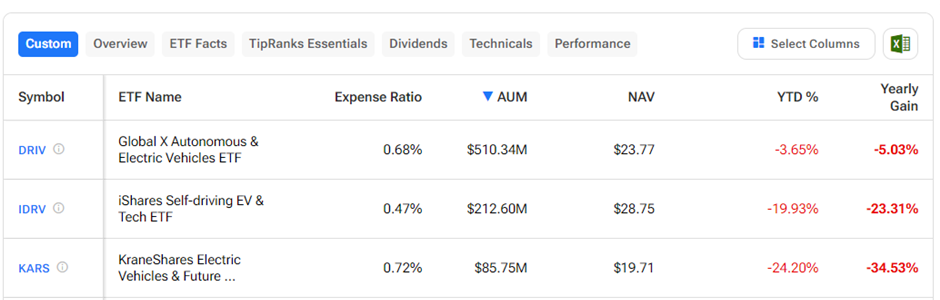

Macro challenges and fading demand have made 2024 one of the worst-performing years for electric vehicles (EVs). The S&P U.S. & China Electric Vehicle Index is down 6.1% year-to-date while the broader S&P 500 index (SPX) has gained 14.7%. Having said that, EVs are here to stay, as countries across the globe hit the decarbonization button. We used TipRanks’ ETFs Comparison tool for EV ETFs to compare Global X Autonomous & Electric Vehicles ETF (DRIV), iShares Self-driving EV & Tech ETF (IDRV), and KraneShares Electric Vehicles & Future Mobility Index ETF (KARS) to determine the best pick based on the assets under management (AUM).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It is difficult to pick a single EV stock with the best product and share performance. In this scenario, investors can consider EV ETFs to gain exposure to the fast-paced EV world. We have narrowed our focus to ETFs tracking EV manufacturing companies, semiconductor players, and autonomous driving companies.

TipRanks’ ETF Comparison Tool enables the comparison of ETFs based on several parameters, including AUM (assets under management), funds flow, expense ratio, technicals, and performance over different time periods.

Global X Autonomous & Electric Vehicles ETF (DRIV)

The Global X Autonomous & Electric Vehicles ETF is the largest ETF in the pure-play EV manufacturing and autonomous ETF segment. As of June 25, DRIV had an AUM of $510.34 million with 76 holdings. Interestingly, DRIV pays a semi-annual dividend of $0.22 per unit, reflecting a yield of 1.68%.

DRIV seeks to track the performance of the Solactive Autonomous & Electric Vehicles Index. This index uses AI (artificial intelligence) to pick global stocks engaged in manufacturing autonomous vehicles, EVs, and related technology. DRIV has an expense ratio of 0.68%.

The ETF’s year-to-date and one-year returns are relatively better compared to the other ETFs in the space. This is perhaps DRIV’s top holdings are not direct EV manufacturers. The top three holdings of the ETF are Nvidia (NVDA), Alphabet Class A (GOOGL), and Qualcomm (QCOM), contributing 13.95% of the total portfolio. In the past six months, DRIV has witnessed net outflows of $174 million.

iShares Self-driving EV & Tech ETF (IDRV)

The iShares Self-driving EV & Tech ETF tracks the performance of the NYSE FactSet Global Autonomous Driving and Electric Vehicle Index. The index invests in global companies that are engaged in the full value chain of self-driving and EV industries. IDRV has one of the lowest expense ratios of 0.47% in the EV ETF space. Meanwhile, as of June 25, IDRV’s AUM stood at $212.60 million with 53 holdings.

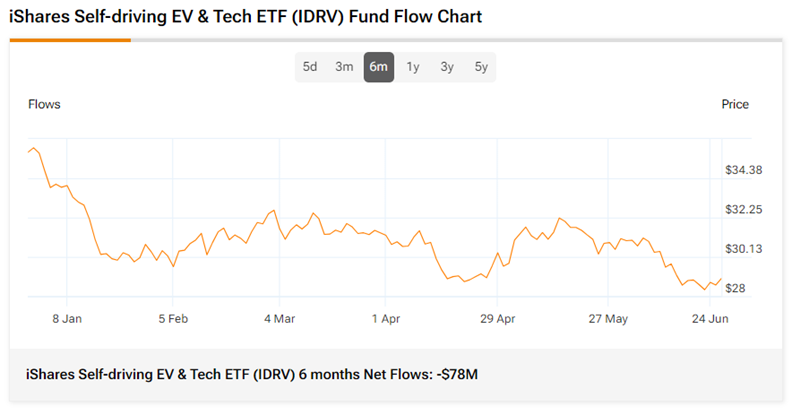

IDRV’s top three holdings are BYD Co. (HK:1211), Tesla (TSLA), and Rivian (RIVN). The three constitute 13.04% of the total portfolio. IDRV has lost 19.9% of its value year-to-date and has declined 23.3% in the past year. The ETF has seen net outflows of $78 million in the past six months.

KraneShares Electric Vehicles & Future Mobility Index ETF (KARS)

The KraneShares Electric Vehicles & Future Mobility Index ETF seeks to replicate the performance of the Bloomberg Electric Vehicles Index. It provides exposure to global equities of companies involved in EV manufacturing, autonomous driving, shared mobility, and their component parts. As of June 25, its AUM stood at $85.75 million, with 58 holdings.

KARS pays an annual dividend of $0.23 per unit, reflecting a yield of 1.13%. It has one of the highest expense ratios (0.72%) among the three ETFs discussed here. Also, the fund generated the most negative returns among the three ETFs. KARS has declined 22.6% year-to-date and 34.3% in the past year. KARS saw $25 million worth of net outflows in the past six months.

Concluding Thoughts

The Global X Autonomous & Electric Vehicles ETF appears to be the best pick of the three EV ETFs based on its asset base (AUM) and comparatively better year-to-date and one-year price performances. DRIV also pays dividends and seems to be well-positioned to benefit from the robust long-term demand for EVs and autonomous vehicles.