Drive-through coffee chain Dutch Bros (NYSE:BROS) could benefit from various tailwinds. These include continued economic growth, an increase in disposable income among consumers, a flood of new store locations, strong revenue growth, and developing brand recognition. While the firm still has an uphill battle against entrenched competitors like Starbucks (NASDAQ:SBUX) and Dunkin’, many analysts on Wall Street are optimistic about Dutch Bros’ potential for gains.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

I share this view, with a word of caution about the persistent effects of inflation and the cost of key ingredients for the company, such as coffee and cocoa. Below, we’ll take a closer look at why Dutch Bros might be a good option for investors looking to boost their exposure to the consumer discretionary space.

Economic Growth and Disposable Income

Though some coffee fans might argue otherwise, Dutch Bros represents part of the discretionary section of a household’s budget, meaning that customers are likely to splurge on its products when they have disposable income and to cut back when times are tighter.

Fortunately for coffee chains, there has been some good news recently for general economic growth. In the first quarter of 2024, real gross domestic product increased at an annual rate of 1.6%. While this is a slower pace of growth than the 3.4% rate of the fourth quarter of 2023, first-quarter growth was spurred by consumer spending, including on discretionary items like coffee.

To be sure, Dutch Bros still faces challenges related to the broader economy as well. Coffee prices remain slightly elevated compared to this time a year ago (although they are down 18% from highs in March). Similarly, Cocoa futures reached a record high of $11,722 per metric ton earlier this year but have since fallen considerably. The lingering impact of inflation and the volatile nature of these commodities means Dutch Bros may have to hike prices again, as it did several months ago, to ensure profitability.

Fortressing and Brand Recognition

In an industry with entrenched stalwarts like Starbucks dominating brand competition, Dutch Bros has chosen to take on an aggressive expansion plan commonly known as “fortressing.” In the most recent quarter, the company opened 45 new locations in 14 states (bringing its total number of locations to 876). In each of the last 11 quarters, it has opened at least 30 new stores.

Fortressing allows a company like Dutch Bros to bolster its brand recognition among consumers through the visibility of its store locations rather than a costly marketing campaign. Domino’s Pizza (NYSE:DPZ) is another chain restaurant that has adopted this technique with successful results.

Strong First-Quarter Performance

The fortressing strategy appears to have paid off so far for Dutch Bros as well. In the first quarter, revenue jumped by an impressive 39.5% year-over-year to $275.1 million. The company noted net income of $16.2 million for the quarter, a turnaround from a loss of $9.4 million in the prior-year quarter.

Two other metrics from the first-quarter earnings report point to an optimistic reading for BROS in the near term. First, system same-shop sales, also known as comps, climbed by 10.0% year-over-year, a notable figure for food service companies. However, full-year 2024 comps are expected to be in the low single digits, so the first months of the year may prove to be outliers.

Second, Dutch Bros executives revised the company’s full-year 2024 revenue guidance upward. They now expect the company to generate revenue as high as $1.215 billion this year, a $10 million increase from prior guidance levels.

Is BROS Stock a Buy, According to Analysts?

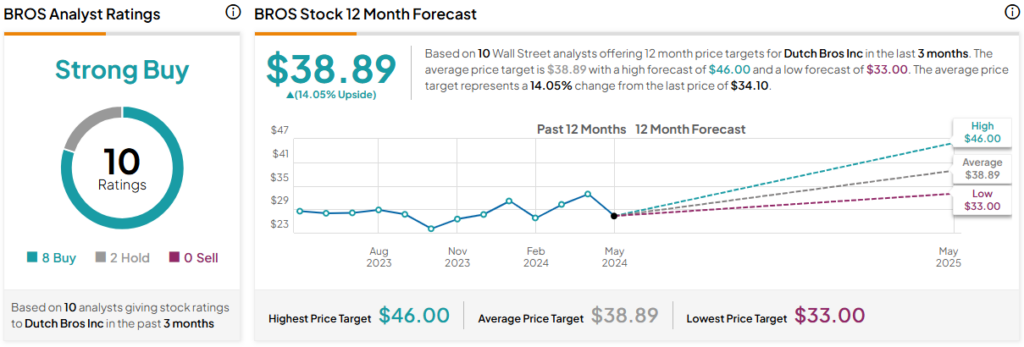

Dutch Bros stock is up 7.7% this year, but at $34.10 per share, it is still trading at less than half the price it reached during its peak in 2021. The average BROS stock price target among Wall Street analysts is $38.89, representing 14.05% upside potential. BROS currently enjoys a Strong Buy rating based on eight Buys, two Holds, and zero Sells.

Conclusion: Rapid Expansion and Momentum Mean Strong Potential

Dutch Bros has seen its consistent and rapid storefront expansion project yield significant revenue gains. This has led to growing brand recognition among consumers increasingly likely to have disposable income to spend on its products. Still, the impact of inflation and volatility in ingredient prices are factors that could give investors some pause when considering this stock. Nonetheless, I believe the pros outweigh the cons with BROS stock.