Shares in U.S. flyer American Airlines (AAL) zoomed higher today as well-heeled flyers helped it to post record quarterly revenues.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Best Ever

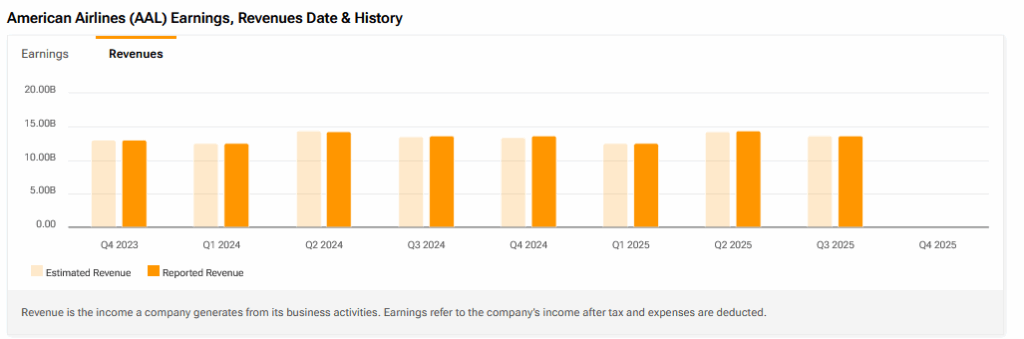

The group said revenues had reached a best-ever $13.7 billion during the period, above Wall Street expectations of $13.63 billion.

It said premium unit revenue growth year-over-year – essentially well-off business and leisure travelers – continues to outperform the “main cabin,” or the ordinary folk in non-airline terms.

It was helped by its AAdvantage loyalty program with active accounts up 7% year-over-year.

Overall the group said that it has remained “resilient” despite weather disruptions and an FAA technology outage in September. It has also had to navigate through President Trump’s tariff strategy.

The airline posted an adjusted loss of $0.17 per share for the third quarter, beating analyst expectations for a loss of $0.28 per share. This was helped by a slight reduction in aircraft fuel costs to $2.7 billion from $2.8 billion last time.

Coffee and Champagne

American Airlines said it expects adjusted earnings per share between $0.45 and $0.75 for the fourth quarter, above the analyst consensus of $0.42. For the full year, the company projects adjusted earnings of $0.65 to $0.95 per share.

“The American Airlines team is delivering on our commitments,” said American’s CEO Robert Isom. “We’ve built a strong foundation, with best-in-class cost management and a focus on strengthening the balance sheet. Looking forward, I’m confident that continued investments in our network, customer experience and loyalty program will position us well to drive revenue growth and shareholder value in 2026 and beyond.”

That includes opening new Flagship lounges in Miami and Charlotte and boosts to the onboard experience for travelers transform with a new coffee partnership with Lavazza, and its first champagne partnership with Champagne Bollinger.

American Airlines however kept a clear head in maintaining its focus on debt reduction, ending the quarter with $36.8 billion in total debt and $10.3 billion in available liquidity. The company remains on track to reduce total debt to less than $35 billion by the end of 2027 and expects to generate over $1 billion in free cash flow for the full year.

Is AAL a Good Stock to Buy Now?

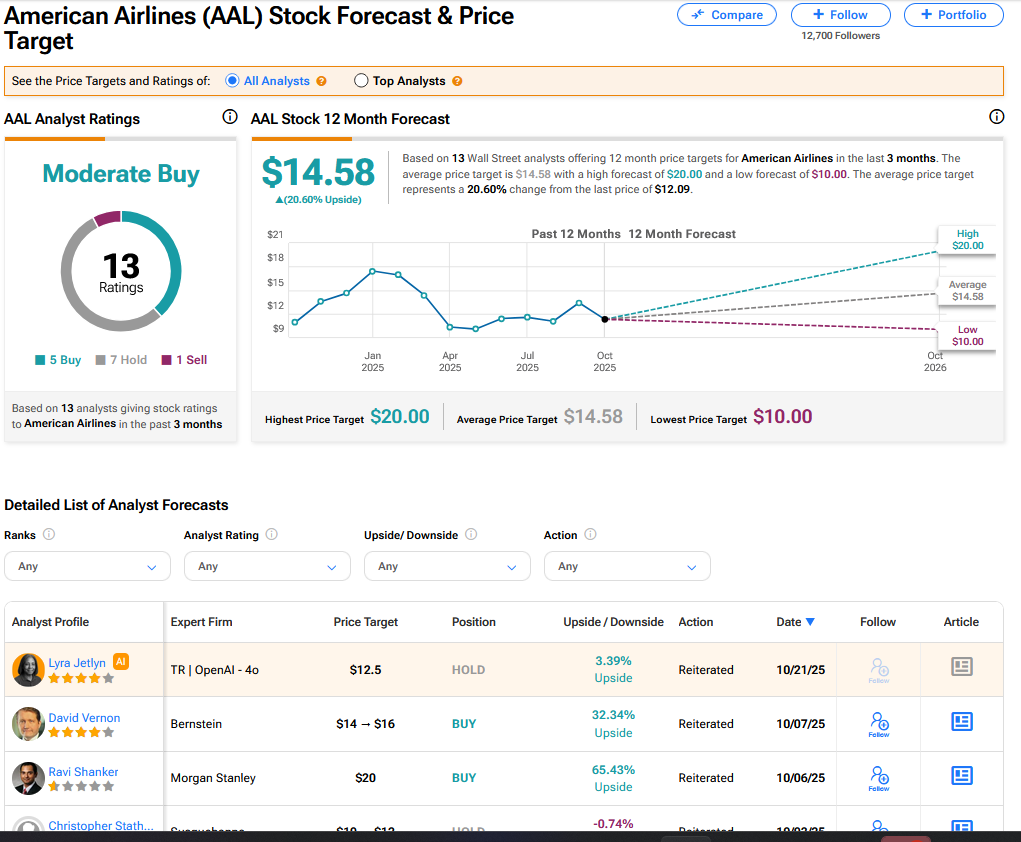

On TipRanks, AAL has a Moderate Buy consensus based on 5 Buy, 7 Hold and 1 Sell ratings. Its highest price target is $20. AAL stock’s consensus price target is $14.58, implying a 20.60% upside.