U.S. pharmaceutical giant Eli Lilly (LLY) has announced plans to spend $5 billion building a new manufacturing plant in the State of Virginia, the first of four new U.S. plants the drug maker is constructing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Eli Lilly is aiming to move more of its manufacturing stateside as U.S. President Donald Trump threatens to impose import tariffs on medications that are made outside of America. President Trump has also called on companies such as Eli Lilly to lower prescription drug prices for U.S. consumers.

Analysts say that Eli Lilly is hedging against potential U.S. tariffs with its plan to develop more manufacturing capacity in the U.S. Other pharmaceutical companies are also increasing their U.S. investments as President Trump calls for the industry to make more medicines domestically.

Tariff of 250%?

President Trump has threatened to impose tariffs as high as 250% on U.S. pharmaceutical companies. In response, Eli Lilly has announced plans to spend $27 billion on four new U.S. manufacturing sites to counter potential import duties on prescription drugs.

The newest facility, to be situated in Goochland County, Virginia, will produce active pharmaceutical ingredients for cancer, autoimmune diseases, and other illnesses. The Virginia plant will also expand Eli Lilly’s capacity to develop new cancer treatments. The plant is expected to be completed within five years and create more than 650 jobs for skilled workers, including engineers and scientists.

Is LLY Stock a Buy?

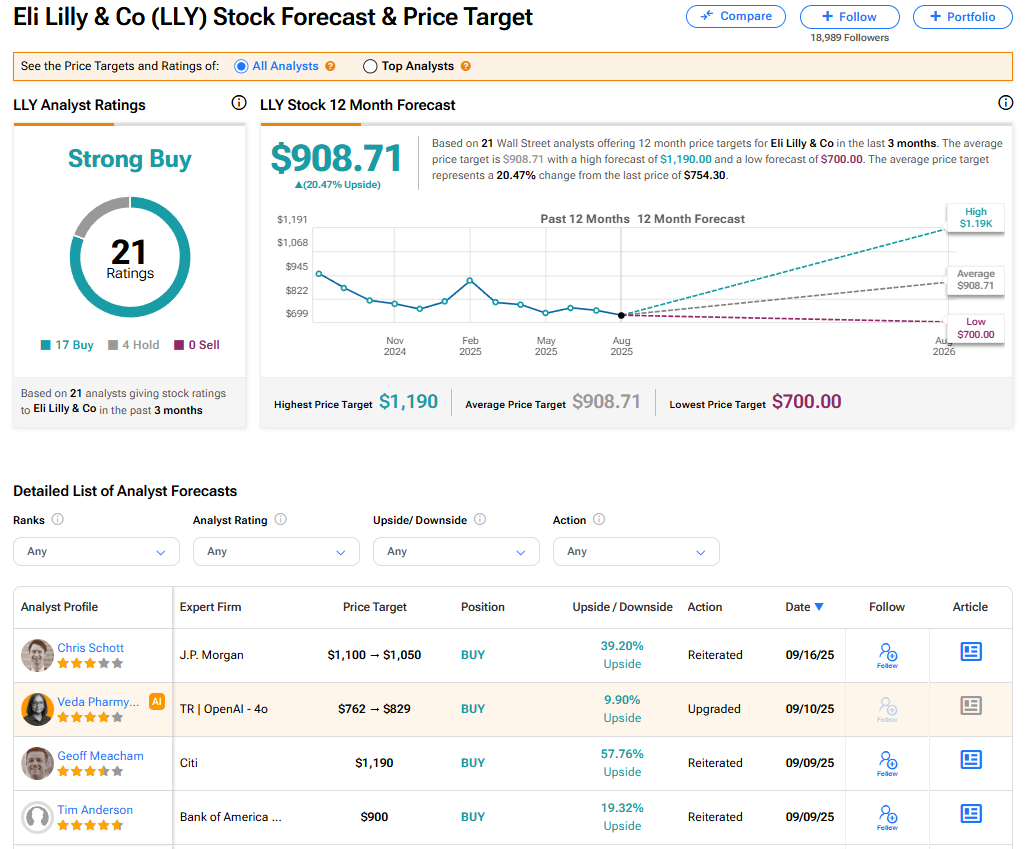

The stock of Eli Lilly has a consensus Strong Buy rating among 21 Wall Street analysts. That rating is based on 17 Buy and four Hold recommendations issued in the last three months. The average LLY price target of $908.71 implies 20.47% upside from current levels.