Online storage platform Dropbox (NASDAQ:DBX) delivered better-than-expected Q1 financials. Despite the Q1 beat, Goldman Sachs analyst Kash Rangan maintained a Sell rating on DBX stock. The five-star analyst lowered the price target to $22 from $24, implying about 5% downside in DBX stock from current levels.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It’s worth noting that Rangan has a 100% success rate on DBX stock. Copying Rangan’s trades and holding them for a year would give you an average return of 13.95%.

Rangan appreciates DBX’s efforts to diversify its platform via Dash, its search tool powered by Generative AI (artificial intelligence). Nevertheless, the analyst maintains a cautious outlook as he sees DBX facing challenges from a strained small and medium business (SMB) environment. It’s worth noting that SMBs are DBX’s primary customer base. Moreover, the analysts listed limited upside to average revenue per user (ARPU) and uncertainty around the timing and potential uplift from Dash as concerns.

Dropbox Surpasses Expectations

Dropbox reported total revenue of $631.3 million, a 3.3% increase from the year-ago quarter, and surpassed analysts’ expectations of $629 million.

The company’s total annual recurring revenue (ARR) reached $2.556 billion, reflecting 3.6% growth. In Q1, paying users were 18.16 million, up from 17.9 million in the corresponding period last year. This quarter’s average revenue per user (ARPU) was $139.59, slightly higher than the $138.97 recorded in the same period the previous year. Additionally, paying users grew by 35,000 quarter-over-quarter.

The company reported adjusted earnings of $0.58 per share, up about 38% year-over-year. Moreover, it exceeded analysts’ average estimate of $0.50.

Is Dropbox a Good Stock to Buy?

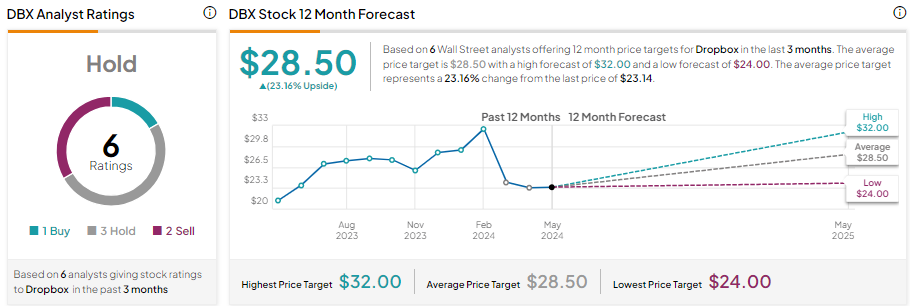

Dropbox stock is down about 21.5% year-to-date. Further, Wall Street analysts are sidelined on DBX stock. With one Buy, three Hold, and two Sell recommendations, Dropbox stock sports a Hold consensus rating.

Analysts’ average price target on DBX stock is 28.50, implying 23.16% upside potential from current levels.