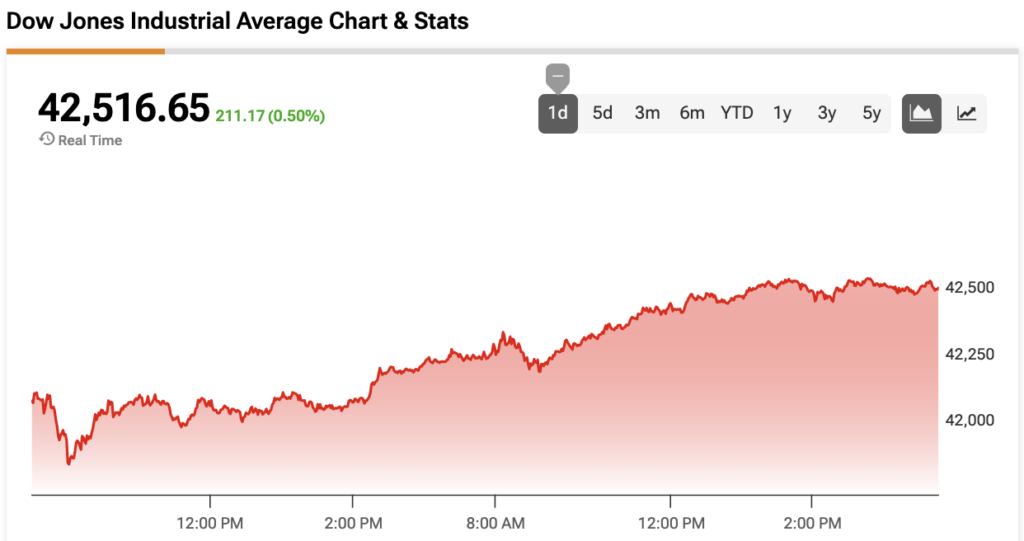

The Dow Jones (DJIA) is in the green on Tuesday despite two negative indicators threatening the index, demonstrating strong strength in an uptrend that begin in April.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

This morning, the U.S. Census Bureau reported that orders for manufactured goods fell by 3.7% month-over-month in April, worse than the forecast for a 3.2% decline and ending a streak of four consecutive months of gains. This is a negative indicator for industrial stocks within the Dow Jones, such as Caterpillar (CAT) and 3M (MMM) given that they are closely linked to supplying machinery and other tools for goods manufactured in factories. However, both of these stocks are rising today.

Additionally, the Organization for Economic Cooperation and Development (OECD) lowered its 2025 U.S. gross domestic product (GDP) forecast to 1.6% from 2.2% as a result of higher barriers to trade and policy uncertainty.

Offsetting those two pieces of negative news is a sign of a resilient labor market. The April Job Openings and Labor Turnover Survey (JOLTS) showed 7.39 million job openings, higher than the estimate for 7.10 million and rising from 7.19 million in March.

The Dow Jones is up by 0.50% at the time of writing.

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRank’s Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Technology stocks within the Dow Jones are pushing the index higher, led by Nvidia (NVDA) with a 2.72% gain and Salesforce (CRM) with a 0.78% jump. Furthermore, all four industrial stocks within the index are in the green, contrasting with a monthly fall in factory orders.

On the other hand, all three consumer defensive stocks, which tend to perform well in times of uncertainty, are in the red, with Coca-Cola (KO) down by nearly 1%.

DIA Stock Moves Higher with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising with the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $464.68 for the stocks within the index, implying upside of 9.12% from current prices. The 31 stocks in DIA carry 30 buy ratings, 1 hold rating, and zero sell ratings.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue