Shares of DoorDash (NASDAQ: DASH) gained in pre-market trading after the food delivery platform’s orders jumped 24% year-over-year to 543 million in the third quarter. The company also raised its outlook and now expects marketplace gross order value (GOV) in the range of $17 billion to $17.4 billion in the fourth quarter while adjusted EBITDA is likely to be between $320 million and $380 million. For reference, analysts were expecting marketplace GOV to be $16.4 billion in Q4.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

DoorDash defines GOV as the “total dollar value of Marketplace orders.” In the third quarter, the company’s losses narrowed to $0.19 per share as compared to a loss of $0.77 per share in the same period last year. The company generated revenues of $2.16 billion, up by 27% year-over-year.

Is DoorDash Stock a Buy?

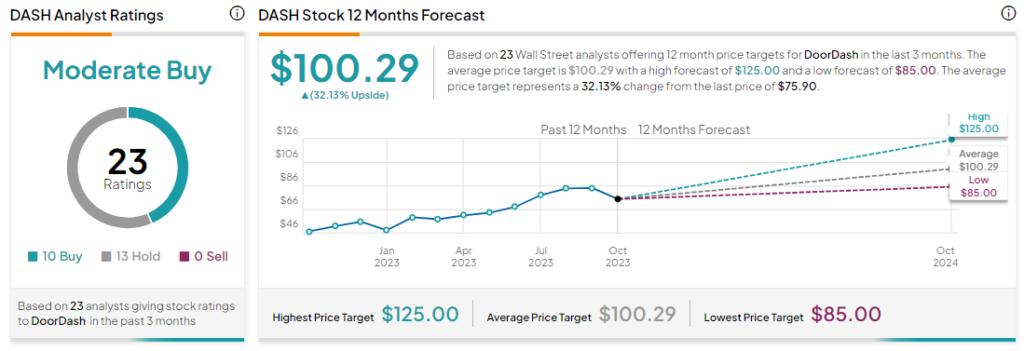

Analysts are cautiously optimistic about DASH stock with a Moderate Buy consensus rating based on 10 Buys and 13 Holds. The average DASH price target of $100.29 implies an upside potential of 32.1% at current levels.