Devon Energy (DVN) stock gained 1.5% in yesterday’s after-hours trading session after the company reported a strong second quarter. DVN exceeded earnings expectations and raised its production guidance for 2024. The company’s strong performance in the Delaware Basin and improved operational efficiency supported the results.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

DVN is an oil and natural gas exploration and production company based in the United States.

DVN: Robust Q2 Performance

Devon reported revenue of $3.92 billion in Q2, up 13.4% year-over-year. This came higher than the Street’s estimate of $3.90 billion. Further, the company posted adjusted earnings of $1.41 per share, above the analysts’ expectations of $1.26.

In terms of key metrics, the company reported record-breaking oil production of 335,000 barrels per day during the quarter. The growth was primarily driven by higher productivity in the Delaware Basin, which accounted for 66% of the total Q2 volume.

Raised Guidance

Encouraged by strong Q2 performance and improved well productivity, Devon raised its full-year production forecast to a range of 677,000 to 688,000 barrels of oil equivalent per day (boepd) from the previously guided range of 655,000 to 675,000. This increase will be achieved while maintaining capital spending within the $3.3 billion to $3.6 billion range.

For the third quarter, Devon expects capital spending of $900 million, and its oil production to average 319,000 to 325,000 barrels per day.

Increased Share Buyback

Devon expanded its stock buyback program by 67% to $5 billion, demonstrating its commitment to shareholder returns. The company attributed this move to the expected free cash flow accretion from the Grayson Mill acquisition, set to close in Q3.

In the second quarter, Devon repurchased 5.2 million shares at a total cost of $256 million.

Is DVN Stock a Good Buy?

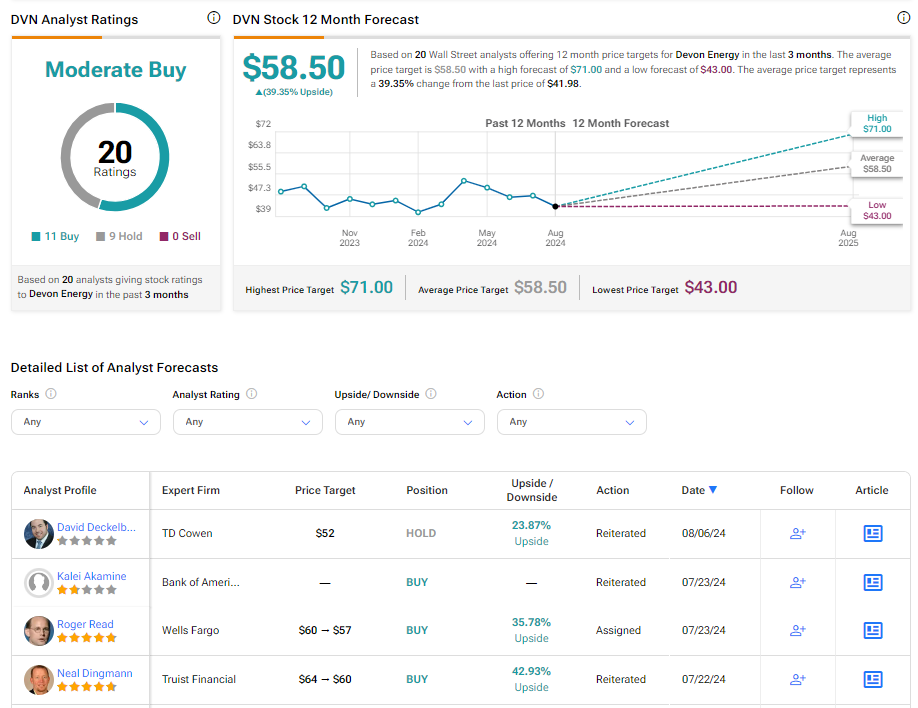

Analysts remain cautiously optimistic about DVN stock, with a Moderate Buy consensus rating based on 11 Buys and nine Holds. The analysts’ average price target on Devon Energy stock of $58.50 per share implies a 39.35% upside potential. Shares of the company have declined by over 17% in the past three months.

It should be noted that analysts’ views on DVN stock could see changes following the earnings report.