The Dow Jones Industrial Average (DJIA) index is set to close out the week strong as a possible stock market recovery lifts shares higher. Earnings reports throughout the week have lifted the DJIA higher, with many companies posting results that were better than expected. This has reignited investor confidence despite tariff concerns.

Additionally, the stock market got a boost on Friday alongside the April U.S. jobs report. 177,000 jobs were added during the month, above the 133,000 expected. This came alongside a surge in transportation and warehouse hiring, suggesting President Donald Trump’s tariffs spurred increased hiring.

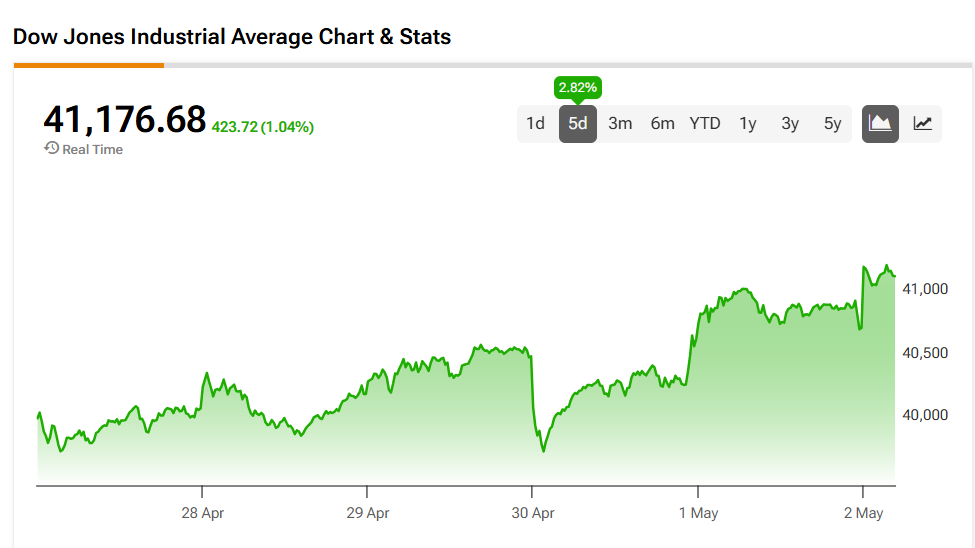

Today’s news has the Dow Jones index up 1.04% as of this writing, and helps it close out the week with a 2.82% increase. However, the DJIA index has a long road to recovery, as it’s still down 4.21% year-to-date.

Stocks Lifting the Dow Jones Index Up Today

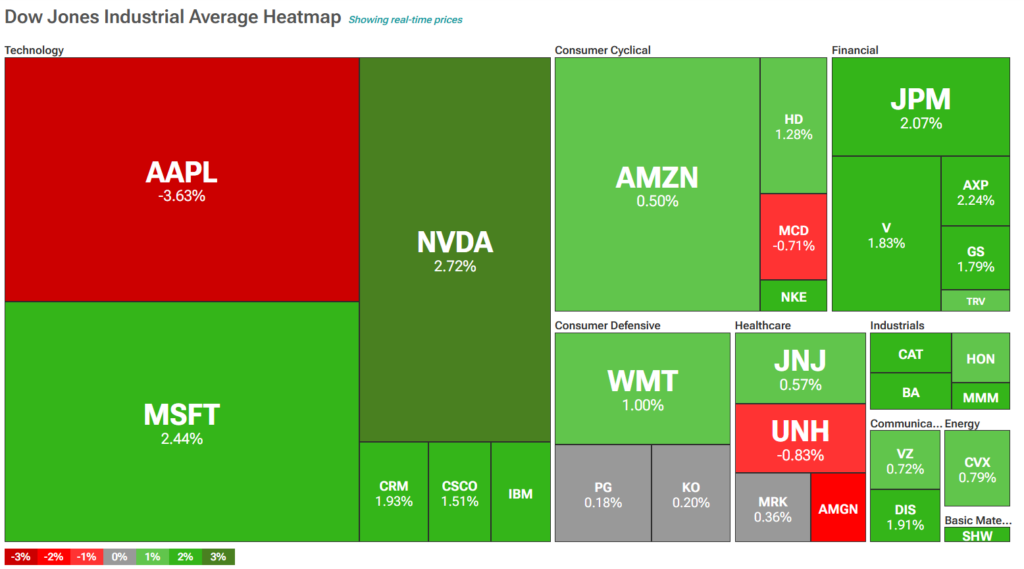

Turning to the TipRanks Dow Jones heatmap tool, traders will see which stocks have the index on the rise Friday. The heatmap is largely green, with only a few standouts in the red. One notable laggard is Apple Apple (AAPL), which dropped after it failed to impress investors with its Q2 2025 earnings report. It also warned of a massive tariff impact in its current quarter.

What Does This Mean for DIA Stock?

The SPDR Dow Jones Industrial Average ETF Trust (ETF) mirrors the movement of the Dow Jones index. As such, the exchange-traded fund’s (ETF) stock has also experienced a rally this week. It’s up nearly 1% today and has increased 2.21% over the last week. However, DIA stock is still down 4.09% year-to-date.

The Wall Street consensus rating for the SPDR Dow Jones Industrial Average ETF Trust is Moderate Buy, based on the 29 Buy and two Hold consensus ratings for the shares it covers. With that comes an average price target of $471.19, representing a potential 14.47% upside for DIA stock.