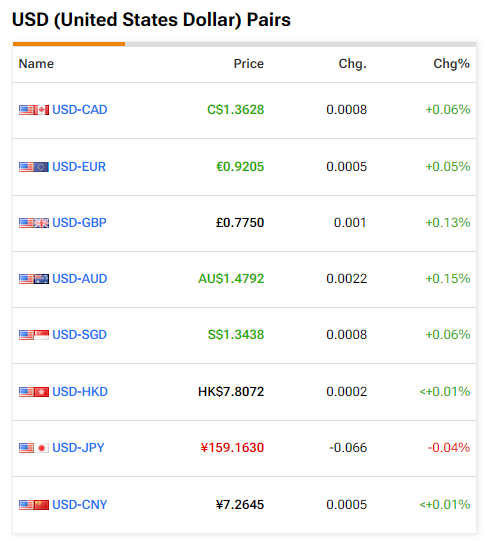

The U.S. Dollar Index (DXY) is on shaky ground this week after the latest CPI print pointed to receding inflationary pressure in the U.S. The CPI data, coupled with recent comments from Fed Chair Jerome Powell, has bolstered hopes of a rate cut in September. Consequently, the DXY could continue to remain under pressure over the coming sessions.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Another Boost for Rate Cut Bets

Core CPI, which excludes food and energy prices, increased by 0.1% in June. The Street had largely expected an increase of 0.2%. Additionally, the year-over-year increase of 3.3% in the inflation gauge was the smallest in about three years. Analysts had anticipated an increase of around 3.5%.

This is another promising data print for the Fed in its effort to drive inflation towards the 2% mark. The CPI reading also bolsters the case for a rate cut in September. Earlier this week, Fed Chair Jerome Powell noted that the U.S. economy was no longer “overheated.” The comment, coupled with the CPI print, could mean lower interest rates for inflation-battered consumers.

While some quarters of the market are beginning to factor in a second rate cut in December, any adverse data print between now and September could derail the rate-cut narrative. Meanwhile, any flare-up in geopolitical tensions in the Middle East, Ukraine, or Taiwan could boost the safe-haven demand for the U.S. Dollar. This, in turn, could lend strength to the DXY.

What Is the Outlook for DXY?

For now, the DXY might stay under pressure, and it could drop below the 104 mark.

Read full Disclosure