Devon Energy (NYSE:DVN) reported better-than-expected results for the fourth quarter. However, DVN stock fell about 1% in after-hours trading yesterday. The dip was primarily due to a year-over-year decline in revenue and earnings.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

DVN is an independent energy company engaged in the exploration, development, and production of oil, natural gas, and natural gas liquids (NGLs).

Q4 Financial Highlights

The company posted adjusted earnings of $1.41 per share, which came above the analysts’ estimates of $1.38 per share but decreased 15.1% from the prior-year quarter. Meanwhile, Q4 revenues of $4.15 billion fell 3.6% year-over-year but surpassed the Street’s estimates of $3.88 billion.

Devon Energy’s performance was impacted by lower realized prices during the quarter. The average total realized price for oil per barrel was $76.98, down 0.6% year-over-year. Additionally, the average total natural gas price per one thousand cubic feet was $2.02, down 50%. Further, the average total realized NGL price per barrel was $19.67, reflecting a decrease of 19%.

Total production increased to 662,000 million barrels of oil equivalent (mboed) from 636,000 mboed.

Outlook

For Q1, the company expects production in the range of 630,000 to 650,000 mboed. For the full year 2024, the company predicts that production will range between 640,000 and 660,000 mboed.

Capital Deployment Activities

Devon Energy increased its quarterly dividend by 10% to $0.22 per share. Also, the company declared a variable dividend of $0.22 per share. Both dividends are payable on March 28, 2024, to shareholders of record on March 15, 2024.

It is worth mentioning that DVN stock has a dividend yield of 6.51%, compared with the energy sector’s average of 3.75%.

Is DVN a Good Stock to Buy Now?

Following the earnings release yesterday, analyst David Deckelbaum of TD Cowen maintained a Hold rating on DVN stock with a price target of $48 (8.3% upside potential).

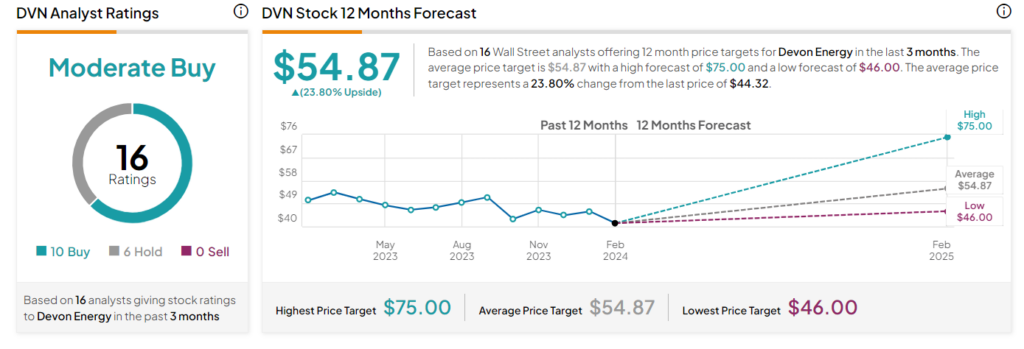

Overall, DVN stock has a Moderate Buy consensus rating based on 10 Buy and six Hold recommendations. The average stock price target of $54.87 implies a 23.8% upside potential. Shares of the company have declined 12.8% over the past year.