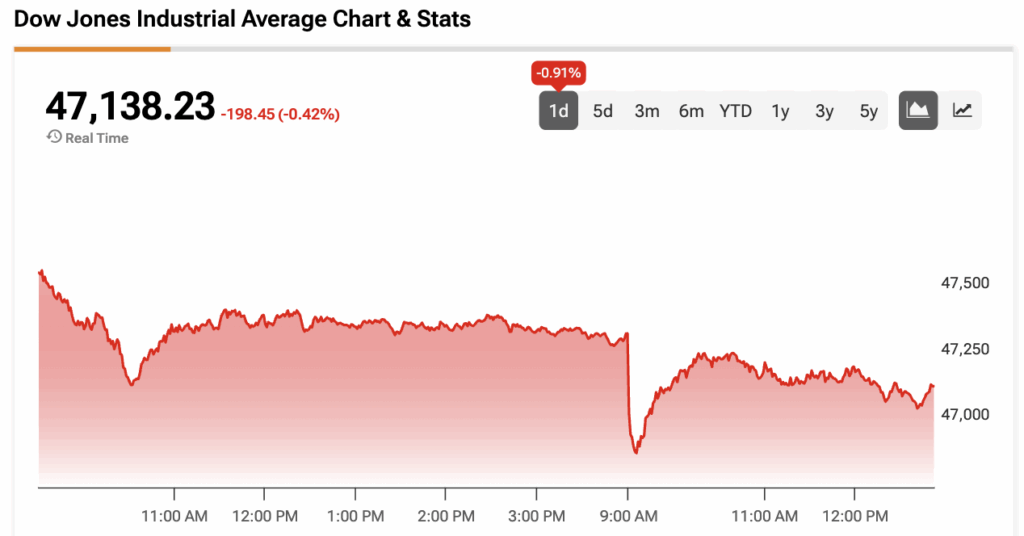

The Dow Jones (DJIA) is trading lower on Tuesday, led by losses in the tech sector amid growing concerns over elevated valuations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Investors are also digesting warnings of a pullback from Goldman Sachs (GS) CEO David Solomon and Morgan Stanley (MS) CEO Ted Pick. “It’s likely there’ll be a 10% to 20% drawdown in equity markets sometime in the next 12 to 24 months,” Solomon said at the Global Financial Leaders’ Investment Summit in Hong Kong. At the same time, Solomon noted that drawdowns are normal during positive market cycles and that they allow investors to reassess their portfolios.

Speaking from the same summit, Pick said that investors should welcome a 10% to 15% drawdown as long as it isn’t “driven by some sort of macro-cliff effect.” He added that the market will place a greater emphasis on companies with strong earnings in 2026, resulting in “greater dispersion.”

Meanwhile, President Trump has called for an end to the filibuster rule as the government shutdown ties a record length of 35 days set in late 2018 and early 2019. “TERMINATE THE FILIBUSTER NOW, END THE RIDICULOUS SHUTDOWN IMMEDIATELY, AND THEN, MOST IMPORTANTLY, PASS EVERY WONDERFUL REPUBLICAN POLICY THAT WE HAVE DREAMT OF, FOR YEARS, BUT NEVER GOTTEN,” Trump said in a Truth Social post.

The filibuster is a Senate rule requiring most legislation to secure 60 out of 100 votes to pass, giving the minority party significant influence. Removing the filibuster would let bills pass with a simple majority in the Senate and could increase the likelihood of the government reopening. Republicans currently hold 53 seats in the Senate.

On prediction platform Polymarket, the odds of the shutdown extending to November 16 and beyond sit at 39%. The chances of the shutdown ending between November 8-11 and November 12-15 both hold odds of 22%.

The Dow Jones is down by 0.42% at the time of writing.

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is leading all tech stocks to the downside, despite Jefferies raising its NVDA price target to $240 from $220 on strong AI demand. That comes as hedge fund manager Michael Burry disclosed a short bet on the semiconductor leader. Salesforce (CRM) and Cisco (CSCO) are also trading lower.

Furthermore, all five industrial stocks are trading lower. Caterpillar (CAT) is the worst hit, shrugging off a price target hike to $581 from $506 by UBS.

Elsewhere, Merck (MRK) is in the green after the company announced $700 million in experimental cancer funding from Blackstone (BX). Amazon (AMZN) is trading lower, although the e-commerce leader is still up by about 8% during the past week.

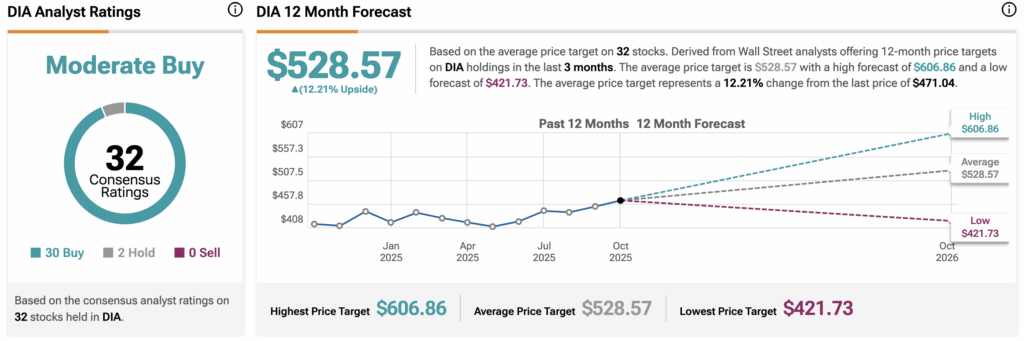

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $528.57, implying upside of 12.21% from current prices. The 32 holdings in DIA carry 30 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.