Shares of Doximity (NYSE:DOCS) fell in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at $0.20, which beat analysts’ consensus estimate of $0.17 per share. Sales increased by 18.5% year-over-year, with revenue hitting $110.97 million. This beat analysts’ expectations of $110.09 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Doximity management offered up some guidance for the next quarter and for Fiscal Year 2024 as well. For the first quarter of 2024, Doximity looks to bring in revenue between $106.5 million and $107.5 million and EBITDA between $39 million and $40 million. For the full year, meanwhile, it expects revenue to come in between $500 million and $506 million, with EBITDA in the range of $216 million to $222 million.

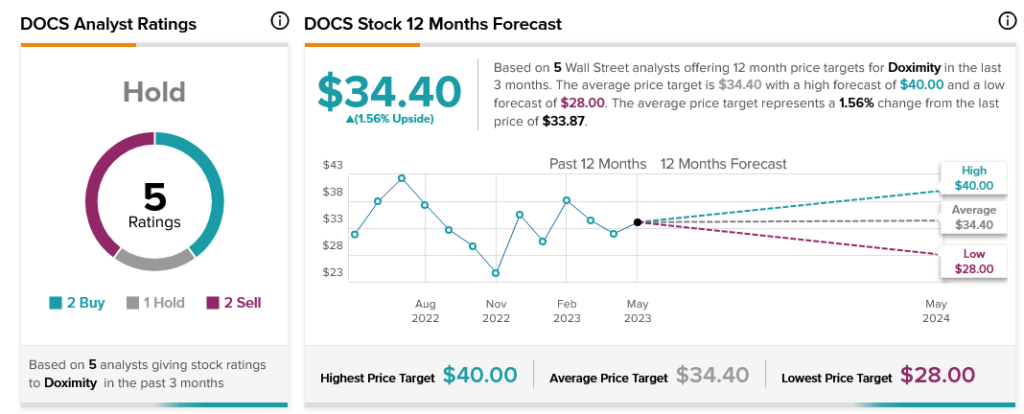

Overall, Wall Street has a Hold consensus rating on DOCS stock based on two Buys, one Hold, and two Sells assigned in the past three months. Indeed, its average price target of $34.40 suggests the stock is close to fair value.