The stock of Eli Lilly (LLY) has been upgraded by independent investment bank Leerink Partners as its weight-loss medications are set to receive coverage under Medicare and Medicaid.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Privately-held Leerink Partners upgraded LLY stock to a Buy rating from Hold previously. Analysts cited more adoption of obesity treatments due in large part to upcoming coverage of the drugs under Medicare and Medicaid. Leerink also raised its price target on Eli Lilly’s stock to $1,104 from $886.

The upgrade comes after Eli Lilly and rival Novo Nordisk (NVO) struck GLP-1 pricing deals with the administration of U.S. President Donald Trump. Under terms of the deal, Medicare patients will pay only $50 per month for all approved uses of injectable and oral obesity medications. The drugs currently cost consumers as much as $1,000 per month.

Revised Earnings Estimate

Leerink Partners expects most of Eli Lilly’s weight-loss drugs to be accessible through Medicare and Medicaid by 2027. That coverage, along with new drug launches and an obesity pill, will reinforce Eli Lilly’s leadership position in the market for weight-loss drugs, says the investment bank.

“We expect Lilly to succeed in the price-for-volume game, given its tremendous scale advantages and growing obesity portfolio,” wrote Leerink Partners. The Wall Street firm also raised its 2026–2030 earnings estimates for Eli Lilly by 4% to 9% annually and boosted its long-term revenue and profit growth outlook, projecting a 15% revenue compound annual growth rate (CAGR) and 20% earnings CAGR through 2030.

Is LLY Stock a Buy?

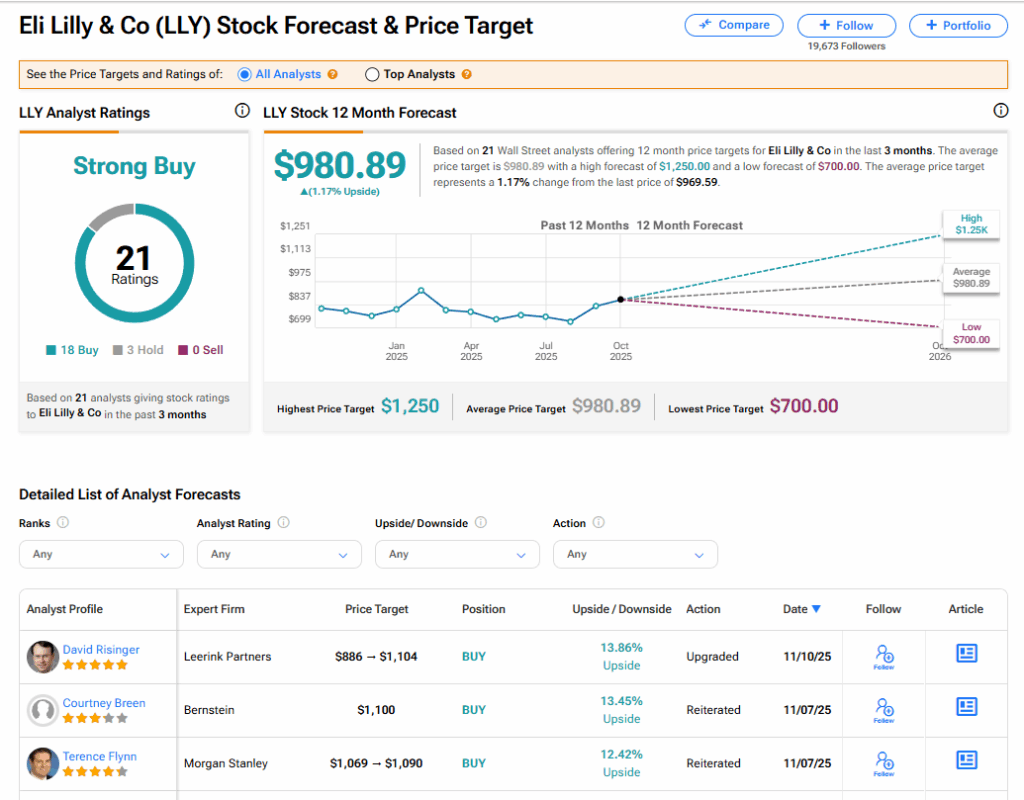

The stock of Eli Lilly has a consensus Strong Buy rating among 21 Wall Street analysts. That rating is based on 18 Buy and three Hold recommendations issued in the last three months. The average LLY price target of $980.89 implies 1.17% upside from current levels.