Lululemon (NASDAQ:LULU), an athletic apparel and accessories retailer, is down 32% from its high and has tanked ever since its recent earnings report in late March. That’s because investors weren’t pleased with its soft guidance. Nevertheless, the stock is reasonably priced now when considering LULU’s growth potential, and we believe it can provide double-digit returns in the medium term. Therefore, we’re bullish on the stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Why Has LULU Stock Been Falling?

Lululemon stock fell 15.8% after its earnings report and has shed another 12.5% since then. Even though its earnings per share of $5.29 beat estimates of $5 (revenue also beat estimates), its guidance disappointed analysts.

Specifically, according to TipRanks reporter Vince Condarcuri, LULU’s “management now expects revenue and adjusted earnings per share for Q1 2024 to be in the ranges of $2.175 billion to $2.2 billion and $2.35 to $2.40, respectively. For reference, analysts were expecting $2.26 billion in revenue along with an adjusted EPS of $2.55.” At the midpoint of the EPS range, its guidance came in about 7% lower than expected.

Lululemon’s CEO, Calvin McDonald, even warned, “There has been a shift in the U.S. consumer behavior of late, and we’re navigating what has been a slower start to the year.” So, these factors led to the initial sell-off. Shortly after, an analyst compared it to athletic apparel retailer Under Armour (NYSE:UAA), which isn’t a compliment, as Under Armour is an underperformer in the industry.

On top of all this, the market has been falling in recent sessions, sending LULU stock lower. However, this has created an opportunity for those who believe in the company.

LULU Stock Is Reasonably Priced Now; Double-Digit Returns Likely

Lululemon stock isn’t a screaming bargain now, but it’s definitely reasonably priced and worthy of consideration at its current price. That’s because, despite the disappointing guidance (which still implies 4.2% growth for the next quarter), LULU stock trades at 24.5x forward earnings when looking one year out. That may seem slightly high, but it’s actually much lower than its five-year average forward P/E of 42.6x.

Now, it’s unlikely that LULU will reach its five-year average P/E again since its expected growth rate has come down recently. Nonetheless, given the company’s brand strength and still-strong expected growth, it’s likely that it can maintain this valuation multiple (or at least only see a slight contraction) for the foreseeable future. For reference, Nike (NYSE:NKE) trades at around the same valuation but has less expected growth.

What does this mean for Lululemon? It means that its stock price can increase in tandem with its earnings growth rate (roughly). That’s good news because its earnings are expected to grow at an 11.8% compound annual growth rate (CAGR) for the next three years.

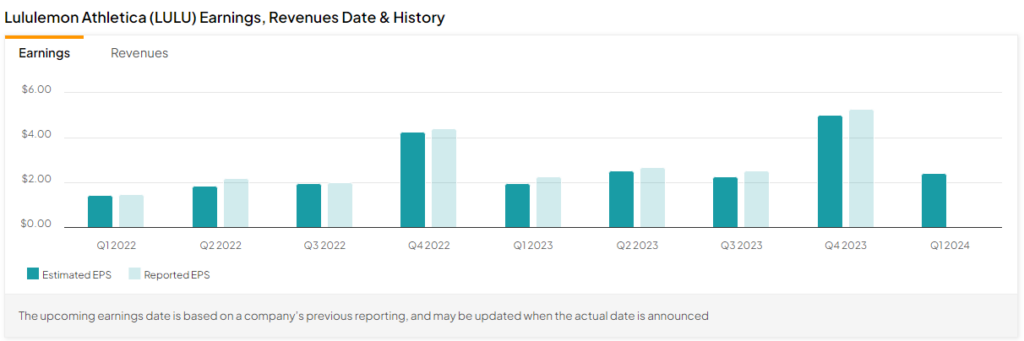

In fact, we’d argue that it could beat these expectations since the company has a history of surpassing analysts’ estimates (see below), and its earnings projections generally get revised upwards. Therefore, it’s likely that the stock can see double-digit annualized returns in the medium term. For what it’s worth, Lululemon’s five-year EPS CAGR comes in at 27.6%, so perhaps the current estimates are too conservative.

Is LULU Stock a Buy, According to Analysts?

On TipRanks, LULU comes in as a Moderate Buy based on 17 Buys, three Holds, and two Sell ratings assigned in the past three months. The average LULU stock price target of $487.81 implies 38.4% upside potential.

The Takeaway

LULU stock has come down quite a bit recently and is now trading at a much lower valuation than its historical average. Some of the drop in its valuation is justified, as the company’s expected earnings growth has been lowered. Still, the sell-off has presented an opportunity for investors looking for “growth at a reasonable price” stocks.

Based on its current valuation, which is likely to be sustained in the medium term, combined with its expected double-digit EPS growth, the stock is likely to see double-digit returns from here, in our view. This prompts us to give LULU stock a bullish rating.