Fitness platform company Peloton (PTON) gave a positive update last week about its cash flow and how much each subscriber is worth over time. While Wall Street wasn’t overly impressed, Macquarie analyst Marni Lysaght saw enough progress to upgrade the stock from Neutral to Outperform. Indeed, she pointed to better user activity, a stronger outlook for subscribers, and solid efforts to cut costs and reduce debt, which led to a 73% improvement in profits.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

As a result, Lysaght thinks that Peloton can continue generating strong free cash flow into Fiscal Year 2026, which would help it lower debt even more and invest in growth. Even though the company is spending less on marketing, its higher-income customer base is holding up better than lower-income groups, and therefore helping keep its subscriber value high. This gives Peloton a better return on its marketing dollars.

Interestingly, a major reason for Lysaght’s upgrade was Peloton’s growing lifetime value-to-customer acquisition cost ratio, or LTV/CAC. This metric rose over 30% year-over-year to just above 2x, moving closer to Peloton’s target of 2-3x. That means that even with less marketing, Peloton is getting more value from its customers, which is a good sign that the company is managing growth and spending effectively. Investors seemed to like this, as shares were up at the time of writing.

Is PTON Stock a Good Buy?

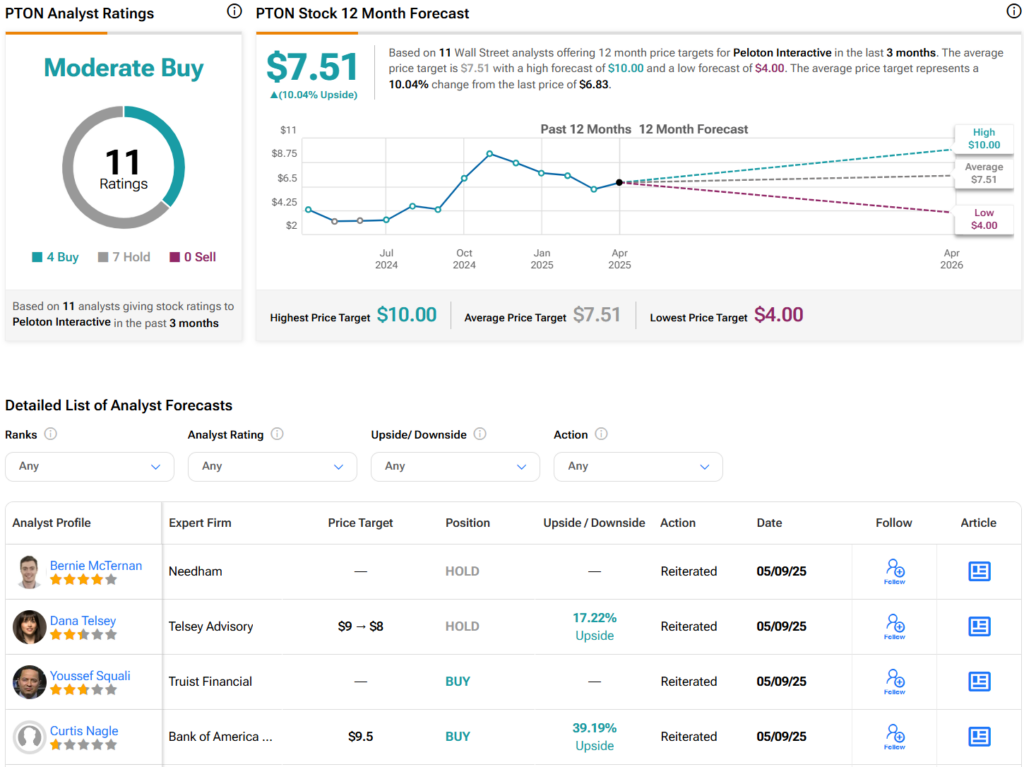

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PTON stock based on four Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average PTON price target of $7.51 per share implies 10% upside potential.