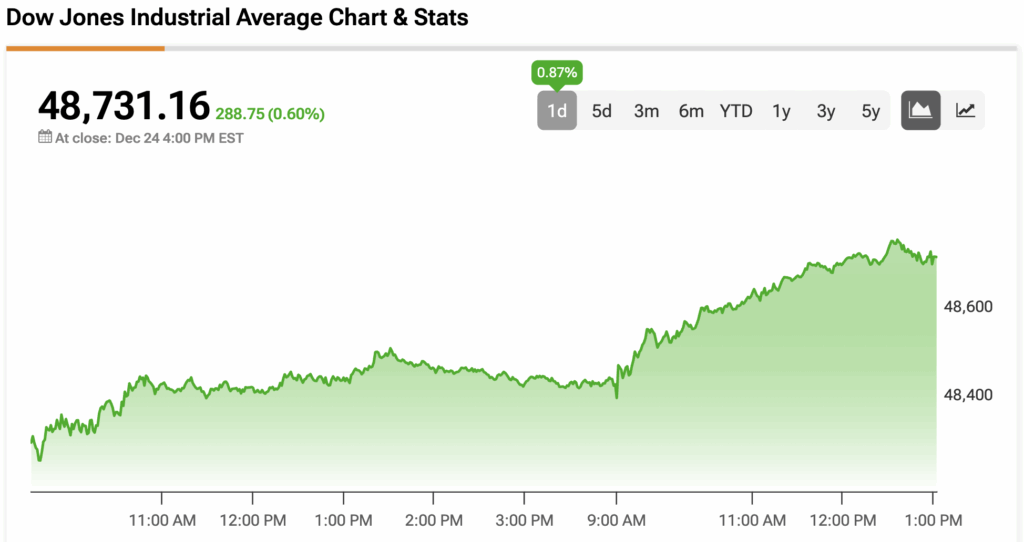

The Dow Jones (DJIA) closed Wednesday’s shortened trading session in the green and less than 0.5% below its all-time high of 48,886.86.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The index got a boost after the Department of Labor announced that initial jobless claims for the week ended December 20 fell by 10,000 to 214,000, less than the consensus estimate of 224,000. These claims act as a gauge of layoffs and have ranged between 210,000 and 250,000 for most of the year. Furthermore, continuing jobless claims for the week ended December 13 were 1.923 million, rising from 1.885 million and above the estimate of 1.900 million.

The jobs data show that the economy remains in a slow-to-fire-and-hire environment that began earlier this year from uncertainty brought on by the Trump administration’s tariffs. In November, the unemployment rate climbed to 4.6%, its highest level in four years.

The data also resulted in traders lowering their bets for an interest rate reduction at the January 28 Federal Open Market Committee (FOMC) meeting. The odds of a 25 bps cut fell to 13.3% compared to 15.5% a day ago and 24.4% a week ago, according to CME’s FedWatch tool.

On Tuesday, the Bureau of Economic Analysis (BEA) announced that U.S. gross domestic product (GDP) grew by 4.3% during the third quarter, well above the estimate of 3.3% and delivering a blow to rate cut odds. With strong GDP growth, the central bank is less incentivized to cut rates and risk overheating the economy.

The Dow Jones closed with a 0.60% gain.

Which Stocks are Moving the Dow Jones?

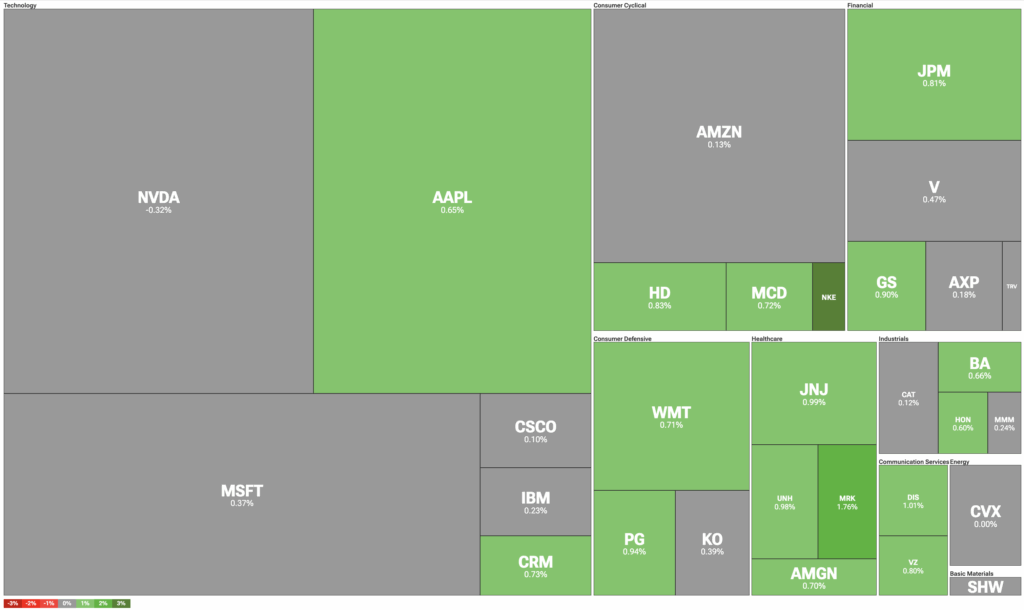

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nike (NKE) was the standout performer on Wednesday, propelled by a surprising insider buy from Apple (AAPL) CEO Tim Cook. Cook sits on Nike’s Board of Directors and purchased $2.94 million of NKE stock, bringing his total position to 105,480 shares.

Elsewhere, a majority of the stocks in the index are in positive territory, led by the healthcare, communication services, and consumer cyclical sectors. Merck (MRK) is continuing to climb higher, bringing its one-month return to 6%, while both Disney (DIS) and Procter & Gamble (PG) are up by about 1%.

DIA Stock Moves Higher with the Dow Jones

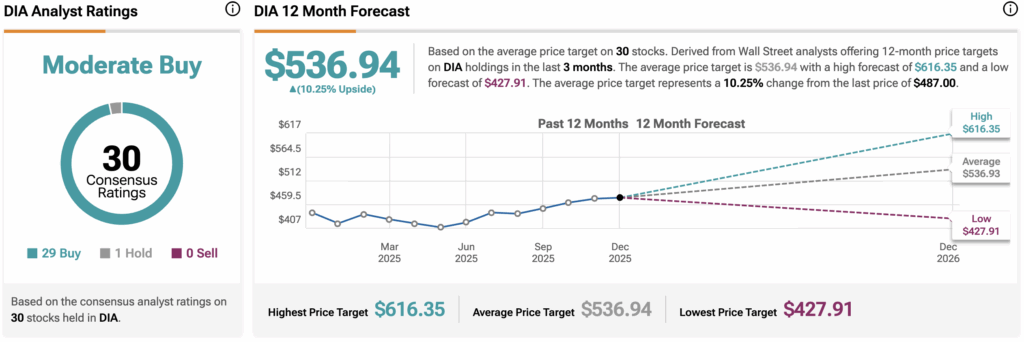

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $536.94, implying upside of 10.25% from current prices. The 30 holdings in DIA carry 29 buy ratings, one hold rating, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.