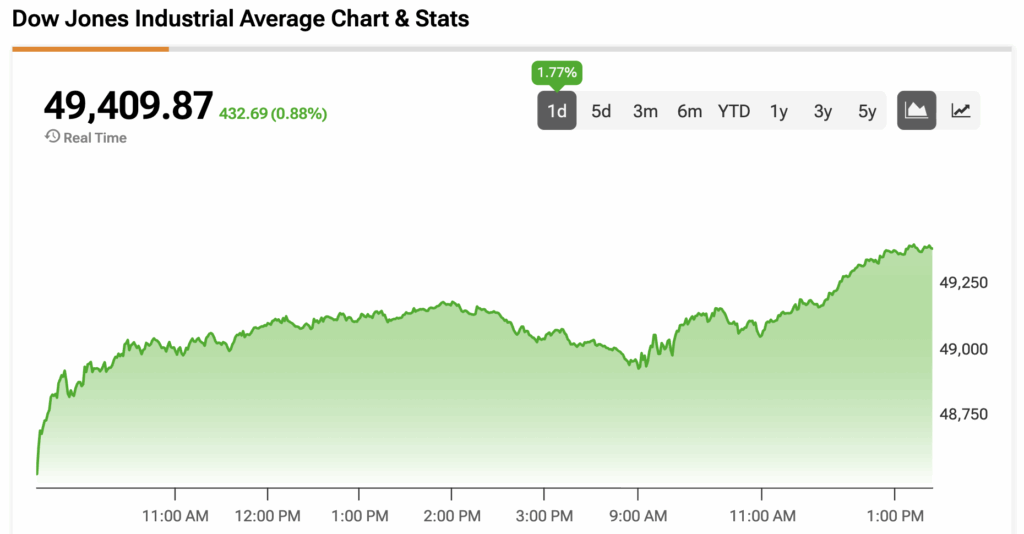

The Dow Jones (DJIA) is trading higher today after closing at a record high of 48,977 on Monday. The 30-stock index is on track to secure another record close and is currently well above the 49,000 level.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors have largely shrugged off mounting geopolitical tensions spearheaded by the ouster of Venezuelan President Nicolás Maduro and President Trump’s comments about intervening in Colombia and Mexico and annexing Greenland. On Tuesday, several European leaders issued a joint statement pushing back against Trump’s focus on Greenland.

“The Kingdom of Denmark – including Greenland – is part of NATO,” read the statement. “Security in the Arctic must therefore be achieved collectively, in conjunction with NATO allies including the United States, by upholding the principles of the UN Charter, including sovereignty, territorial integrity and the inviolability of borders.” Trump has previously pushed for Greenland’s annexation due to its strategic location, critical minerals, and sparse population.

Meanwhile, Supreme Court justices have scheduled their opinion day for Friday, January 9 at 10 a.m. Eastern Time and could potentially issue a decision on the legality of Trump’s tariffs. The court doesn’t provide advance notice of what decisions will be announced.

Finally, the odds of a rate cut at the January 28 Federal Open Market Committee (FOMC) meeting continue to dwindle, despite Fed Governor Stephan Miran voicing his support for over 100 basis points of rate cuts in 2026. “I think policy is clearly restrictive and holding the economy back,” Miran told Fox Business. “I think that well over 100 basis points of cuts are going to be justified this year.”

The Dow Jones is up by 0.88% at the time of writing.

Which Stocks are Moving the Dow Jones?

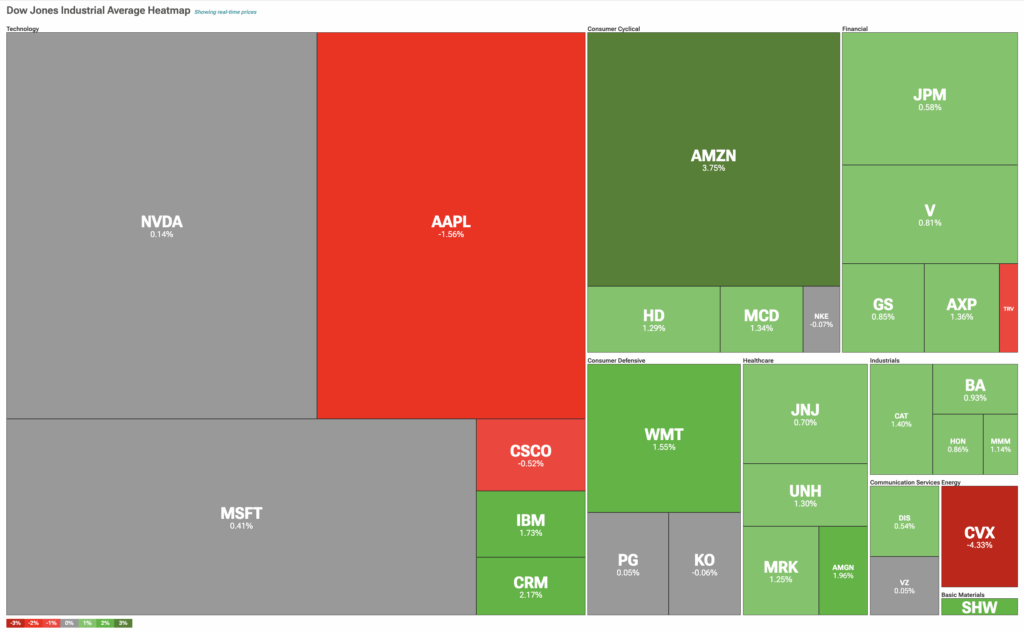

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is trading slightly higher, despite both Piper Sandler and KeyBanc reaffirming an “overweight” rating on its stock. The semiconductor leader also announced the launch of Alpamayo, a family of open-source AI models that power autonomous driving.

Elsewhere, all healthcare and industrial stocks are in the green. Caterpillar (CAT) is getting a boost after revealing its Cat AI Assistant, which will help customers manage and maintain their equipment and digital applications.

Finally, Chevron (CVX) is falling alongside lower oil futures and as investors digest the implications of the U.S. taking control of Venezuela’s oil supply.

DIA Stock Moves Higher with the Dow Jones

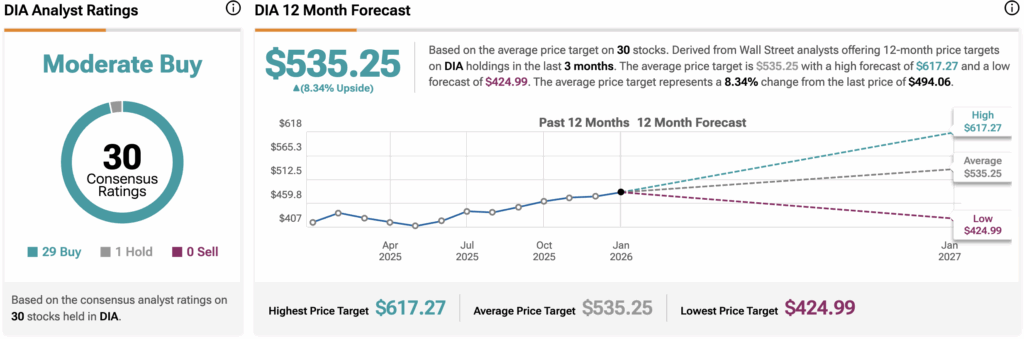

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $535.25, implying upside of 8.34% from current prices. The 30 holdings in DIA carry 29 buy ratings, one hold rating, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.