Shares in bashed-up auto hire company Hertz Global (HTZ) revved up over 20% higher today on hopes that the U.S. government’s 25% tariff on imported vehicles could turn the country’s motor fans into renters rather than buyers.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Hiring Could Start Firing

Hertz shares got a lift on the news that President Trump was imposing the tax on vehicles from abroad, including popular makes such as BMW and Mercedes. Given the threat of reduced supply and higher prices, investors believe consumers may opt for car hiring instead of shelling out on the forecourt or online to buy expensive new cars. Peer Avis Budget (CAR) saw its stock accelerate over 21%.

Indeed, industry experts fear that the new tariffs could add thousands of dollars to the cost of an average vehicle in the U.S., making the choice a lot easier, particularly for occasional weekend motorists and holidaymakers.

“These rental companies actually benefit from the tariffs because if car prices are going to go up, maybe some people who are like, ‘You know what? I don’t travel that much. I’ll just rent a car,'” said Dennis Dick, chief strategist at the Stock Trader Network.

Stock Has Been Punctured

Hertz has seen its stock punctured by nearly 50% over the last 12 months. It has been hit by weaker demand for electric vehicles, given the lack of charging infrastructure in the U.S., and higher repair costs. Many of those EVs were Teslas (TSLA), but Hertz, which is trying to slim its EV fleet, has also been hit by weaker prices hitting resale revenues.

Hertz has been popular with short sellers, investors betting on a stock’s decline, with nearly 15% of its outstanding shares in short positions, according to LSEG data. “You get a little bit of a short squeeze here too and that’s really, really kick-starting this rally,” Dick added.

Opportunity, it seems, is always somewhere around the corner in a Trump administration.

Is HTZ a Good Stock to Buy Now?

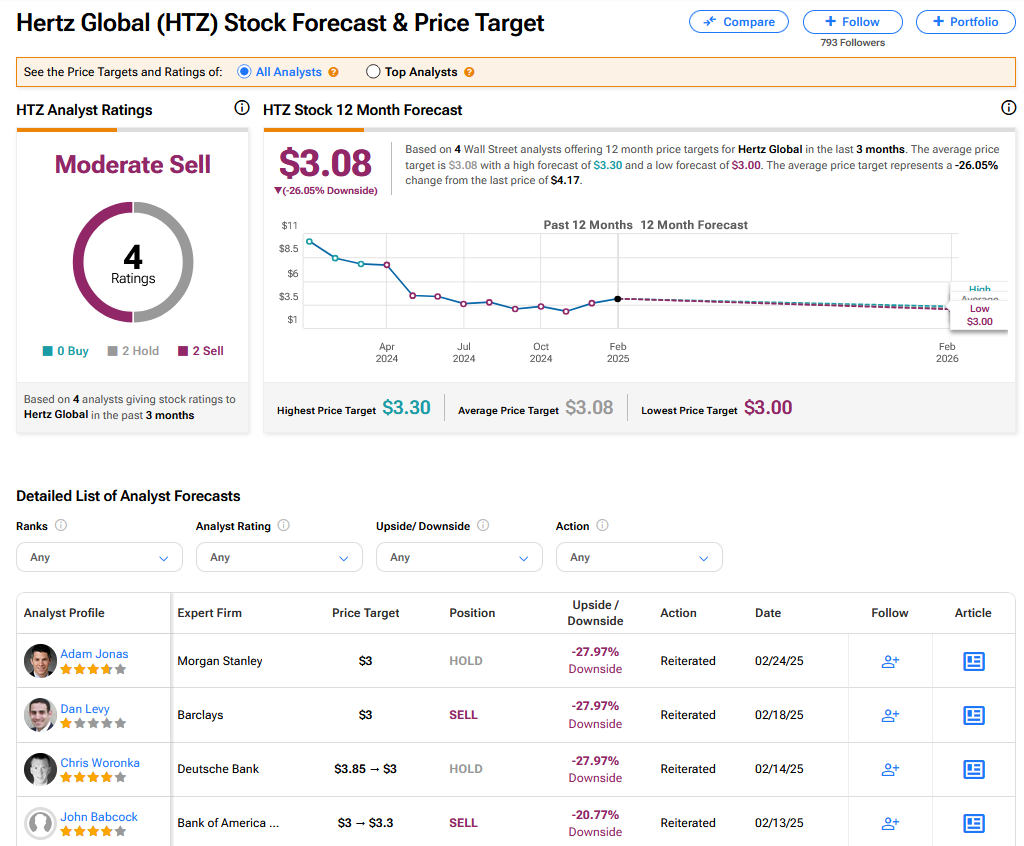

On TipRanks, HTZ has a Moderate Sell consensus based on 2 Hold and 2 Sell ratings. Its highest price target is $3.30. HTZ stock’s consensus price target is $3.08 implying an 26.05% downside.