Bad news for chip stock Intel (INTC) today as the first leak in the Arrow Lake refresh line emerged, and made investors downright nervous. Maybe they are more concerned about Intel’s upcoming earnings announcement, but the arrival of the Arrow Lake refresh’s first word did little to help in its own right. Intel shares dropped over 4% in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The word about the Arrow Lake refresh line brought some interesting ideas with it. Revealed as part of a Geekbench listing on a Lenovo (LNVGY) desktop, the Core Ultra 7 270K Plus had a lot to offer. It packs in 24 cores, which puts it roughly in the same class as the 280K. But since we are dealing with a 270K here, it is easy to believe that the chip would be slightly lower in performance given standard naming conventions.

Intel seems to be going with the word “plus” to help distinguish the older models from the newer. When the Ultra 7 270K Plus was tested, it brought back stats that were roughly the same as the Core Ultra 9 285K. Some point out here that the 270K Plus was supposed to have lower clock speeds, but may have faster memory support, giving it roughly similar performance overall.

“The Markets are Giving Intel a Major Pass”

Meanwhile, tomorrow is Intel’s next earnings report, and the early word about the likely outcome is starting to show up. Intel has been engaged in a comeback story for quite some time now, with shares nearly doubling from earlier this year. Intel has landed a string of capital infusions, and as we found yesterday, a new client in Microsoft (MSFT).

However, we also know that Intel investors did not look particularly optimistic today, as evidenced by the substantial drop in share prices. Will investors shrug off the likely unpleasant earnings report to come? Or will investors maintain optimism based on a combination of new capital and some new clients in a market where processors are about to be even more in demand? Only time will tell.

Is Intel a Buy, Hold or Sell?

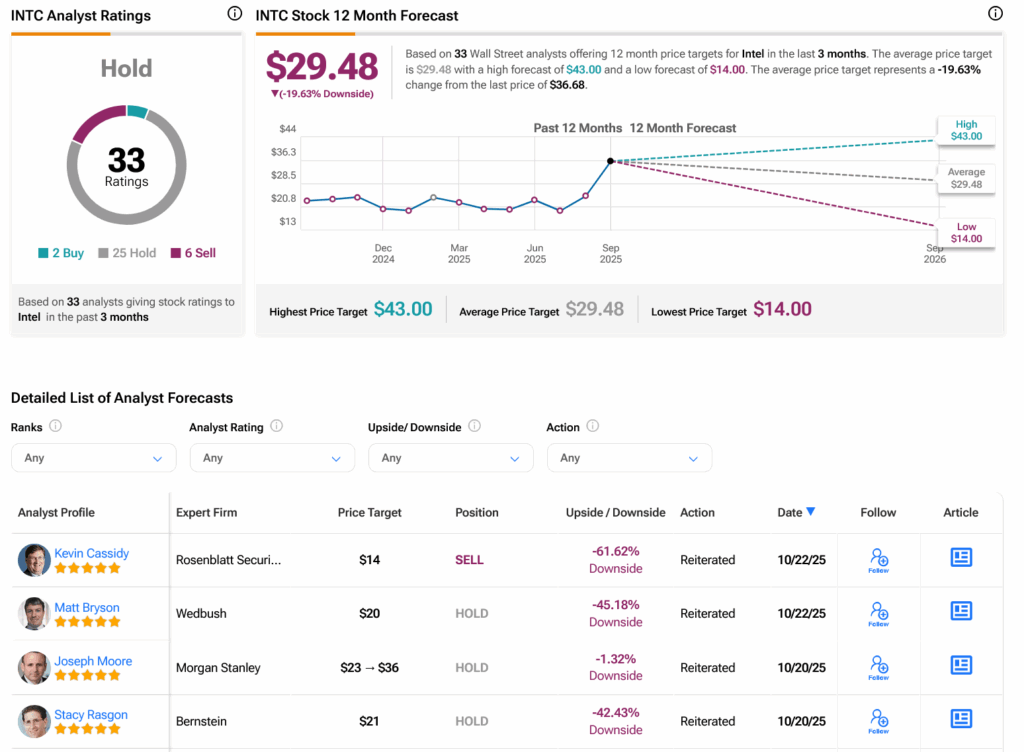

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 25 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 73.43% rally in its share price over the past year, the average INTC price target of $29.48 per share implies 19.63% downside risk.