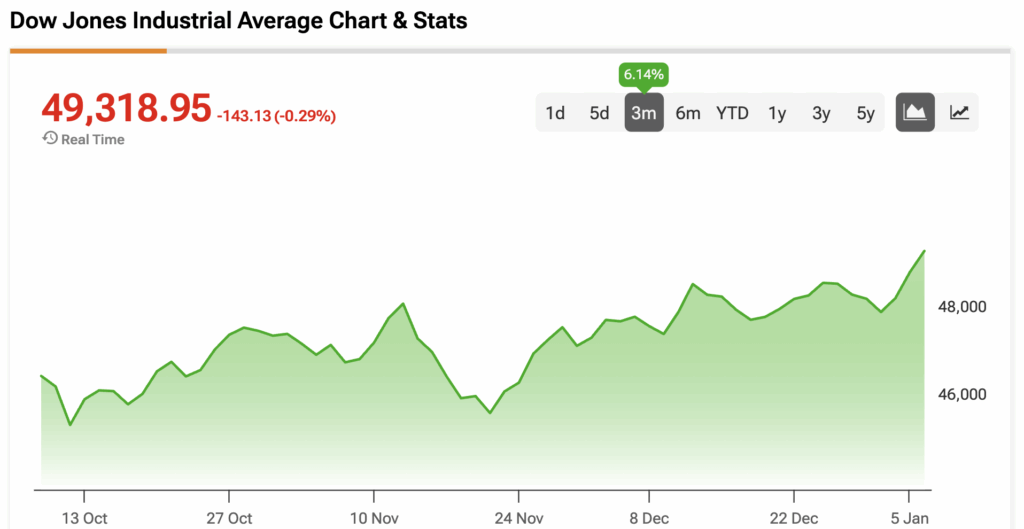

The Dow Jones (DJIA) is trading lower on Wednesday as investors digest a weaker-than-expected Job Openings and Labor Turnover Survey (JOLTS) alongside U.S. services sector activity rising to a 14-month high.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Job openings in November fell to 7.146 million from 7.449 million during the prior month and were below the consensus estimate of 7.648 million. In addition, the hiring rate dropped to 3.2% from 3.4%.

“The 3.2% hiring rate was one of the worst since the Great Recession era,” said Navy Federal Credit Union Chief Economist Heather Long in an X post. “The United States is in a hiring recession. Virtually no jobs added since April outside of healthcare.”

More employees are also choosing to voluntarily leave their positions, with the quits level rising to 2.0% from 1.9%. On the bright side, the layoffs rate dropped to 1.1% from 1.2%.

While hiring remains subdued, the U.S. services sector expanded in December with the ISM Services Purchasing Managers’ Index (PMI) rising to a 14-month high of 54.4. The Services PMI has now remained in expansion territory for ten consecutive months. A reading above 50 signals expansion, while a reading below 50 signals contraction. At the same time, the Prices Index registered its 13th consecutive month above 60 at 64.3 as businesses continue to face uncertainty and elevated prices from the effect of tariffs.

Finally, White House Press Secretary Karoline Leavitt said that the Trump administration is “discussing a range of options” to acquire Greenland, which includes “utilizing the U.S. Military.” Earlier this week, Secretary of State Marco Rubio weighed a buyout of the autonomous territory, according to the Wall Street Journal.

The Dow Jones is down by 0.29% at the time of writing.

Which Stocks are Moving the Dow Jones?

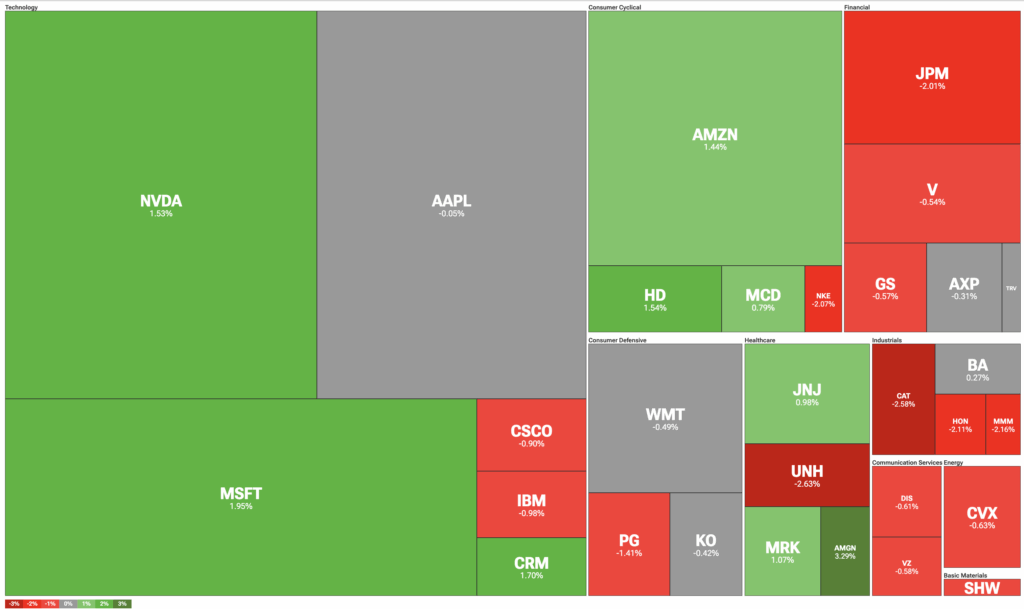

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is in the green, shrugging off reports that the Chinese government ordered some tech firms to halt orders of H200 chips as it reviews the import eligibility of the technology. Tech peers Microsoft (MSFT) and Salesforce (CRM) are also in positive territory.

Elsewhere, Chevron (CVX) is trading lower after the energy company announced a bid in collaboration with Quantum Capital Group to buy the assets of Russian oil company Lukoil (LUKOY). Lukoil estimates the assets are worth $22 billion. Furthermore, Amgen (AMGN) is leading the healthcare sector higher after UBS assumed coverage of its stock with a “Buy” rating and a price target of $380.

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $536.83, implying upside of 8.77% from current prices. The 30 holdings in DIA carry 30 buy ratings, zero hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.