Elanco Animal Health (NYSE:ELAN) is at a 52-week high after the company’s first-quarter earnings release. Not only did the animal health company beat consensus expectations, but it also provided encouraging updates regarding its product pipeline. However, there are plenty of challenges ahead, including margin contraction, leverage, and industry competition, making me neutral on the stock.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Indiana-based Elanco Animal Health is the world’s second-largest animal health company after Zoetis (NYSE:ZTS). Spun off from Eli Lilly (NYSE:LLY) in 2018, it provides a range of pet and livestock products and services to veterinarians, farmers, and pet owners.

In conjunction with its first-quarter financial results, Elanco announced several positive regulatory developments that could soon expand its product set. The U.S. Food and Drug Administration is reviewing multiple product candidates, including a cattle feed additive that management expects to approach blockbuster status later this year.

It’s not all roses, though. The first-quarter update did have some parts that smelled of manure. Although Elanco outperformed analyst estimates, profits declined for the fourth consecutive quarter. This reflects the company’s ongoing margin struggles that have weighed on its stock.

I have mixed feelings about Elanco. While the potential for multiple new animal health product launches in 2024 is exciting, the company’s fundamental health is lacking. Until there are signs of margin improvement, sustainable profit growth, and debt reduction, I believe a neutral stance is appropriate, as stated earlier.

Let’s dig further into Elanco’s first-quarter numbers and the products that could boost its performance in the second half of 2024.

ERP Blackout Impacted Results

Elanco’s first-quarter revenue fell 4% year-over-year to $1.2 billion. Excluding the impact from last year’s enterprise resource planning (ERP) blackout that shifted revenue into the first quarter of 2023, revenue increased about 4%. Elanco’s transition to an SAP (NYSE:SAP) ERP platform has had ripple effects on customer orders, invoicing, and financial reporting.

Adjusted earnings per share (EPS) of $0.34 came in well ahead of consensus but were down 24% from the prior year period. Further, Elanco’s gross profit margin declined 350 basis points due to the ERP blackout, a manufacturing cutback to reduce inventory and cost inflation.

Although the ERP issue was anticipated, the other issues show that management is still having trouble containing costs. Marketing and R&D expenses both increased during the first quarter.

Another fundamental flaw is Elanco’s hefty debt burden. The company exited the first quarter with a net leverage ratio of 6.1x adjusted EBITDA. This marked a significant increase from the 5.6x leverage ratio at the end of 2023.

Elanco’s Late-Stage Pipeline Is Advancing

Management increased its new product sales expectations largely due to the anticipated success of Experior and AdTab. As a result, it narrowed its 2024 revenue guidance range to $4.460-4.515 billion. Meanwhile, the company’s adjusted EPS outlook was raised slightly to $0.88-0.96.

Much of the upbeat outlook is based on Experior, the first FDA-approved feed additive that reduces ammonia gas emissions from an animal or its waste. Elanco recently submitted combination clearance requests to the FDA for Experior with MGA (melegestrol acetate). If approved, the product variant would expand the company’s addressable market to include nearly 40% of all U.S. feedlot cattle.

The clearance would also move Experior closer to becoming a blockbuster product with more than $100 million in annual sales. Elanco is also optimistic about AdTab, its flea and tick treatment for dogs, which had strong first-quarter sales in Europe.

Elanco has several other late-stage innovations that could achieve pivotal milestones this year, including:

- Bovaer, a methane-reducing cattle feed ingredient that the FDA is expected to finish reviewing by the end of this month,

- Zenrelia, a dermatitis treatment for dogs that is expected to receive FDA approval by June 2024 and several international approvals in late 2024,

- Credelio Quattro, an all-in-one pet parasiticide that is also expected to be approved by next month.

At the midpoint of management’s revised adjusted EPS guidance, Elanco stock is trading around 19x this year’s consensus earnings estimate. Industry leader Zoetis trades at 29x this year’s consensus earnings estimate. This would seem to make Elanco a grossly undervalued way to invest in the animal health market. But is its valuation enough to attract Wall Street bulls?

Is ELAN Stock a Buy, According to Analysts?

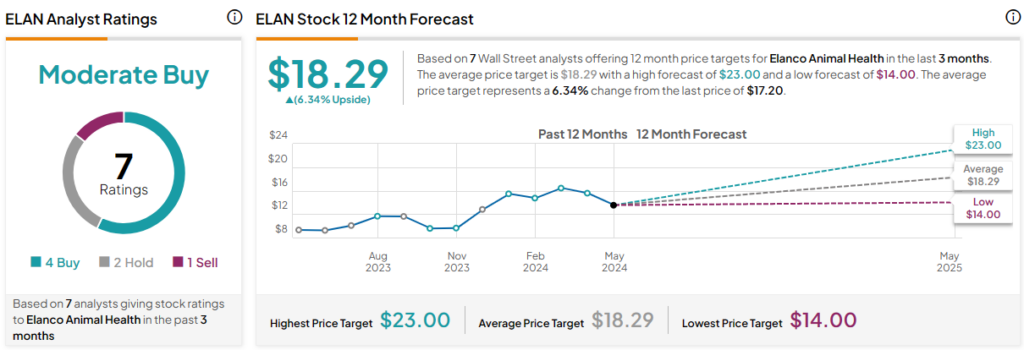

Following the first-quarter earnings report, Barclays (NYSE:BCS) analyst Balaji Prasad maintained a Buy rating on ELAN, while JPMorgan (NYSE:JPM) analyst Chris Schott kept a Hold rating on the stock. Overall, the mid-cap stock has earned a Moderate Buy rating from Wall Street, along with a $18.29 price target that implies 6.3% upside from here.

The Bottom Line on ELAN Stock

Elanco Animal Health stock continues to dig out of its record low from 12 months ago, thanks to better-than-expected first-quarter financials and an improved 2024 outlook. The company has a bunch of pending FDA approvals that could significantly boost its financials. However, until profitability and leverage improve, I wouldn’t bet the farm on the stock.