Politicians in the land of Vincent Van Gogh, Johannes Vermeer, and Johan Cruyff are looking to reduce the impact of U.S. tech firms such as Amazon (AMZN) on its national life. However, their call impacted one of its own – Dutch semiconductor group ASML Holdings (ASML) whose stock dropped.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Digital Sovereignty Boost

In the latest of a series of moves in Europe against the U.S. tech sector, the Dutch Parliament today passed motions urging the government to slash its reliance on software companies from across the Atlantic. The motions even included a proposal from politicians to establish a cloud services platform controlled by the Netherlands state to enhance its digital sovereignty. This would prioritize investment in and the development of a national digital framework that can support local businesses and protect data privacy.

The move to gain independence from Stars and Stripes software giants comes amid growing concerns over issues such as data sovereignty, technological dependence, and what has been seen by some European regulators as market abuse by the American tech titans.

This includes potential fines for Apple (AAPL) and MetaPlatforms (META) from the European Union for breaking the Digital Markets Act and market abuse claims against Alphabet (GOOGL) in Italy.

Impact on ASML

What the Parliament’s move means for Dutch semiconductor group ASML (ASML) is unclear, although its shares were down nearly 1% today.

ASML is facing challenges on a number of fronts given President Trump’s tariffs tirade. It supplies the necessary tools and materials used for the manufacturing of semiconductors and designs the machines that build microchips. Its three largest customers are thought to be TSM (TSMC), Intel (INTC) and Samsung Electronics.

A Dutch crackdown on any element of U.S. tech could lead to an even more fulsome negative reaction from the Trump administration. Although, a reduction in perceived U.S. interference, which has included an attempt to restrict ASML’s engineers from maintaining semiconductor equipment in China, could be welcome.

Is ASML a Good Stock to Buy Now?

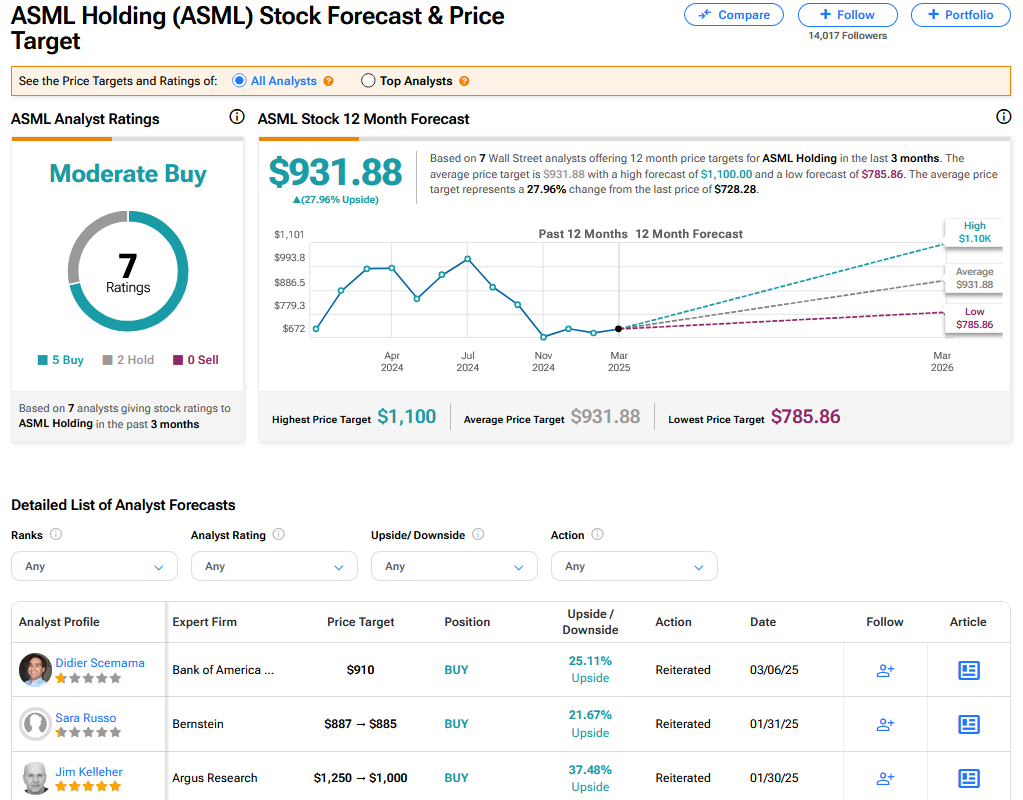

On TipRanks, ASML has a Moderate Buy consensus based on 5 Buy and 2 Hold ratings. Its highest price target is $1,100. ASML stock’s consensus price target is $931.88 implying an 27.96% upside.