It might sound like something out of a strange Magnificent Seven themed disaster movie but tech giant Apple (AAPL) has reportedly airlifted millions of iPhones out of India to beat President Trump’s tariffs.

Apple Ramped Up Production

As reported on Reuters, Apple has, since March, chartered cargo flights to fly 600 tons of iPhones, or around 1.5 million, to the U.S. from India after it stepped up production. The strategy, which included lobbying Indian airport authorities to cut to six hours the time needed to clear customs at the Chennai airport down from 30 hours, was part of a plan to beef up its U.S. stocks before the tariffs hit.

“Apple wanted to beat the tariff,” one source told Reuters. The news led Apple stock lower in pre-market trading.

Apple Is Vulnerable

According to President Trump’s initial plan India was hit by reciprocal tariffs of around 26%, although these have now been paused for 90 days. Despite that there is a still huge cost risk for Apple due to its strategy of having production facilities in India but also China, the main manufacturing hub of its devices, which is subject to a staggering 125% tariff rate.

As reported by Reuters analysts have warned that U.S. prices of iPhones could surge, given Apple’s high reliance on imports from China. Apple sells more than 220 million iPhones a year worldwide, with Counterpoint Research estimating a fifth of total iPhone imports to the United States now come from India, and the rest from China.

Apple has recently announced a huge investment to build facilities in the U.S. but the tariffs turmoil has exposed its vulnerabilities to an ever more volatile global trade world. It is why it features on the TipRanks Trump Tariffs comparison tool as one of the stocks most at risk.

Is AAPL a Good Stock to Buy Now?

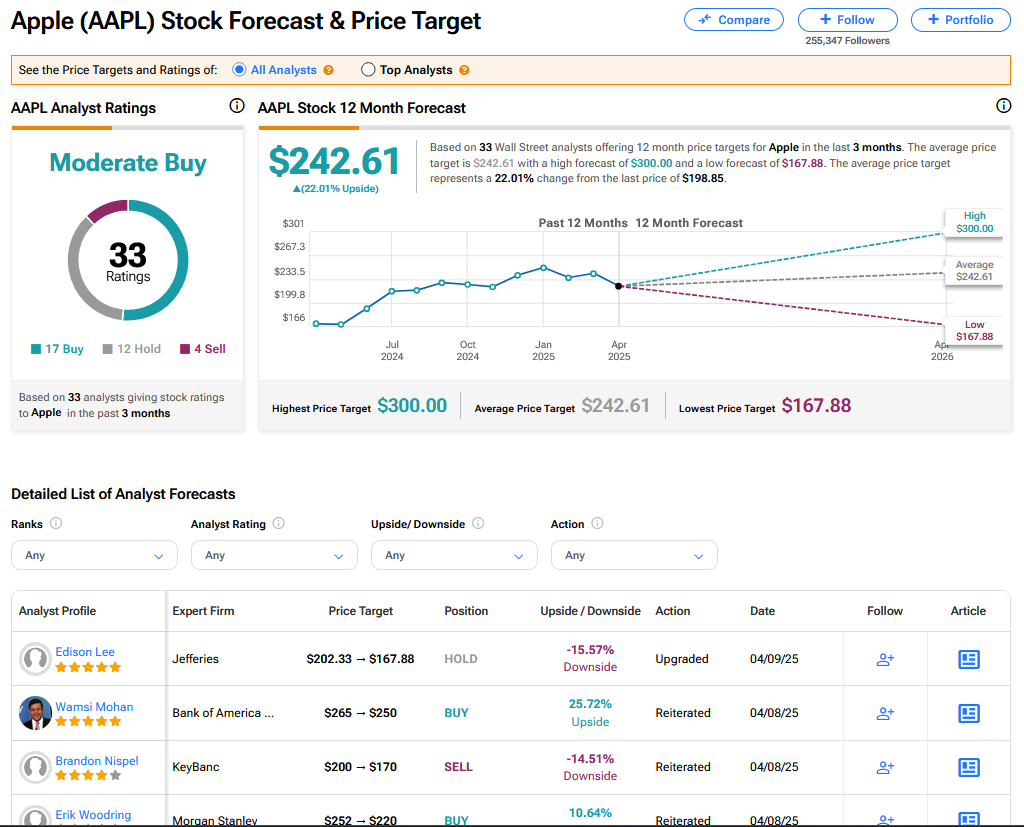

On TipRanks, AAPL has a Moderate Buy consensus based on 17 Buy, 12 Hold and 4 Sell ratings. Its highest price target is $300. AAPL stock’s consensus price target is $242.61 implying an 22.01% upside.