e.l.f. Beauty (ELF) has responded to the recent claims made by short seller Muddy Waters in a recent short report. Two days ago, the activist short-selling firm revealed a short position in the cosmetics retailer, claiming that e.l.f. has “materially overstated revenue over the past three quarters” by a number ranging between $130 million and $190 million. It also accused the company of reporting inflated profits and revenue. One day later, e.l.f. issued a statement in response, describing the report’s claims as false and “unsubstantiated.”

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Happening with ELF Stock Today?

News of the short report initially pushed ELF stock down. While shares remain in the green for the past week, they have been volatile all day and are currently trending downward. As of this writing, e.l.f. is down 1.5% for the day, and its current trajectory suggests that it has further to fall. The company has been struggling for the past two quarters, with shares falling 36% over a six-month period.

Now the fallout from the short report could take e.l.f. down even further. The holiday shopping season is quickly approaching, but if Muddy Waters’ findings are correct, a retail boost likely won’t make much of a difference. That will be especially true if the allegations that e.l.f. “seems to sell product it does not have” turn out to be accurate. The fact that shares are still falling after the report’s publication suggests that the market believes there is merit to the short seller’s claims.

As noted, e.l.f. responded to the report by challenging it, claiming that Muddy Waters’ case is built on “incomplete data and flawed assumptions.” However, these arguments haven’t helped push share prices back into the green yet. This comes after the company reported positive earnings for Q2 and even raised its outlook. It is clear that confidence in e.l.f. is declining, as Muddy Waters isn’t the only short seller targeting it. Data from Fintel shows that short interest currently accounts for 9% of the stock’s float.

Wall Street Remains Bullish on ELF Stock

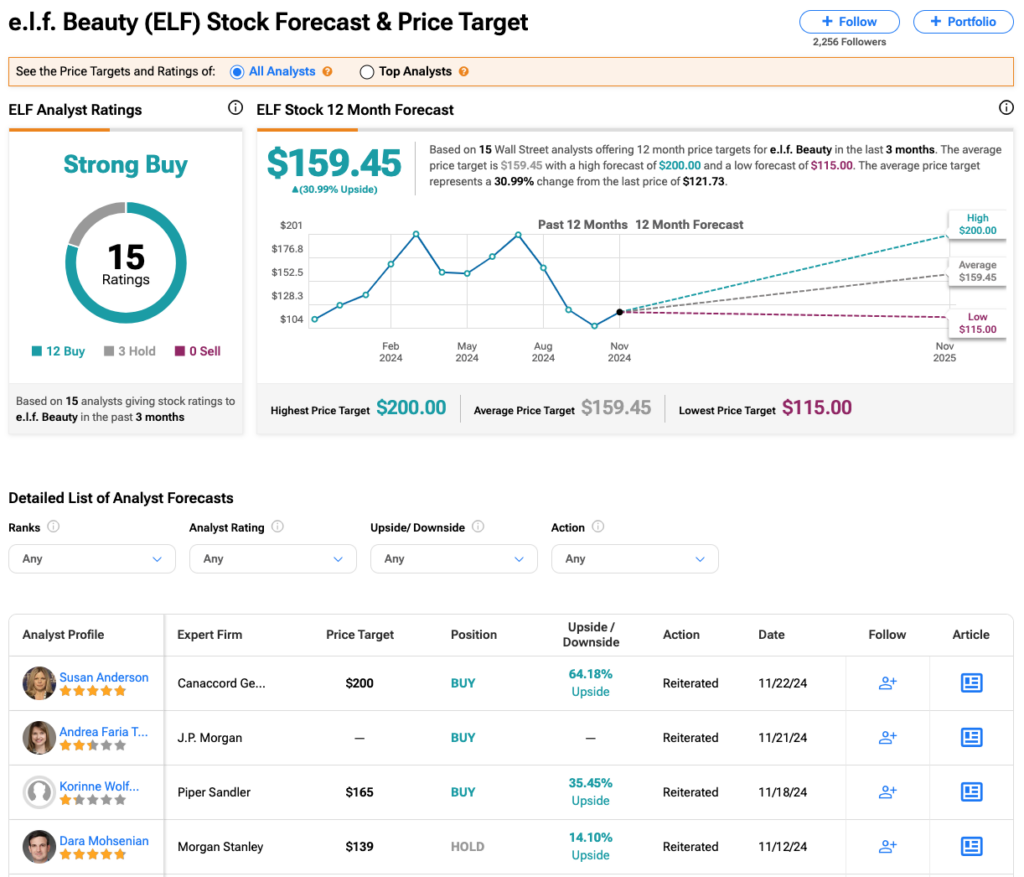

Turning to Wall Street, analysts have a Strong Buy consensus rating on ELF stock based on 12 Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 6.5% gain in its share price over the past year, the average ELF price target of $159.45 per share implies 31% upside potential.