Tesla (TSLA) CEO Elon Musk has expressed concerns about the lack of reciprocity in the tech relationship between the U.S. and China, according to a Financial Times report. This marked a rare criticism of Beijing from Musk and came after President-elect Donald Trump signaled he would likely extend the deadline for ByteDance, TikTok’s parent company, to divest its U.S. operations.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Musk Calls for Change in U.S.-China Trade Dynamics

Following Trump’s statement, Musk stated on the social media platform X that the current dynamic—where TikTok operates freely in the U.S. while X, formerly Twitter, is banned in China—is “unbalanced.” As a result, Musk stated that “something needs to change.”

Musk has historically maintained a cautious approach regarding China due to Tesla’s reliance on the country as both a key market and production hub.

In response, Chinese foreign ministry spokesperson Mao Ning asserted that China welcomes any company that abides by its laws. Regarding Trump’s proposal to push TikTok to form a joint venture in the U.S., Mao reiterated that such decisions should be made independently by the companies involved.

China remains a critical market for Tesla, accounting for around 25% of its sales in the third quarter, with more than 25% of its vehicles exported from its Shanghai factory to other countries.

TikTok’s Rivals Move to Capitalize on the Disruption

As TikTok resumed operations in the U.S. on Sunday, rivals moved swiftly to capitalize on the momentary disruption. Meta’s (META) Instagram announced a new video editing app, Edits, while X launched a dedicated video tab in its mobile app. Musk’s social media platform, X, aims to establish itself as a hub for diverse content, spanning live streams, video podcasts, and longform interviews. The company announced the rollout of “an immersive new home for videos” to U.S. users starting Sunday.

What Is the 12-month Price Target for Tesla?

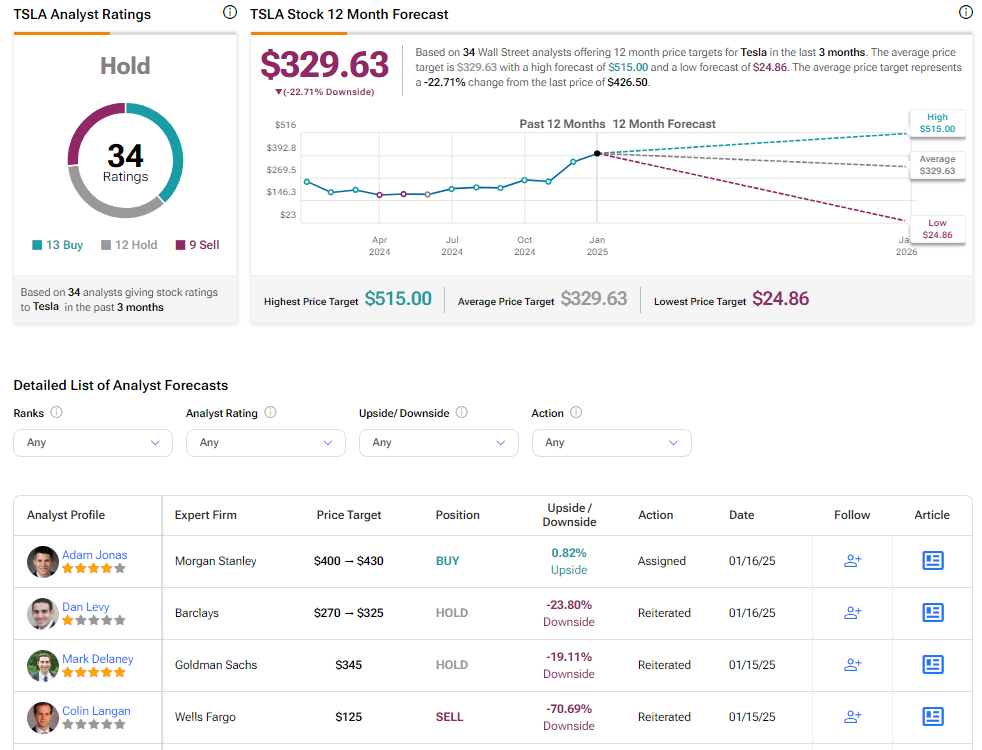

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on 13 Buys, 12 Holds, and nine Sells. Over the past year, TSLA has surged by more than 100%, and the average TSLA price target of $329.63 implies a downside potential of 22.7% from current levels.