Doximity (NYSE:DOCS) surged in pre-market trading after the digital platform for medical professionals announced its second-quarter results. The company reported adjusted earnings of $0.22 per diluted share as compared to $0.17 per diluted share in the same period last year. This was above analysts’ consensus estimates of $0.17 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company posted second-quarter revenues of $113.6 million, up by 11% year-over-year, and surpassing analysts’ expectations of $109.05 million.

Looking forward, Doximity expects third-quarter revenues to be in the range of $127 million to $128 million, with adjusted EBITDA likely to be between $61 million and $62 million. For FY24, the company has projected revenues in the range of $460 million to $472 million, while adjusted EBITDA is projected to be between $207 million and $219 million.

Is Doximity a Buy, Sell, or Hold?

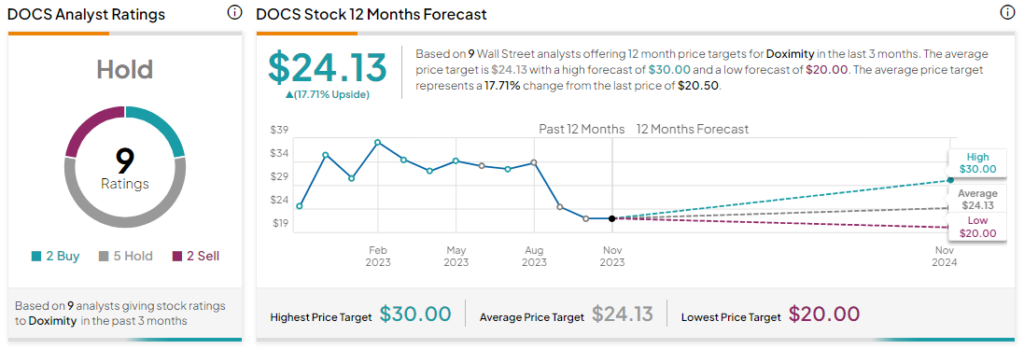

Analysts remain sidelined about DOCS stock, with a Hold rating based on two Buys, five Holds, and two Sells. The average DOCS price target of $24.13 implies an upside potential of 17.7% at current levels.