e.l.f. Beauty (NYSE: ELF) surged in pre-market trading on Thursday after the cosmetics company raised its FY24 guidance, projecting net sales in the range of $896 million to $906 million. Those numbers compare favorably to its prior net sales forecast of between $792 million and $802 million. Furthermore, it is considerably higher than analysts’ FY24 consensus estimates of $866.3 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ELF also raised its FY24 earnings outlook, and now forecasts adjusted earnings in the range of $2.47 to $2.50, versus its prior forecast of between $2.19 and $2.22 per share. For reference, analysts were expecting adjusted earnings of $2.43 per share.

In the Fiscal second quarter, ELF’s adjusted earnings more than doubled to $0.82 per diluted share and above consensus estimates of $0.24 per share. The company generated revenues of $431.8 million, up by 76% year-over-year and surpassing analysts’ estimates of $413.4 million.

Is ELF Good to Invest In?

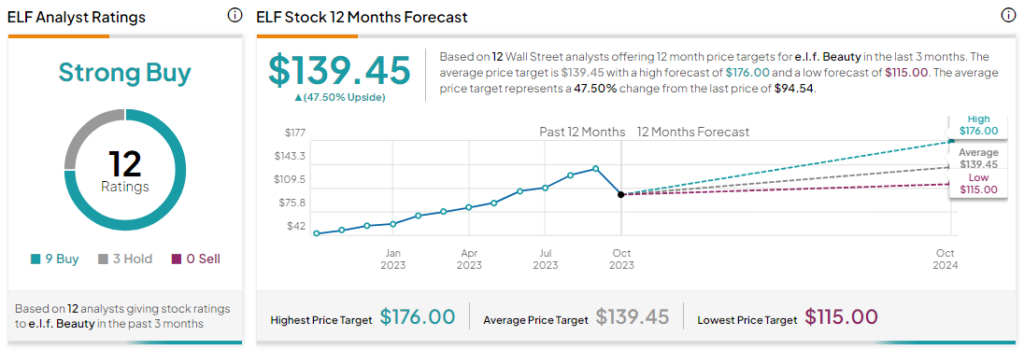

Analysts remain bullish on ELF stock with a Strong Buy consensus rating based on nine Buys and three Holds. The average ELF price target of $139.45 implies an upside potential of 47.5% at current levels.