Ebix (NASDAQ:EBIX) shares surged by nearly 15% today after the on-demand software and eCommerce services provider announced its results for the third quarter. Revenue declined by 1.1% year-over-year to $119.2 million, while EPS of -$0.11 came in lower than estimates by $0.17. Last week, Ebix noted that its quarterly report for the quarter ending September 30 would be delayed due to negotiations and work associated with its credit facility and forbearance agreement.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Exchanges continued to be the largest revenue channel for the company, with revenue trending marginally lower by 0.7% to $99.29 million. Revenue from the RCS channel also dropped by 2.8% to $19.94 million. Further, the company’s operating income dropped by 32.4% year-over-year to $20.5 million thanks to restructuring and IPO marketing costs.

While the overall operating environment remains difficult, Ebix plans to focus on higher-margin businesses with the goal of driving its top line and operating income.

What is the Price Target for Ebix Stock?

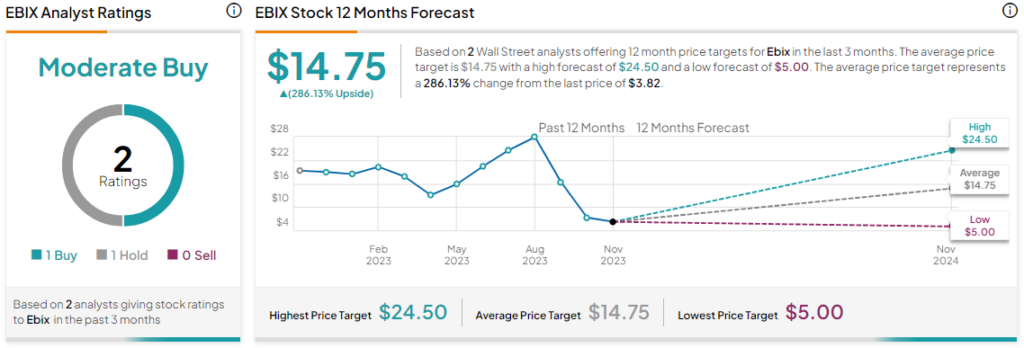

Overall, the Street has a Moderate Buy consensus rating on Ebix. Following a nearly 83% slide in the company’s share price over the past year, the average EBIX price target of $14.75 points to a 286.1% potential upside.

Read full Disclosure