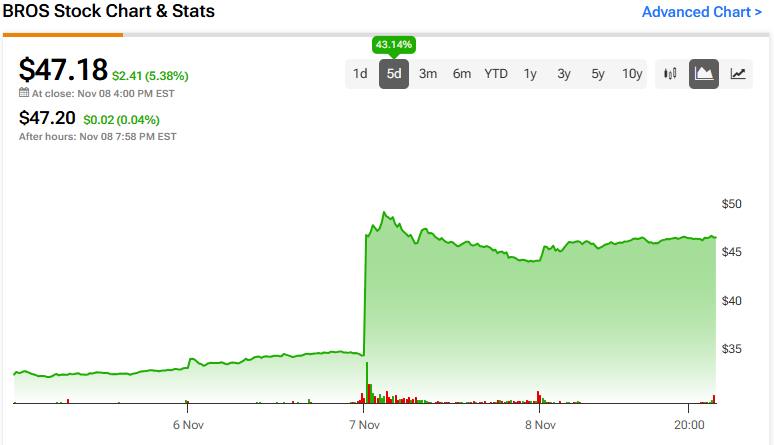

With over 950 drive-thru coffee shops across 18 states, Dutch Bros (BROS) is brewing up a robust cup of growth, with top-and-bottom-line results exceeding expectations in the third quarter of 2024, propelled by successful strategic moves such as the launching of a mobile ordering system and the establishment of 38 new outlets. To top off this buoyant performance, like a sweet and creamy foam, Dutch Bros’ raised revenue and adjusted EBITDA projections for the end of the year. The stock has jumped over 43% in response to the delicious news.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

As the company continues on its high-growth path with new shop openings and advanced mobile ordering capabilities, investors may find BROS a tasty option with long-term growth potential.

Dutch Bros’ Ambitious Growth Plans

Dutch Bros is a rapidly expanding operator and drive-thru shop franchisor specializing in serving high-quality, handcrafted beverages. In addition to its signature core espresso-based beverages, Dutch Bros offers a wide range of customizable cold and hot drinks to cater to a diverse customer base.

The company began its journey with a double-head espresso machine and a pushcart. Now, it boasts 950 locations across 18 states, with ambitions to transition from a regional chain to a national one. It plans to operate over 4,000 shops in the next 10 to 15 years, aiming for mid-teen annual growth.

The company prides itself on more than just its products; it is committed to substantially impacting the lives of its employees, customers, and communities. This blend of high-quality, handcrafted beverages, a unique drive-thru experience, and a community-centric culture has enabled Dutch Bros to steadily grow its footprint.

Dutch Bros’ Recent Financial Results

The company reported financial performance for the third quarter. Revenue hit $338.21 million, beating predictions by $13.24 million and marking 27.9% year-over-year growth. Company-operated shop revenues saw a significant increase of 30.4%, resulting in a company-operated shop gross profit of $68.4 million. However, associated pre-opening costs contributed to a year-over-year decrease in gross margin by 190 bps to 22.2%.

The selling, general, and administrative expenses were $57.5 million, roughly 17.0% of the revenue, showing a decrease compared to 2023’s 19.1% of revenue. Net income significantly increased to $21.7 million from $13.4 million in 2023. Adjusted EBITDA also grew by 20.3% to $63.8 million compared to the same period in 2023. Finally, adjusted net income increased to $27.7 million from $22.4 million in 2023, while non-GAAP earnings per share (EPS) of $0.16, exceeding analysts’ expectations by $0.04.

BROS’s management has revised its 2024 outlook, with total revenue projected to rise to between $1.255 billion and $1.260 billion, an increase from the previously estimated range of $1.215 billion to $1.230 billion. Total system shop openings in 2024 are set to be 150. The expected capital expenditures have been revised downwards to between $245 million and $265 million. The same shop sales growth for the fourth quarter of 2024 is forecasted to be between 1% and 2%. Adjusted SG&A is projected to be in the range of $195 million to $200 million. Moreover, the Adjusted EBITDA is now expected to be between $215 million and $220 million, an increase from the prior estimate of $200 million to $210 million.

Is BROS Stock a Buy?

The stock has been on an upward, though volatile (beta 2.07) trend for the past year, climbing over 74%. It trades at the higher end of its 52-week price range of $25.46 – $50.24 and shows ongoing positive price momentum as it trades above all moving averages. The P/S ratio of 3.715x is a bit rich compared to the restaurant industry average of 3.076x, which is likely pricing in some of the company’s growth potential.

Analysts following Dutch Bros have been constructive on BROS stock. After posting its Q3 performance, Barclays has increased the price target on the shares from $31 to $38 while maintaining an Equal Weight rating. TD Cowen has also upped the price target from $47 to $53 and maintains a Buy rating. UBS has improved the price target from $39 to $44, maintaining a Buy rating. It’s clear that the company’s positive Q3 results, strong same-store-sale transaction trends, continued margin strength, and raised 2024 guidance have impacted analysts’ outlook.

Dutch Bros is rated a Moderate Buy overall, based on the aggregate of the most recent recommendations from 10 analysts. The average price target for BROS stock is $45.80, representing a downside of -2.92% from current levels.

Bottom Line on BROS

Dutch Bros recently released third-quarter results, and its ambitious expansion strategy is a strong brew. Solid year-over-year growth, with positive adjustments to future forecasts, including revenue projections and adjusted EBITDA, further cement Dutch Bros as a potential rising star among coffee houses looking to challenge Starbucks for the crown. While the trajectory may be choppy at times, the upward trend suggests BROS may offer a tempting opportunity for a cup of joe… and long-term growth investment.