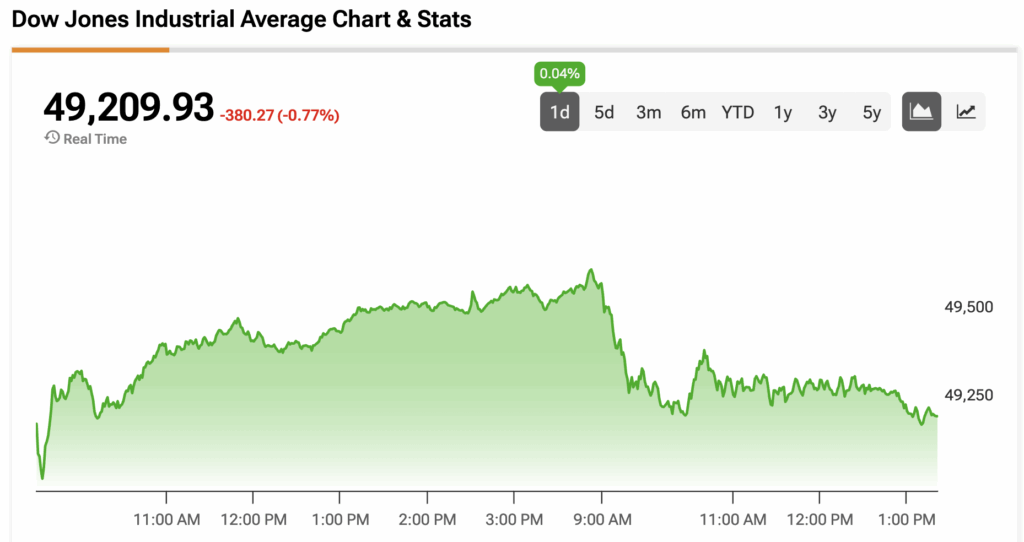

The Dow Jones (DJIA) is trading lower on Tuesday, shrugging off an encouraging inflation reading that pushed rate cut odds lower.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Inflation, as measured by the Consumer Price Index (CPI), grew by 2.7% year-over-year, in line with the consensus estimate of 2.7% and holding steady from November. Core CPI, which excludes volatile food and energy prices, rose by 2.6% year-over-year, below the estimate of 2.7% and unchanged from the prior month. The annual rise in core CPI remains at its lowest level since March 2021.

“Bottom line: The Federal Reserve can stay on hold in January,” said Navy Federal Credit Union Chief Economist Heather Long. “Inflation doesn’t appear to be getting worse.” Following the data, the odds of a 25 bps rate cut at the next three upcoming Federal Open Market Committee (FOMC) meetings on CME’s FedWatch tool all fell. By the end of the year, the odds of two rate cuts sit at 32.8%, while the chances of a single rate cut are at 24.6%.

However, the rate of inflation remains above the Fed’s target of 2%. That didn’t stop President Trump from reiterating his call for lower rates. “JUST OUT: Great (LOW!) Inflation numbers for the USA,” he said in a Truth Social post. “That means that Jerome ‘Too Late’ Powell should cut interest rates, MEANINGFULLY!!!”

Meanwhile, the U.S.-China trade truce may be at risk after Trump announced a 25% tariff on countries that do business with Iran in response to its brutal treatment of its protesters. He added that any meetings with Iranian officials would be put on hold until the killing of protesters ceases. China is a major trade partner of Iran and purchased over 80% of its oil exports in 2025. Other key trading partners include India, Japan, and Russia.

The Dow Jones is down by 0.77% at the time of writing.

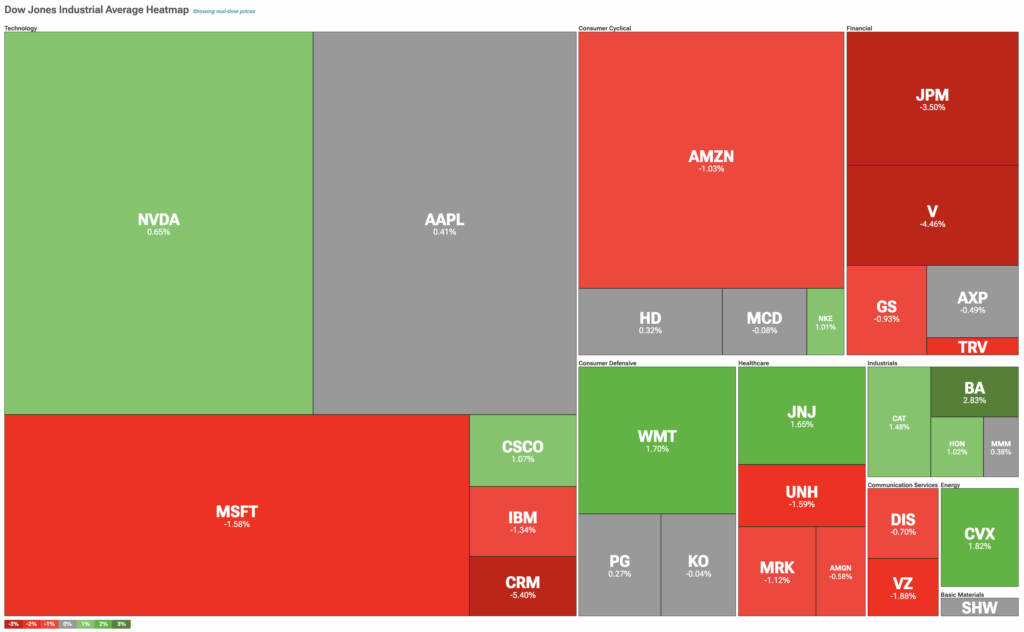

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is trading higher after The Information reported that China would restrict domestic tech company purchases of H200 chips to specific purposes, such as for development labs and university research. Furthermore, Salesforce (CRM) is leading the tech sector lower, despite announcing an updated Slack Bot powered by Anthropic’s AI model.

Elsewhere, both JPMorgan Chase (JPM) and Visa (V) are deep in negative territory as investors digest the implications of Trump’s 10% interest cap on credit cards. In contrast, all four industrial stocks are trading higher.

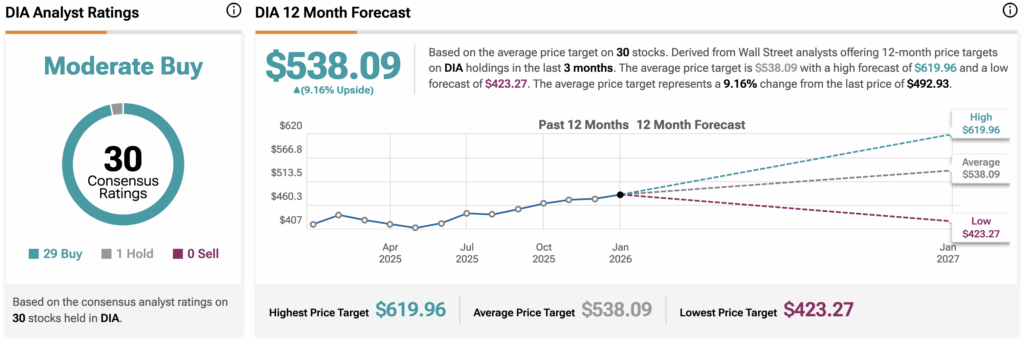

Is DIA Stock a Good Long-Term Investment?

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $538.09, implying upside of 9.16% from current prices. The 30 holdings in DIA carry 29 buy ratings, one hold rating, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.