Shares of search-powered solutions provider Elastic N.V. (NYSE:ESTC) surged nearly 19% in the early session today after its second-quarter results and financial outlook impressed investors.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Driven by rising customer activity in generative AI and large language models, the company’s revenue jumped by 17.6% year-over-year to $311 million, exceeding estimates by about $7 million. EPS of $0.37 also outpaced expectations by $0.13. Further, Elastic Cloud revenue increased by 31% year-over-year to $135 million.

Elastic’s total subscription customer count rose by 1,000 to 20,700 compared to the year-ago quarter. Additionally, its total customer count with an annual contract value (ACV) of over $100,000 increased by 170 to 1,220.

Looking ahead to Fiscal Year 2024, the company expects revenue to be in the range of $1.247 billion to $1.253 billion. EPS for the year is anticipated to land between $1.06 and $1.15. For the upcoming quarter, Elastic expects to generate an EPS of $0.30 to $0.32 on a revenue range of $319 million to $321 million.

Is ESTC a Good Stock to Buy?

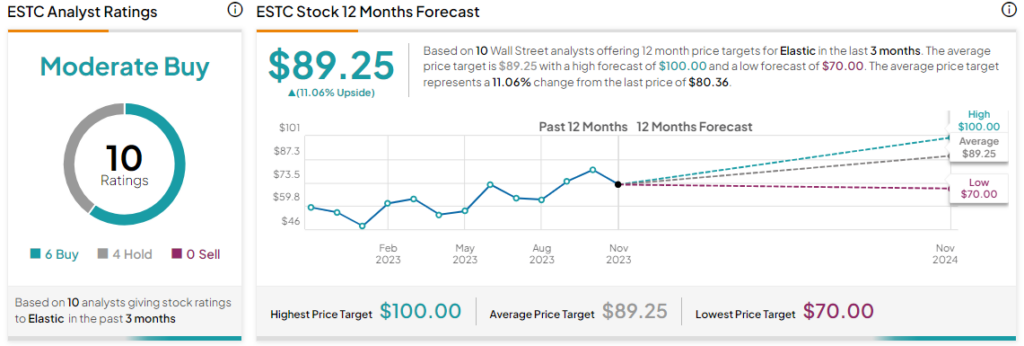

Overall, the Street has a Moderate Buy consensus rating on Elastic, and the average ESTC price target of $89.25 implies a modest 11% potential upside. That’s after a nearly 31% price gain in the company’s shares over the past year.

Read full Disclosure