The Dow Jones (DJIA) is down on Tuesday amid disappointing jobs data and concerns that the current market environment mirrors conditions seen before the 2000 Dot-Com Bubble crash.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With the government shutdown entering its seventh day, federal agencies have continued to halt key labor market data. That’s placed greater emphasis on data from independent organizations. According to investment firm Carlyle, September’s nonfarm payrolls grew by 17,000, missing the estimate of 50,000 by a wide margin.

“If you looked at the employment data, you’d think it’s an economy that’s on the cusp of or in a recession,” said Carlyle head of global research and investment management Jason Thomas. “That is nowhere else in the data.”

Meanwhile, several Wall Street experts have sounded the alarm on recent multibillion-dollar deals led by OpenAI, which include partnerships with Advanced Micro Devices (AMD), Nvidia (NVDA), and Oracle (ORCL). These transactions have led to significant gains while also bolstering investor sentiment, potentially echoing the environment seen before the 2000 Dot-Com Bubble crash.

“If any one of these deals falls through it has this domino effect downstream that I think is concerning,” said Zacks Investment Management client portfolio manager Brian Mulberry. “It reminds me of what happened with telecom back in the mid-nineties.”

Concentration also poses a risk. The largest tech companies in the S&P 500 (SPX) account for about 35% of the index compared to 15% in 1999. In other words, the risk of sharp market swings is higher, as a small group of companies now drives a large portion of the index’s performance.

The Dow Jones is down by 0.36% at the time of writing.

Which Stocks are Moving the Dow Jones?

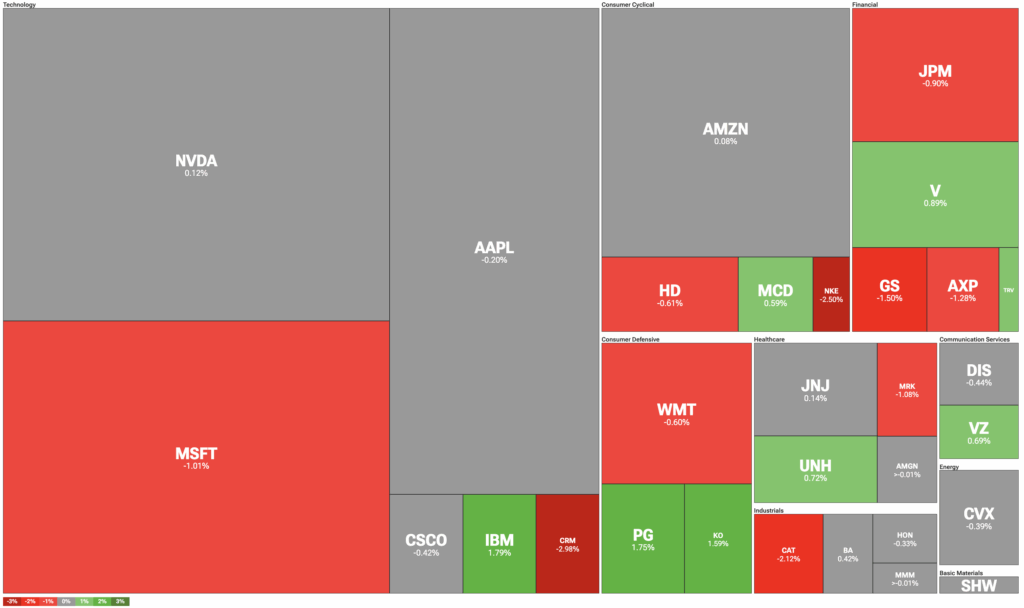

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Salesforce (CRM) and Microsoft (MSFT) are leading the tech sector to the downside. That comes despite Truist reiterating its CRM price target of $400 and Wells Fargo raising its MSFT price target to $675 from $650 this morning.

Meanwhile, healthcare stocks are mixed, with UnitedHealth Group (UNH) leading all companies higher. Earlier today, Bank of America Global Research upgraded the healthcare sector to “Overweight” from “Underweight.”

Elsewhere, Boeing (BA) is trading slightly higher following reports that the company is expected to receive EU antitrust approval for its $4.7 billion acquisition of Spirit AeroSystems (SPR).

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $508.21, implying upside of 9.35% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.