DouYu International Holdings (NASDAQ:DOYU) stock has risen about 78% since the release of its Q1 2024 financial results on June 5. This increase was fueled by higher Q1 ad revenues and the announcement of a special dividend. DouYu is a leading game-centric live-streaming platform in China.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors cheered DouYu’s ad revenue growth, which surged by 109.3% in the first quarter. This strong performance highlights the success of DouYu’s efforts to diversify its revenue streams.

A Special Dividend Announcement

Adding to the positive sentiment, DouYu announced a special cash dividend on July 3. The dividend, set at $9.76 per American Depositary Share (ADS), which represents about 78% of the stock’s closing price of $12.59 on July 2. Shareholders of record as of August 21 will get the dividend, with payments expected around August 30. The total payout will be approximately $300 million.

Concerns Amidst Positive Developments

Despite these developments, there are concerns about DouYu’s overall financial health. The company announced a very high special dividend amid declining sales and margins. It’s worth noting that DOYU’s total net revenues for Q1 2024 decreased by 29.9%, and live-streaming revenues fell by 41.5%. This decline reflects a challenging macro environment.

Moreover, Chinese authorities are investigating some third-party streamers for past illegal activities. Although DouYu is not under investigation, the potential regulatory scrutiny presents challenges.

Management’s Defense and Cash Position

DouYu’s management defended the special dividend, highlighting their commitment to boosting shareholder value despite the tough market. They pointed to the company’s solid cash reserves as the reason for the $300 million payout.

It’s worth noting that DouYu had $510.2 million in cash on its balance sheet as of March 31, 2024.

Is DOYU a Good Stock to Buy?

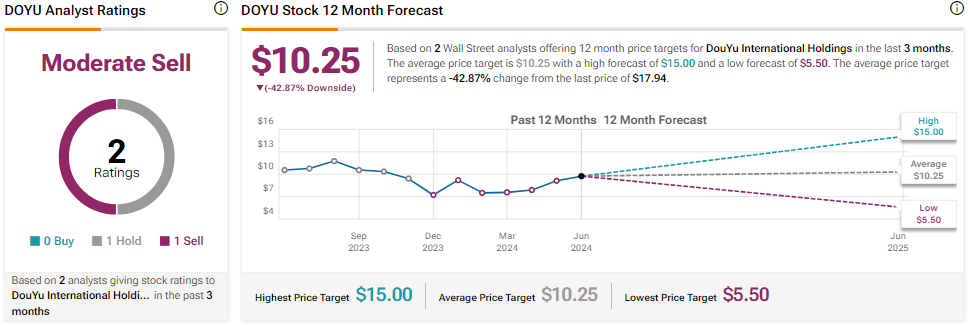

Citi analyst Brian Gong lowered DouYu’s price target to $5.50 from $6 and reiterated a Sell rating on June 7. The analyst cited the company’s Q1 miss and uncertainty from ongoing government investigations as reasons for his bearish stance. Gong’s price target of $5.5 suggests a 69.34% downside potential from current levels.

While Citi is bearish on DOYU stock, HSBC analyst Ritchie Sun upgraded DOYU stock to Hold from Sell on July 3. However, SUN’s price target of $15 implies a downside potential of 16.39%.

Bottom Line

The analysts have mixed opinions on DouYu’s prospects, but neither recommends buying at current levels. While rising ad revenue, streamlined operations, and a special dividend have boosted the stock, the tough market and regulatory risks remain concerns.