After all the trials and tribulations of the past quarter, Tesla’s (TSLA) Q3 report finally landed this week—and to be honest, it was rather underwhelming. Yes, there were a few clear wins, but expectations were far higher. More importantly, Tesla shareholders may be slowly realizing that despite sales resilience and exciting projects on the horizon, the company’s growth engine is stalling.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue and deliveries hit record levels, yet the results didn’t shine as much as they should have, especially since many U.S. buyers rushed to secure expiring EV tax credits, pulling demand forward. The energy and free cash flow numbers stood out positively, but profitability told a weaker story. With the stock still priced for perfection, I’m feeling more Bearish than bold on TSLA stock.

Why Tesla’s Q3 Was Disappointing

Let’s start with the miss. Tesla reported adjusted EPS of $0.50, falling short of Wall Street’s $0.55 estimate, even though revenue came in strong at $28.1 billion versus the expected $26.4 billion. Operating margin slid to 5.8% from 10.8% a year earlier—a steep drop that reminded investors just how tricky the auto business can be. Operating expenses surged about 50% year over year, while high-margin regulatory credit revenue plunged 44%, dealing a double blow to profitability.

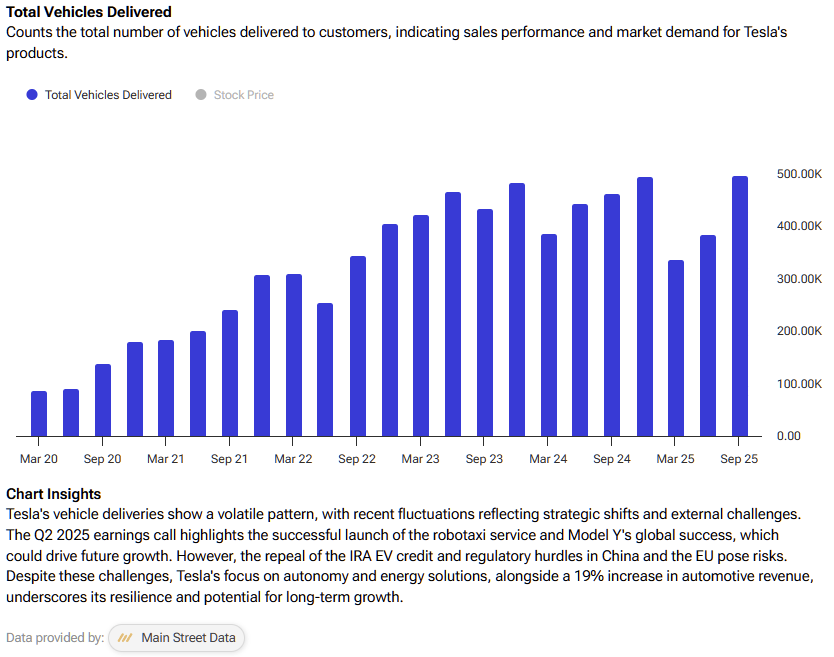

So why was this so disappointing, despite seemingly solid growth? Because much of that growth was “borrowed” from the future. Many U.S. buyers rushed to take advantage of a federal EV tax credit before it expired, pulling demand into Q3 and boosting deliveries to a record 497,099. That helped lift revenue—but it also means a likely demand hangover in the next quarter. Layer on more than $400 million in tariff costs and a weaker contribution from credit sales, and the profit math quickly turned painful.

Management also called out several headwinds: higher costs (including tariffs), lower one-time FSD revenue recognition compared to last year, and increased R&D and AI spending. These are fixable over time, but they hit hard in Q3 and could make investors more cautious about Q4 and beyond. As a result, consensus estimates for upcoming quarters may start to drift lower in the weeks ahead.

Notable Wins Assist Tesla’s Bullish Case

Now for the positives—and to be fair, there were some meaningful ones. Free cash flow nearly hit $4 billion, a quarterly record that boosted Tesla’s cash reserves to $41.6 billion. The energy segment continued to shine, with storage revenue surging 44% to $3.4 billion, driven by record deployments of 12.5 GWh, led by the ramp-up at Megafactory Shanghai. Tesla also rolled out Megablock, a modular solution designed to streamline utility-scale installations, further fueling that growth. For anyone betting on the “Tesla Energy” narrative, Q3 offered plenty of validation.

On the technology side, Tesla continued to stretch its innovation arc. The company began rolling out FSD v14 in October and expanded its robotaxi operations—launching ride-hailing in the Bay Area, extending coverage in Austin, and targeting 8–10 metro areas by year-end. Management highlighted over 6 billion cumulative FSD (Supervised) miles, 250,000 driverless miles in Austin testing, and a growing AI training capacity equivalent to 81,000 H100 GPUs. In short, Tesla’s “real-world AI” story is steadily taking more tangible shape.

Within automotive, Tesla notched a few tactical wins. The company rolled out new “Standard” Model 3 and Y trims for the post-credit U.S. market, launched the Model Y Long Wheelbase in China, and ramped up Performance variants. These moves are designed to boost factory utilization and broaden price coverage—without the need for new facilities. Meanwhile, automotive margins excluding credits inched up to 15.4%, a modest but notable indication that scale efficiencies are still kicking in.

Priced for Perfection…And Then Some

Unfortunately, despite some good news on operations, these achievements struggle to justify the multiple Tesla stock currently trades at. By mainstream measures, Tesla still trades at an eye-watering valuation of around 265x this year’s expected earnings. At that altitude, there’s no oxygen for error. A single sloppy quarter exposes how little cushion the stock affords. Q3 did just that.

The bulls may point to the “optionality” in robotaxis, Optimus, and in-house AI silicon, but this may not be enough. Management honestly talked up expanding production with confidence in unsupervised FSD and the installation of first-gen Optimus lines. Those are thrilling ideas, but they just aren’t cash cows yet, and Tesla still has to navigate tariffs, expiring incentives, and a more challenging EV competitive landscape. If those headwinds persist while investors keep paying ~265x forward earnings, any misstep can turn into a slide.

For what it’s worth, even the “beats” came with caveats. Revenue outperformance leaned on that pre-expiry tax-credit rush, regulatory credits were light, and opex is rising as Tesla funds its AI ambitions. None of that invalidates the long-term vision, but it makes the near term choppy, which matters a lot when the stock is priced like everything will go right on schedule.

Is Tesla Stock a Buy, Sell, or Hold?

As you would expect, Wall Street’s sentiment on Tesla is very mixed. The stock is now carrying a Hold consensus rating based on 14 Buy, 13 Hold, and 10 Sell ratings over the past three months. Moreover, TSLA’s average stock price target of $375.63 suggests ~16% downside from current levels, reflecting its pricey valuation.

TSLA Set to Stall on Fragile Margins and Gravity-Defying Valuation

Q3 showed that Tesla can still move metal and generate serious cash, but it also revealed the company’s vulnerability when incentives fade and costs creep higher. The quarter proved Tesla’s operational strength—delivering record volumes and record free cash flow—yet it also underscored how thin the margin for error has become.

With the stock still priced like a flawless moonshot, the risk-reward balance feels tilted to the downside. Execution remains impressive, and the long-term vision—spanning energy, autonomy, and AI—is undeniably ambitious. But admiration for the mission doesn’t change the math: at today’s valuation, expectations border on perfection. And when perfection is the price of entry, even a minor stumble can hit hard.