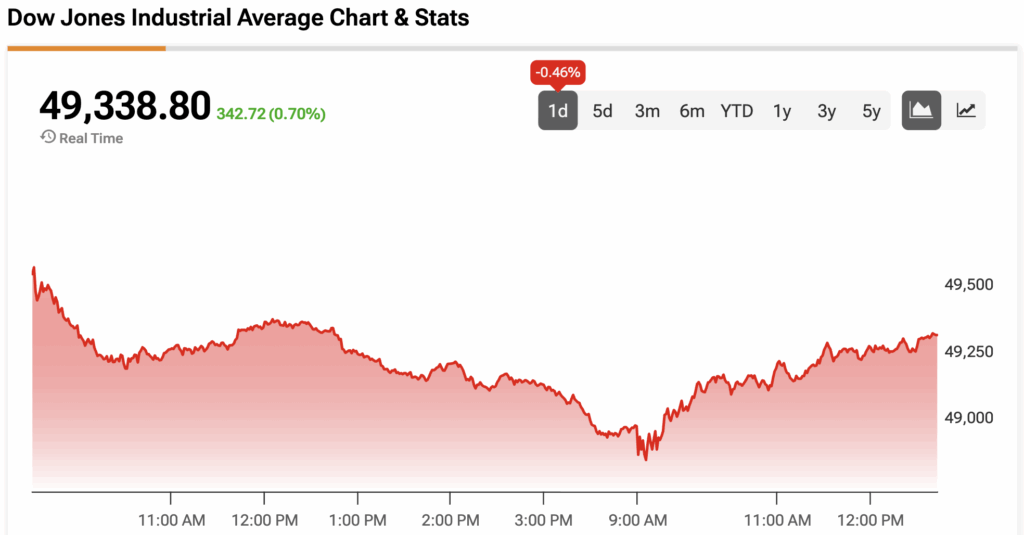

After a slow start, the Dow Jones (DJIA) is trading in positive territory on Thursday as investors digest a trade deficit and labor market update.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The U.S. Bureau of Economic Analysis announced that the U.S. goods and services deficit fell by $18.8 billion, or 39%, in October to $29.4 billion, marking the lowest monthly total since 2009. The trade deficit is calculated by subtracting exports from imports, with exports rising by 2.6% to $302 billion and imports falling by 3.2% to $331.4 billion. That bodes well for fourth quarter gross domestic product (GDP), as a narrower trade deficit means net exports contribute more positively to overall economic growth.

Industrial supplies and materials, nonmonetary gold, and other precious metals were the key contributors to rising exports, while falling imports were led by pharmaceutical preparations, computer accessories, and telecommunications equipment.

Meanwhile, initial jobless claims, which act as a gauge of layoffs, increased by 8,000 to 208,000 for the week ended January 3, below the consensus estimate of 210,000 and snapping a three-week streak of declines. Continuing jobless claims, which track the number of people receiving unemployment benefits, were 1.914 million, above the estimate of 1.9 million.

Finally, the Fed is scheduled to meet for its first Federal Open Market Committee (FOMC) meeting of 2026 on January 28, where it is expected to maintain interest rates. That comes despite Federal Reserve Governor Stephen Miran calling for 150 bps of rate cuts this year. “I’m looking for about a point and a half of cuts. A lot of that is driven by my view of inflation,” said Miran in an interview with Bloomberg Television’s Surveillance.

The Dow Jones is up by 0.70% at the time of writing.

Which Stocks are Moving the Dow Jones?

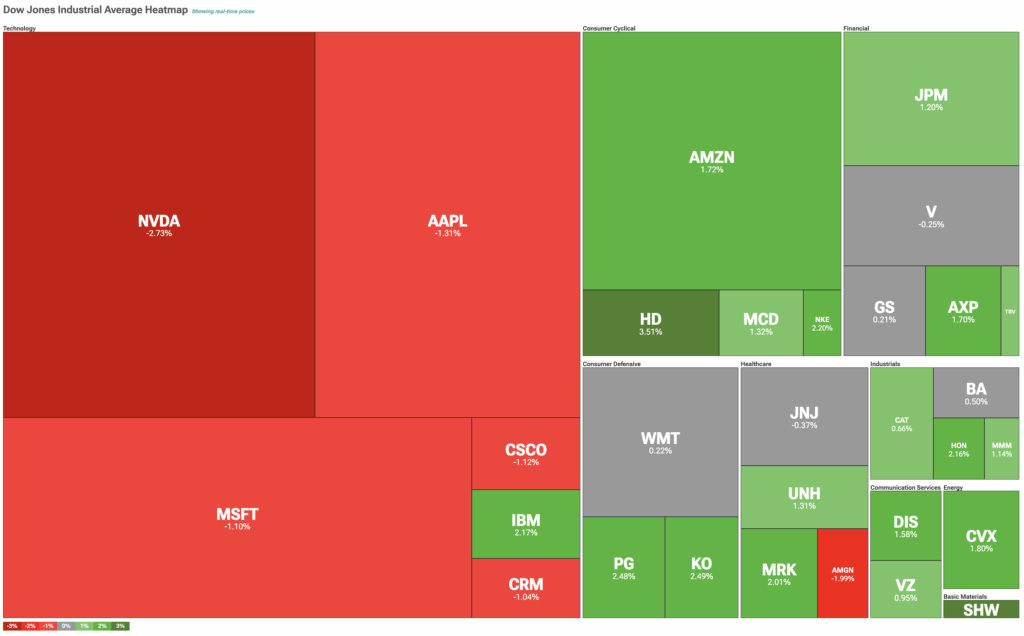

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

The tech sector is noticeably red on the heatmap, with Nvidia (NVDA) leading to the downside. That comes despite plans for China to approve some imports of the semiconductor company’s H200 chips as soon as this quarter, according to Bloomberg.

Meanwhile, all of the stocks in the consumer cyclical, consumer defensive, and industrial sectors are trading higher, highlighted by Home Depot’s (HD) gain of over 3%. After underperforming the Dow Jones in 2025, Amazon (AMZN) is off to a strong start in the new year with a year-to-date return of 6.3%.

Elsewhere, Chevron (CVX), the lone energy stock in the index, is in the green alongside rising oil futures.

DIA Stock Moves Higher with the Dow Jones

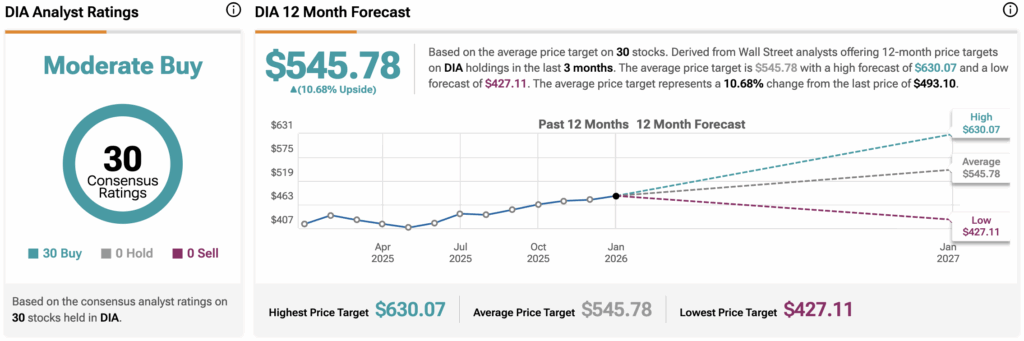

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $545.78, implying upside of 10.68% from current prices. The 30 holdings in DIA carry 30 buy ratings, zero hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.