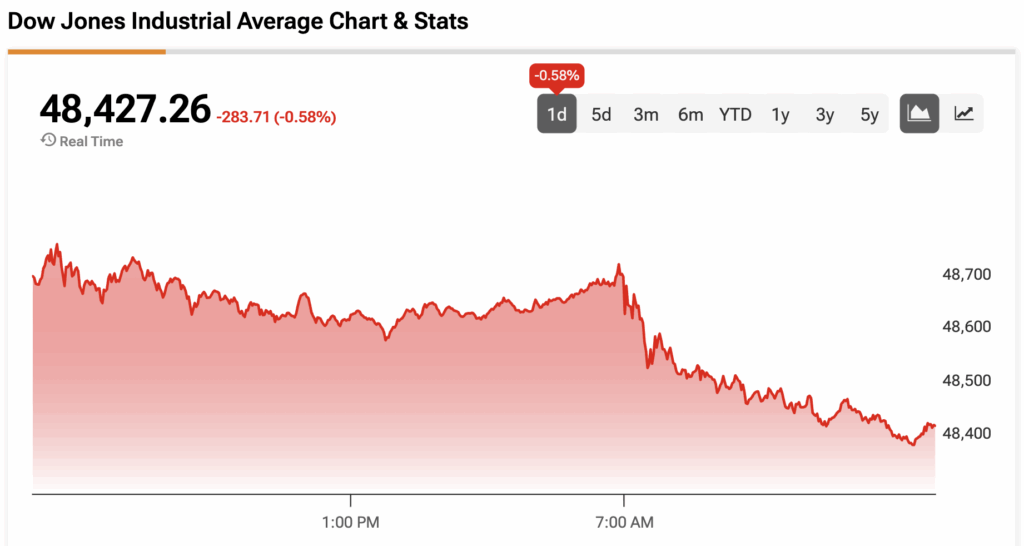

The Dow Jones (DJIA) is trading lower on Monday in a slow start to the final week of the year.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With just a few days left in 2025, investors are taking profits and selling losing positions to take advantage of tax-loss harvesting. U.S. tax laws allow Americans to offset capital gains with capital losses. Any remaining capital losses can be used to offset ordinary income, up to $3,000 per year.

The end of the year has also resulted in a slow trickle of economic data. Still, the National Association of Realtors (NAR) announced this morning that pending home sales increased by 3.3% in November, rising to a near 3-year high on a falling 30-year fixed-rate mortgage (FRM) and wages rising faster than home prices. The 30-year FRM is currently at 6.18% and has fallen from a peak of 7.04% in January.

“Homebuyer momentum is building,” said NAR Chief Economist Lawrence Yun. “The data shows the strongest performance of the year after accounting for seasonal factors, and the best performance in nearly three years, dating back to February 2023.”

Looking ahead, Wall Street is widely bullish for 2026, although CIBC Capital Markets Strategist Christopher Harvey warns that investors should keep an eye out for macroeconomic risks. One of these risks is the transition of Fed leadership with Jerome Powell’s term set to expire in May 2026. Harvey also points out that the review of the United States-Mexico-Canada Agreement (USMCA) in July 2026 could revive tariff concerns and surprise investors.

The Dow Jones is down by 0.58% at the time of writing.

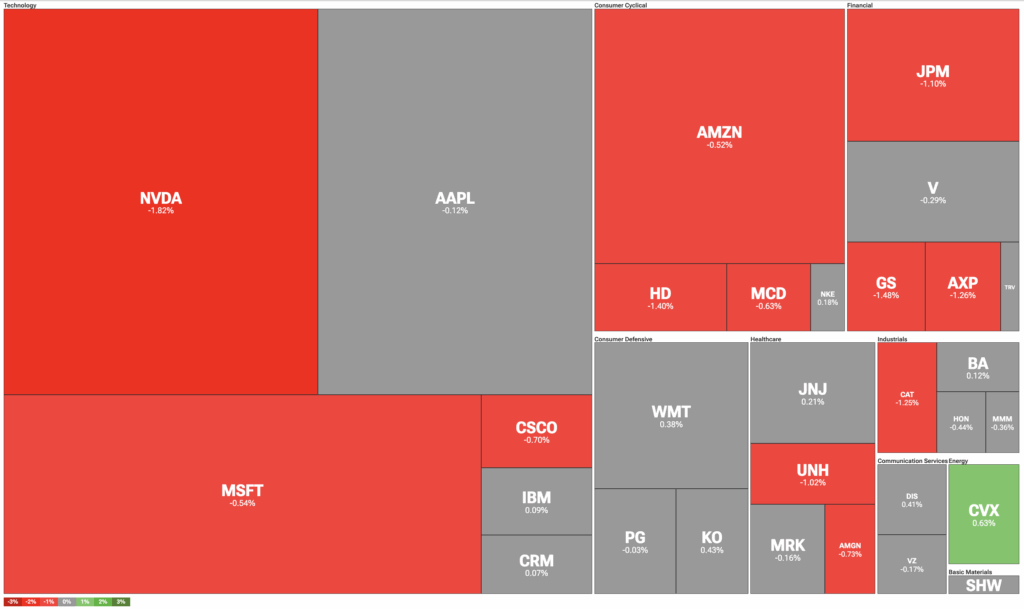

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is leading the Dow Jones lower. This morning, Intel (INTC) announced that Nvidia had purchased $5 billion of INTC stock, satisfying an agreement reached last September. Magnificent 7 peers Microsoft (MSFT) and Amazon (AMZN) are also in the red.

Financial stocks are also dragging down the index, with JPMorgan Chase (JPM), Goldman Sachs (GS), and American Express (AXP) all down by at least 1%.

Elsewhere, Chevron (CVX), the lone energy stock in the index, is trading higher on rising oil futures, while Home Depot (HD) is set to end the year with double-digit losses.

DIA Stock Moves Lower with the Dow Jones

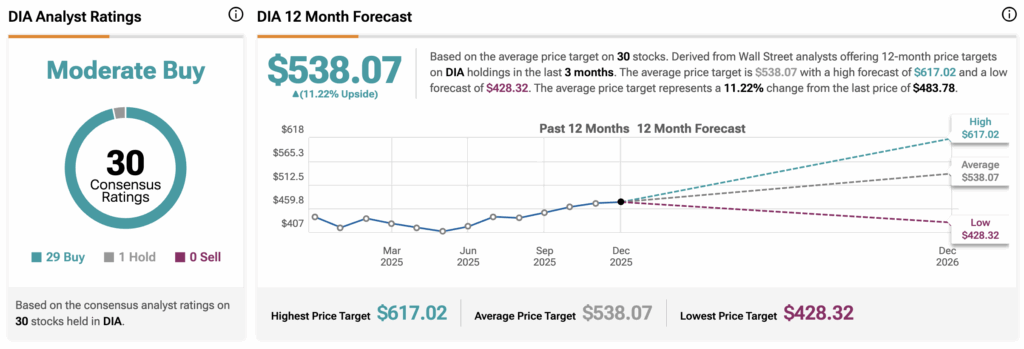

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $538.07, implying upside of 11.22% from current prices. The 30 holdings in DIA carry 29 buy ratings, one hold rating, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.