The Dow Jones (DJIA) is trading slightly lower on Monday with Microsoft (MSFT), Amazon (AMZN), and Apple (AAPL) all in the red. Still, the DJIA has held up better than the S&P 500 (SPX) and the Nasdaq 100 (NDX) in recent days given its higher allocation to defensive and value stocks.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Investors are gearing up for a busy week of economic data releases. On Tuesday morning, the Bureau of Labor Statistics (BLS) will publish November’s nonfarm payrolls and unemployment rate, while the Census Bureau will release October’s retail sales report. On Thursday, the market will receive the latest consumer price index (CPI) inflation gauge, followed by a consumer sentiment reading on Friday.

The Fed will closely track these data points ahead of its next Federal Open Market Committee (FOMC) meeting on January 28. The central bank will appoint a new Chair in May 2026, with President Trump reportedly narrowing down his candidate choices to National Economic Council Director Kevin Hassett and former Fed Governor Kevin Warsh. In an interview with the Wall Street Journal, Trump said that his selection should support rate cuts and consult with him when making monetary policy decisions. He added that he sees rates at 1% or below in one year.

“I don’t think he should do exactly what we say,” Trump said. “But certainly we’re—I’m a smart voice and should be listened to.”

Fed Governor Stephen Miran, who called for a 50 bps rate cut last week, believes that underlying inflation is “within noise” of the Fed’s target of 2% due to lagging data. He pointed to inflation components that included falling rents and portfolio management fees to back his claim.

“Shelter inflation is indicative of a supply–demand imbalance that occurred as much as two to four years ago, not today,” Miran said in prepared remarks for a speech at Columbia University.

The Dow Jones is down by 0.27% at the time of writing.

Which Stocks are Moving the Dow Jones?

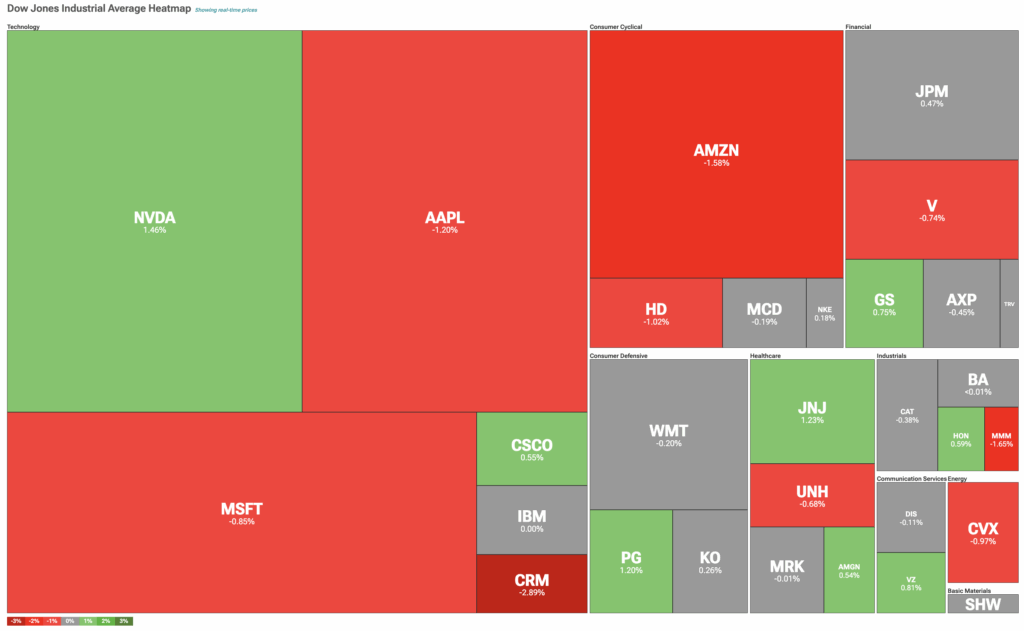

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is the only Magnificent 7 member in the index trading higher after JPMorgan said that its recent price decline should be viewed as a buying opportunity. The bank also reiterated its $250 price target and “overweight” rating. On the other hand, Salesforce (CRM) is falling despite Truist Securities reiterating a price target of $380 and a “buy” rating.

Meanwhile, Procter & Gamble (PG) is continuing its strong performance, rising by 4% over the past week. That comes despite the company announcing that its healthcare division CEO, Jennifer Davis, would retire in June 2026. Elsewhere, Chevron (CVX) is in the red on falling oil futures, while both Walmart (WMT) and Home Depot (HD) are in negative territory as well.

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $536.13, implying upside of 10.68% from current prices. The 30 holdings in DIA carry 29 buy ratings, one hold rating, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.