Shares of American e-commerce company eBay (EBAY) gained on Tuesday, even as French authorities launched an investigation into the alleged sale of illicit products on its platform.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The action confirms an earlier report by French daily Le Parisien. The move comes less than two weeks after the French consumer protection watchdog DGCCRF flagged eBay, alongside another American e-commerce platform Wish (LOGC) and Chinese international retail platform Temu (PDD), for selling illicit weapons such as brass knuckles and machetes on their platforms.

DGCCRF also claimed that Chinese e-commerce outlet AliExpress, owned by tech giant Alibaba Group (BABA), and Lisbon-based privately-owned Joom sold child-like sex dolls on their platforms.

Global Headwinds Hit eBay Abroad

The investigation comes as tough economic conditions outside the U.S. slowed eBay’s international sales volume in its recent third-quarter earnings results. The e-commerce company’s global gross merchandise volume (GMV) rose almost 4% when the effect of currency fluctuation is removed, pointing to slower growth.

One of the key factors that weighed on the GMV growth was the elimination of the de minimis exemption for small, packaged imports under $800 into the U.S. by the Trump administration.

However, eBay still managed to grow its overall GMV by 8% to $20.1 billion. The California-based company also saw its revenue climb by the same percentage to $2.82 billion during the quarter.

Moreover, the company recently raised $1 billion in a senior note offering to boost its financial position and market competitiveness. eBay has also turned to AI to improve its listing tools and customers’ shopping experience.

Is eBay a Good Stock to Buy?

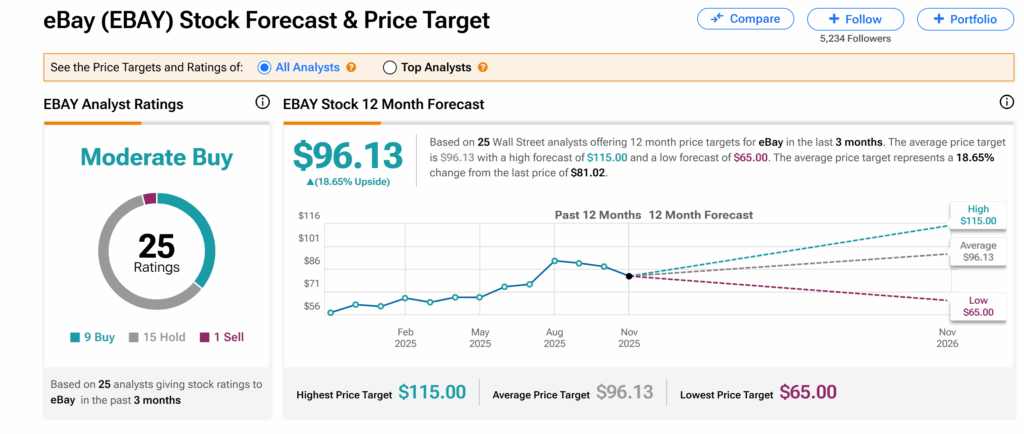

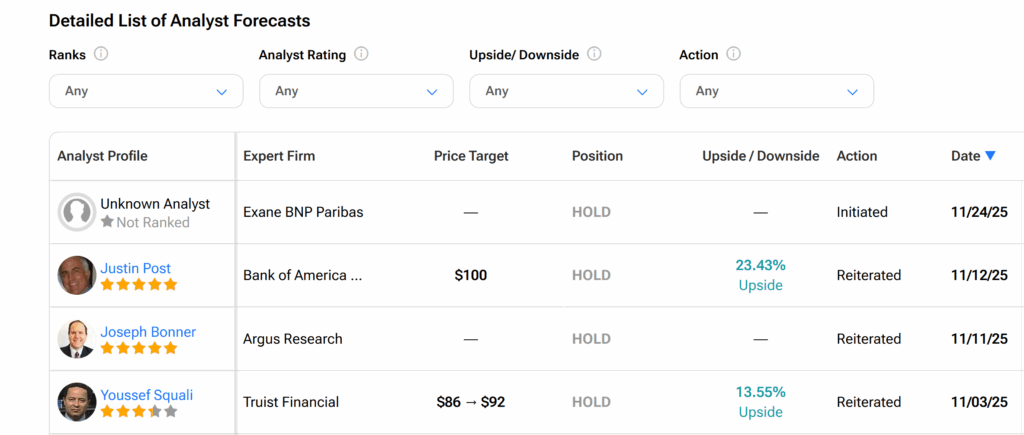

On Wall Street, eBay’s shares currently have a Moderate Buy consensus rating based on nine Buys, 15 Holds, and one Sell assigned by 25 analysts over the last three months.

At $96.13, the average EBAY price target suggests approximately 19% upside from the current levels.