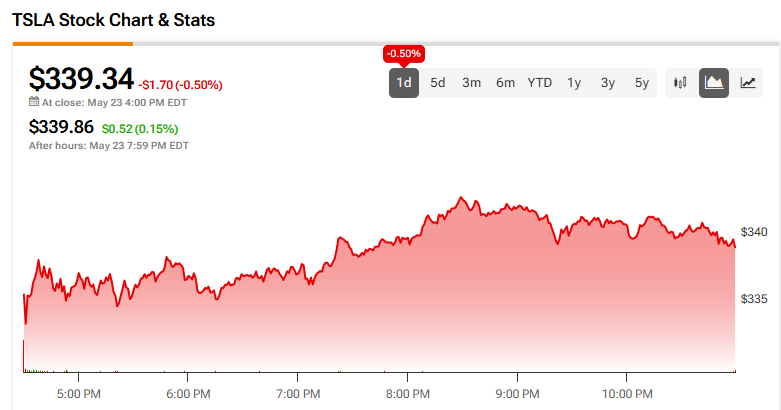

For Tesla investors, this could be the shift they’ve been waiting for. Meanwhile, the TSLA stock hasn’t moved much in the wake of Musk’s statements, declining 0.50% on Friday’s market trading.

From Washington to a Focus Mode

Musk has taken heat for being distracted, splitting his time between politics, social media, and moonshot projects. His role in the Department of Government Efficiency (DOGE) and massive political donations raised concerns, especially as Tesla posted its first annual sales drop in over a decade. Now, Musk says he’s returning from politics and pouring energy into Tesla, xAI, and SpaceX again. Since that April 22 announcement, when Musk declared his intention to pull back from Washington to his business, Tesla shares have surged 43%, bouncing back into $1 trillion market cap territory.

History suggests that a focused Musk can be powerful. Investors remember 2018’s “production hell” when he camped out at Tesla’s Fremont factory to push the Model 3 out the door. Back then, the stock reacted positively and soared.

But the road ahead isn’t easy. Tesla is facing fierce pressure from Chinese EV rivals. The Cybertruck rollout hasn’t lived up to the hype. Musk’s promise of a budget-friendly Tesla still hasn’t materialized. And over at xAI, the Grok chatbot is getting attention but lacks a clear way to make money.

Meanwhile, X is dealing with tech issues, falling ad dollars, and a battered reputation.

The Bottom Line

Musk’s “back to 24/7” pledge could mark a turning point — or just more noise. For investors, it’s worth watching not what he tweets, but what he builds next.

Track Tesla, xAI, and SpaceX-related stocks on TipRanks to stay ahead.

Is Tesla a Buy, Sell, or Hold?

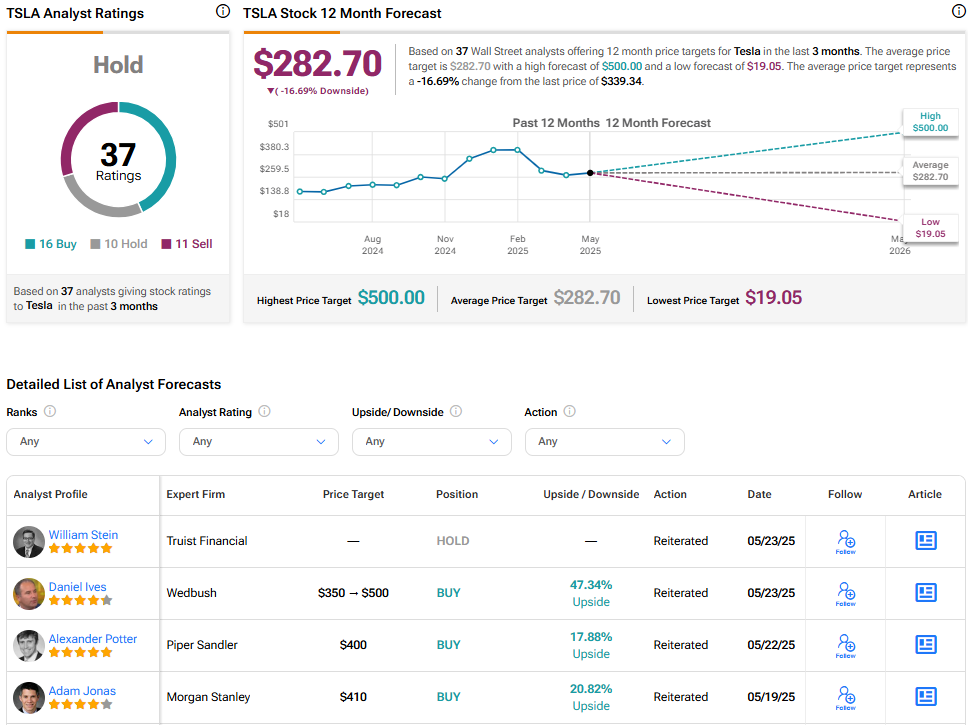

According to the Street’s analysts, Tesla is currently rated a hold. The average TSLA stock price target is $282.70, implying a 16.69% downside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue