The Dow Jones (DJIA) is trading at an intra-day low as the Israel-Iran conflict continues to rage on with both sides exchanging strikes.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

President Trump is “seriously considering” launching an attack on Iran’s nuclear facilities, according to Axios. Yesterday, Trump warned the citizens of Tehran, Iran to “immediately evacuate” in a Truth Social post. In addition, the Pentagon will send additional planes to the Middle East for refueling and defensive purposes. The U.S. has already sent two aircraft carriers to the Arabian Sea as the conflict continues.

On Truth Social, Trump also demanded “UNCONDITIONAL SURRENDER!” from Iran, stating that the U.S is aware of Supreme Leader Ayatollah Ali Khamenei’s location but is holding back from targeting him.

Meanwhile, the June Housing Market Index (HMI) came in at 32, well below the estimate for 36 and reflecting the poor sentiment of single-family homebuilders. June’s reading was the lowest since December 2022.

The Dow Jones is down by 0.75% at the time of writing.

Which Stocks are Moving the Dow Jones?

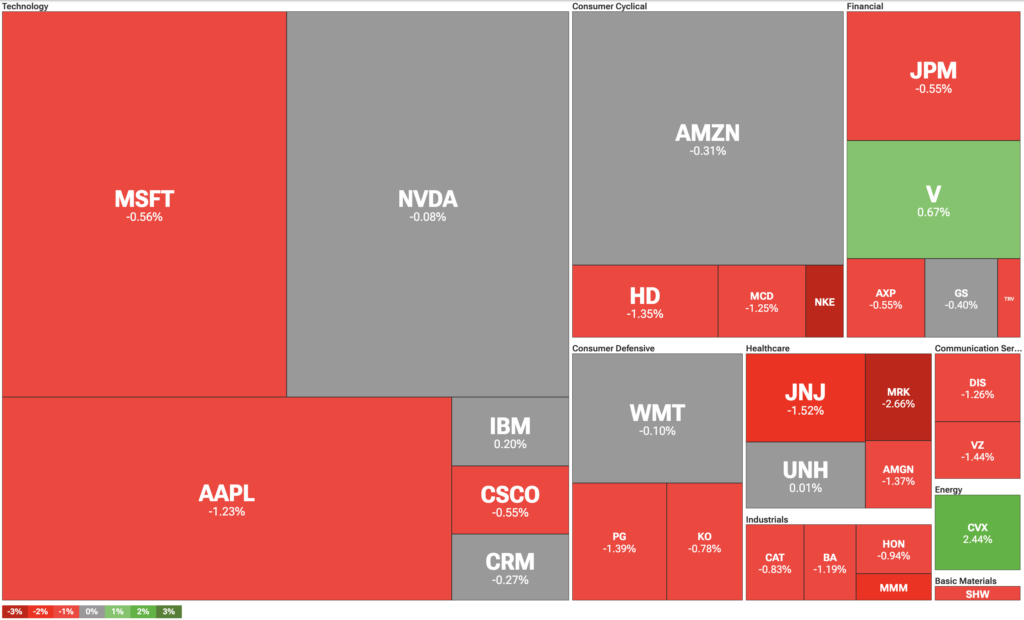

Let’s turn our attention to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

All four industrial stocks within the index are trading lower after industrial production data for May showed a 0.2% fall compared to the estimate for an unchanged reading. Furthermore, IBM (IBM) is the only technology stock in green territory, with the losers led by Apple (AAPL).

Healthcare is performing poorly as well with Merck (MRK) leading the charge lower. The index’s two communication services stocks, Disney (DIS) and Verizon (VZ), haven’t been able to stand out with losses over 1%.

DIA Stock Moves Lower with the Dow Jones

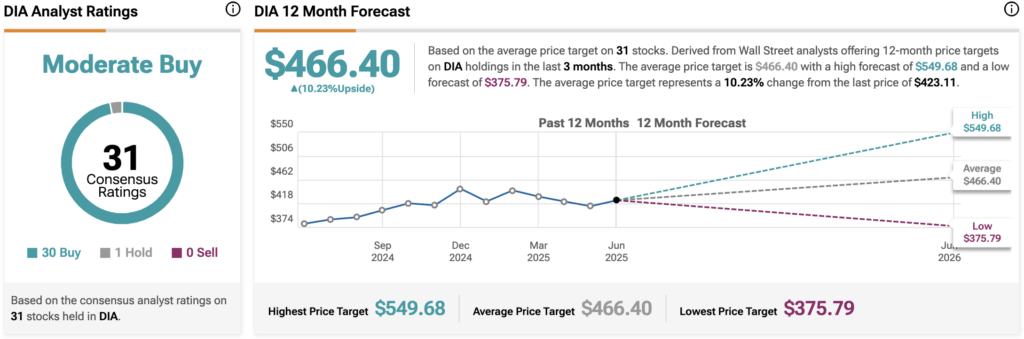

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $466.40 for the stocks within the index, implying upside of 10.23% from current prices. The 31 stocks in DIA carry 30 buy ratings, 1 hold rating, and zero sell ratings.